Metals of Africa declares 61.6Mt resource

Published 16-NOV-2015 16:22 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Metals of Africa (ASX:MTA) has just become a player in the world of graphite, announcing a maiden resource of 61.6 million tonnes at 10.3% total graphitic carbon, and it has drilled less than 5% of its targets.

In a market release this morning, it outlined its maiden JORC resource at the Montepuez project in Mozambique, with an indicated mineral resource of 27.6Mt at 10.4% TGC and an inferred resource of 34.1Mt at 10.2% TGC.

The resource remains open along strike and at depth, and MTA has drilled less than 5% of targets at the project.

The JORC resource positions MTA as one of the leading resource holders in the region, and backs up managing director Cherie Leeden’s previous claim that the company was undervalued in the region.

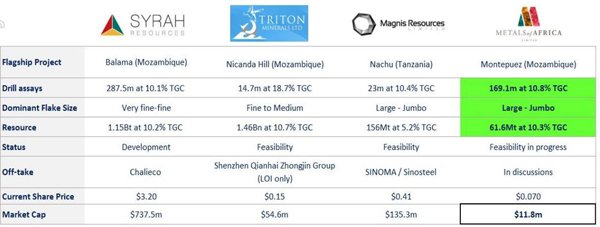

By comparison, world-beater Syrah Resources (ASX:SYR) has a resource of 1.15 billion tonnes at 10.2% TGC, while fellow company Magnis Resources (ASX:MNS) has a resource of 156Mt @ 5.2%. SYR has a current market cap of $737 million while MNS has one of $135 million.

In comparison, MTA has a market cap of just $11.75 million before the start of trade today.

A comparison of graphite players in the region

“This impressive maiden resource positions Metals of Africa as a major player in the global graphite space,” Leeden said of the resource declaration.

“Our flake size and quality is exceptional and our deposit clearly hosts the best ratio of large and jumbo flake of graphite deposits in Mozambique.”

Initial test work indicated ‘very coarse’ flake sizes, returning 56.3% for large and jumbo flakes.

She also confirmed that offtake agreements were under discussion “with a number of parties”, and MTA has started putting the numbers together on ultimate commercialisation via a pre-feasibility study.

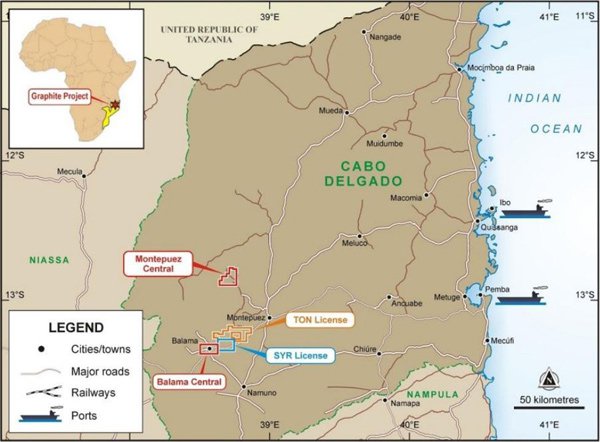

It said that it was studying the possibility of exporting its product from the nearby ports of Pemba and Nacala, while it has also investigated the possibility of setting up a spherical graphite plant in the US.

Elsewhere, it said that drilling at its Balama Central project was ongoing and it should be in a position to declare a resource there by February or March next year.

Shares in MTA are up 15.7% to 8.1c in intraday trading.

More on Metals of Africa’s graphite play

Its flagship project is the Montepuez Central project in the Cabo Delgado region, and is made up of three key deposits being the Buffalo, Elephant, and Lion prospects.

Meanwhile, it is also drilling at the Balama Central project.

The location of MTA’s projects in Mozambique

That project is along strike (on electromagnetic data) to the projects being advanced by SYR and Triton Minerals, with MTA recently confirming rock chip samples taken at the project were high-grade.

The chip samples brought up grades of up to 17.55% TGC and 0.364% Vanadium.

Its flagship graphite project is at the Montepuez Central Graphite Project in the prolific Cabo Delgado graphite province.

So far, it has found three key prospects at the Montepuez Central Graphite Project including the Buffalo, Elephant, and Lion prospects.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.