Meteoric Resources adds Canadian cobalt project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

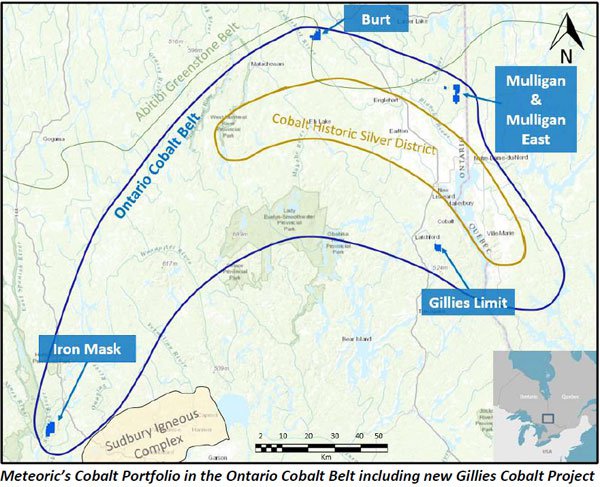

Junior explorer Meteoric Resources (ASX:MEI) has entered into an agreement to acquire 100% of the Gillies Cobalt Project in Ontario, Canada.

The project consists of 11 contiguous claim blocks within the prolific Cobalt Camp mining district. It’s located on the same geological trend, and within just 2.5 kilometres, of numerous historical high-grade cobalt and silver mines.

Nearby projects include the Cobalt A-53 mine, the Silver mining company mine (produced 2,251 lbs of cobalt), the Provincial mine (34,473 lbs cobalt & 287 lbs silver), and the Waldina silver mines shaft (2,066 lbs cobalt). The Gillies township alone has produced more than 60,000 pounds of cobalt and over 33 million ounces of silver making up a significant proportion of the production from the prolific Cobalt Camp.

Recent grab samples at the Gillies Cobalt Project yielded high-grade cobalt assays up to 1.6% cobalt.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

Cobalt mineralisation within the Gillies Claims is hosted within the Nippising Diabase which outcrops in the western portion of the property, where it dips east beneath sedimentary sequences belonging to the Cobalt Group.

Idealised diagram depicting contact-related mineralisation within the cobalt embayment:

In the Cobalt Camp, considerable cobalt-silver mineralisation typically is encountered in the diabase sill below the contact with Cobalt Group sediments. Historically between 80-90% of the cobalt ores were extracted from the Huronian conglomerates that are in contact with the diabase intrusion.

The Gillies Project hosts both the lower and upper sill contacts, with both contact zones having the potential to host cobalt and silver mineralisation. Most historic workings in the area targeted the upper contact of the diabase, leaving the lower contact zone relatively underexplored.

The area’s prospectivity, and potential to host significant cobalt mineralisation given the considerable exposed lengths of the upper and lower contact zones, are encouraging. There are numerous surface cobalt-silver showings that are associated with two major northerly- and northwesterly-trending faults.

MEI’s exploration plans

The company plans to resample the extensive historic workings with the major focus being on primary cobalt mineralisation.

Prospect scale mapping and surface sampling, as well as a detailed geophysical survey (Induced Polarisation, Magnetics & Radiometrics) is planned for as soon as the weather allows.

MEI will also conduct additional trenching to determine the extent of the previously exploited veins and is hoping to produce a bulk sample for analysis along with preliminary metallurgical test work.

The company also plans to fast track its systematic and rigorous exploration approach with an extensive programme of prospect scale mapping, surface sampling and geophysics, and resample the numerous outcrops and open pit operations.

The terms of the deal

The consideration for the acquisition comprises:

- An initial payment of C$50,000 and C$50,000 in MEI shares (at the 10-day VWAP prior to completion), and a 2% net smelter royalty.

- Three additional payments of C$30,000, on the first, second and third anniversaries of completion of the acquisition.

- C$30,000 in MEI Shares (at the 10-day VWAP prior to each anniversary).

- Introduction fees of C$5,000 and 1,000,000 MEI Shares.

The acquisition of the exploration rights over the Gillies Limit project claims is conditional upon MEI completing due diligence and receiving regulatory approval, while the company may terminate the agreement at any time.

MEI MD Dr Andrew Tunks said: “The Gillies Cobalt Project is an exciting addition to Meteoric's already impressive portfolio of primary cobalt projects in Ontario, Canada. The new look management team at Meteoric continues to demonstrate an active approach to acquiring highly-prospective primary cobalt projects in this case within a few kilometres of the town of Cobalt. A similar approach is set to continue with on-ground exploration activities, where we expect to commence work at Mulligan and Mulligan East in April.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.