Metminco’s Quinchia looking more like a combined mining district

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Metminco Limited (ASX:MNC), soon to be renamed Los Cerros Limited, has had immediate success at its Chuscal Gold Target, having intersected an impressive 350 metre wide zone of gold mineralisation from surface in the first diamond hole ever drilled into the Chuscal target located in the Mid-Cauca Porphyry Belt of Colombia.

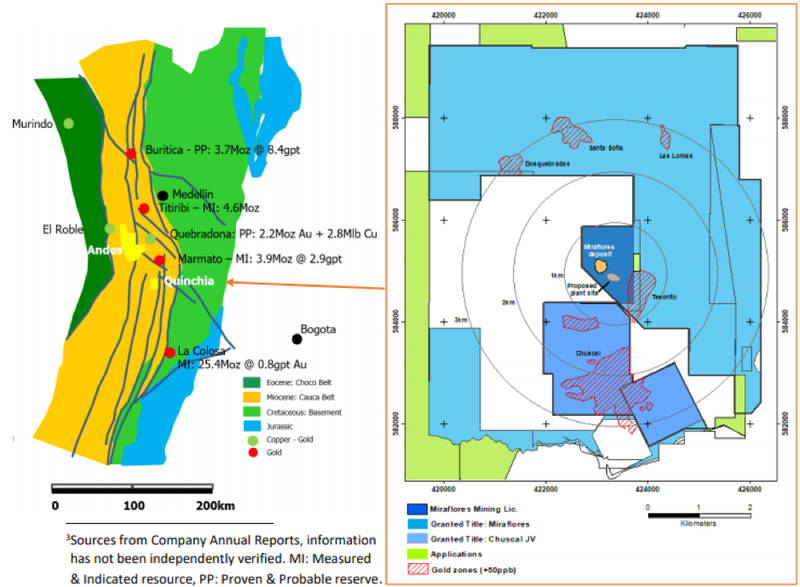

Chuscal is part of the company’s Quinchia Gold Project, situated along the Mid-Cauca Porphyry Belt trend which hosts several multi-million ounce porphyry and epithermal ore bodies.

Some of these have characteristics similar to those being observed in early results now being received from the maiden drilling program into the large Chuscal Gold Target.

It was in late October that Metminco made the decision to extend the first hole of the Chuscal target beyond the planned 350 metre final depth, given it remained in a breccia system that has strong mineralisation potential.

The hole continued to a depth of 452 metres, and this has proven to be an astute decision by management.

This morning’s share price surge of approximately 25% is likely to be just as much a vote of confidence in management ability to create shareholder value from the broader project, as it is in the prospects for one drill hole.

That said, the results speak for themselves and they have no doubt brought the company under the spotlight as an extremely undervalued emerging gold play with extensive exploration upside.

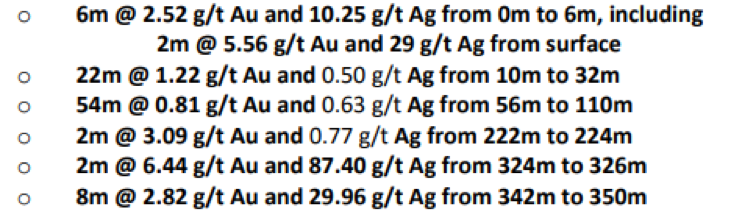

The results included:

As indicated above, a number of intervals with higher grade gold and silver were intersected within the broader 350 metre zone, but the depths tell the story.

Note the higher grade gold (Au) intersected at and below the 222 metres mark.

There is also a significant increase in silver (Ag) mineralisation below 320 metres.

Results from two more hole pending

Geological features of a second hole have also been encouraging with porphyry style characteristics noted around 260 metres.

Assays for this hole are imminent, and a third hole which is due to be completed by the end of November should provide investors with further assay results in mid-December, potentially culminating in a stellar finish to 2019.

While upcoming developments are much anticipated, the success at Chuscal has far-reaching implications and should be considered in light of its potential benefits for the broader Quinchia Project.

On this note, Metminco’s managing director Jason Stirbinskis said, “This is a remarkably strong result on our first hole given the extent of the mineralisation encountered from surface, and it has proven very illuminating, greatly improving our understanding of the geology.

After outstanding drill success last year at the nearby Tesorito porphyry discovery, including a best result of 253 metres at 1 g/t gold from surface, including a higher grade zone of 64 metres at 1.67 g/t gold, and now hitting this wide interval at Chuscal, we believe we are in enviable porphyry territory.

‘’It remains early days into drilling at Chuscal, but this first intersection has certainly provided very strong encouragement about what Chuscal could be when one considers the sheer scale of the gold anomaly at surface, the impressive widths of mineralisation encountered and its location in the heart of the Mid-Cauca belt, which is already host to several multi-million ounce porphyry and epithermal deposits.

‘’When compared to other global porphyry systems and recent discoveries, this early result reaffirms our view that our Quinchia Project and Chuscal in particular, have great potential”.

The project is certainly located in prime territory as indicated in the following map which shows multi-million ounce projects to the north and south.

Importantly, the Chuscal target is situated in close proximity to Metminco’s discoveries.

It is only two kilometres from the group’s Miraflores deposit where a mineral resource of 877,000 ounces at 2.8 g/t gold and an ore reserve of 457,000 gold ounces at 3.3 g/t gold have been defined.

Further, Chuscal is only one kilometre from the Tesorito prospect which as outlined by Stirbinskis has already demonstrated its porphyry characteristics with mineralisation encountered across broad intersections.

Given their close proximity, management is of the view that they may form the cornerstone assets for a multi-mine district with a central processing facility.

The extensive near surface mineralisation which would lend itself to low-cost open pit mining, combined with the use of a central processing plant would make for a particularly economical project in terms of development costs and ongoing production costs.

At Chuscal, the near surface, high-grade epithermal vein population overprinting the porphyry mineralisation is of particular interest given the potential to create wide mineralised zones with internal, higher grade zones.

While Metminco has 100% ownership of Miraflores and Tesorito, it is earning a 51% interest in Chuscal from AngloGold Ashanti Columbia SA.

Promising early signs from second hole

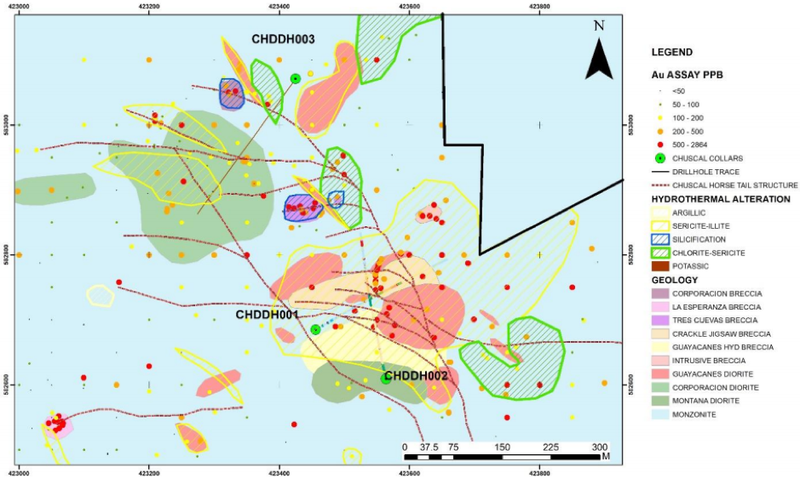

The second hole (CHDDH002) was recently completed for a total depth of 412 metres.

The primary objective of the drill hole is to test the eastern end of the large surface geochemical anomaly and pass underneath the historic Guayacanes workings to investigate the core of the diorite zone as mapped on surface.

After passing through the diorite, the hole intersected an extension of the breccia zones mapped in CHDDH001.

The second half of CHDDH002 is of most interest as it passes under old workings and should intercept several of the ‘’horsetail’’ structures as indicated by the red lines below.

Management’s first impressions on the second hole were interesting in that Stirbiskis acknowledged that the company only had quick visual logs to date, but he did say, ‘’We note that we entered a zone of considerable potassic alteration characterised by magnetite and secondary biotite alteration around 260 metres down hole.

‘’Both of these alteration minerals are indicative of higher temperatures associated with porphyry style mineralisation.

‘’We were also very encouraged to intercept a number of zones of increased veining between 120 metres – 240 metres, 290 metres – 300 metres, 320 metres – 340 metres and again between 360 metres and 390 metres.

‘’These coincided with where the structural model predicted them to occur.

‘’We expect assay results for the hole to be available within 2 to 3 weeks.”

The rig has now begun drilling the third hole (CHDDH003).

This hole lies some 500 metres north-northwest of CHDDH002 and will test the Corporacion diorite on the north-west end of the gold soil anomaly and is orientated to intercept several of the inferred “horsetail” structures.

The 350 metre hole is expected to take the remainder of November with results due mid-December.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.