Metro Mining starts to motor ahead of transformational DFS

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It appears that investors are finally starting to realise the underlying value in Metro Mining Ltd’s (ASX:MMI) bauxite operations with company shares surging 13% under high volumes on Thursday.

The volumes traded up till mid-afternoon on Thursday were similar to those recorded over two days in July when the company’s shares increased more than 20% from 11.5 cents to 14 cents.

Management continues to deliver on the production and sales fronts at its Bauxite Hills project, and it would appear that the retracement from 14 cents can mainly be attributed to volatility in global equities markets.

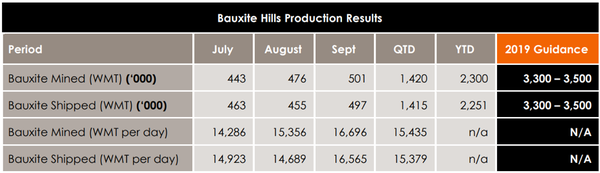

Production for the three months to September 30, 2019 was the strongest since operations commenced, laying the foundation for management to meet its full-year guidance which is in a range between 3.3 and 3.5 million wet metric tonnes (WMT).

Mining and haulage is benefitting from excellent machine availabilities, the barge loading facility is now sustainable at higher levels, and ship-loading rates have been assisted by better productivity and returning vessels that have previously performed strongly.

Consensus forecasts on the rise

There was an uptick in consensus forecasts in the last week, suggesting that analysts have started to factor in this strong production outlook.

Consensus forecasts provided by Stock Doctor point to earnings per share of 3 cents in fiscal 2020, implying a PE multiple of approximately 4 relative to the group’s current share price.

The heavily discounted PE multiple appears to be unjustified, and not surprisingly the consensus valuation gleaned by Stock Doctor from the brokers that cover Metro is 36.5 cents.

While a near 200% premium to the company’s current share price may sound too good to be true, it should be noted that the company was trading in the vicinity of 30 cents per share in February 2018 as mining was about to commence.

It could be argued that Metro’s investment metrics are far better today than they were in 2018 given the group is producing at full tilt and on the verge of delivering its first full year of production at nameplate capacity.

Consequently, Metro offers strong earnings visibility, assisted by the fact that offtake agreements are in place and the company has sufficient reserves to support a mine life out to 2037.

DFS could be a game changer

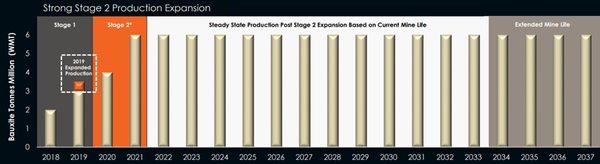

Significant upside will be gained if the company is successful in upgrading the project’s production capacity to 6 million tonnes per annum.

This hinges on a definitive feasibility study that has largely been completed and will be released to the market in coming weeks.

The DFS is a much anticipated development and arguably one of the most significant share price catalysts in the company’s history.

Should Metro be able to double production it will not only provide a substantial uplift in sales revenues, but the benefits of scale should see a proportionately higher increase in the bottom line as margins increase from already robust levels.

Perhaps the recent share price action is being driven by expectations of a positive DFS outcome.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.