Metals Australia Ltd releases Lac Rainy Graphite Project Maiden JORC Resource

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Metals Australia Ltd (ASX:MLS) has released a maiden JORC (2012) Mineral Resource at its 100% owned Lac Rainy Graphite Project located in Quebec, Canada.

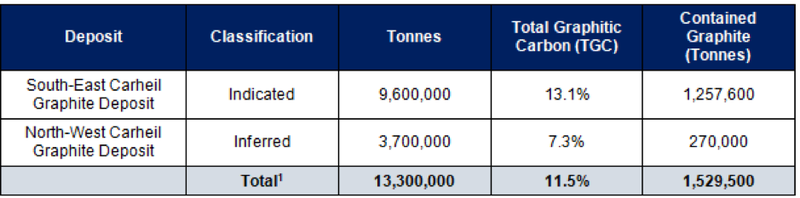

The results exceeded the expectations of the Board of Directors and management, with the Mineral Resources being estimated at 13.3 million tonnes Indicated and Inferred at an average grade of 11.5% TGC (total graphitic carbon) for 1.53 million tonnes of contained graphite, using a 5% TGC cut-off.

The world class grade at Lac Rainy, combined with its size, offers significant flexibility for potential development into a long life, high-grade graphite mining operation, in the safe and stable jurisdiction of Quebec in Canada.

Lac Rainy has the potential to be mined using open cut mining methods with low strip ratios, with more than 90% of the current global resource defined within the first 100 metres.

Drilling completed to date has only tested the first 1.6 kilometres of the approximate four kilometres of strike along the Main Carheil Graphitic Trend with the south-east and north-west strike extensions and the recently discovered West Carheil Graphitic Trend still to be drilled.

Management is currently planning an extensional drilling program to further grow the resource base and drill test some of the other high-priority targets which have been identified. The deposit at Lac Rainy remains open to the north and south along strike, as well as down-dip and plunge, indicating significant exploration upside and drill ready targets.

As shown below, the global resource is made up of the high-grade South-East Carheil Graphite Deposit which is classified in the Indicated category, and the North-West Carheil Graphite Deposit which is classified in the Inferred category.

Progressing to product specification test work

The Lac Rainy project has the potential to deliver attractive economics due to its significant size, high grades and extensive surface outcrop that offers low strip ratios.

Metallurgical studies to date indicate a straightforward processing flowsheet, and management plans to commence its first round of product specification test work with a view to delivering a scoping study towards the end of 2020.

The Company’s ongoing focus is to develop this Mineral Resource into a low-cost mining operation.

Discussing these developments and the Company’s strategy going forward, Director Gino D’Anna stated, “The delivery of the maiden JORC Resource estimate at Lac Rainy signifies the culmination of our significant exploration efforts over the last 18 months. When we acquired Lac Rainy, it was a greenfield exploration project. Today, Lac Rainy possesses a significant high-grade resource which remains open along strike as well as down-dip and plunge, indicating significant exploration upside.

“Our resource is readily and rapidly expandable, demonstrated through the discovery of the West Carheil Graphitic Trend, which has a similar genesis as the Main Carheil Graphitic Trend.

“The Lac Rainy project offers significant flexibility, as it has projected low strip ratios, can be readily accessed through open cut mining methods and has consistently delivered exceptionally high-grade results.

“The metallurgical and mineralogical test work program undertaken with SGS (Canada) Inc. is nearing completion and the final report is expected imminently. This will be the catalyst for the company to commence its first round of product specification test work, including spheronization test work and electrochemical exfoliation test work.

“We will then build this into a scoping study and commence our graphite marketing program.

“The Lac Rainy Graphite Project offers significant upside and we look forward to building on this great success.”

Peer comparisons highlight strength of TGC grades

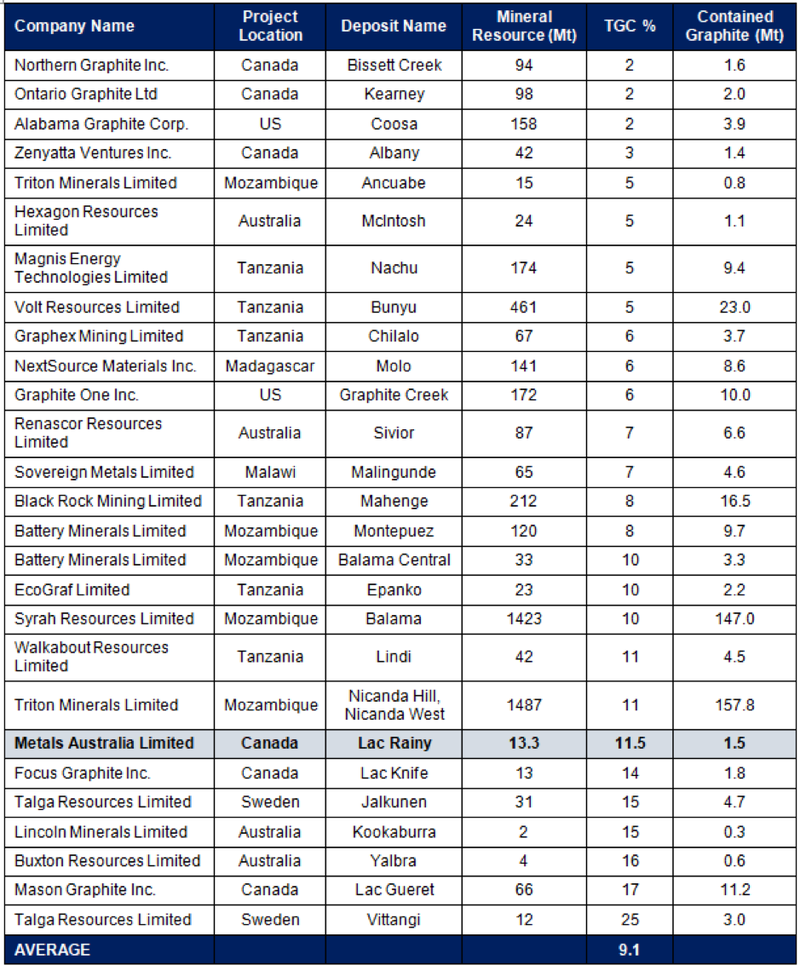

An examination of the Lac Rainy Mineral Resource with other global graphite resources highlights the quality of the mineralisation.

Having already determined that the mineralisation is of high grade, expansion of the resource is likely to provide significant share price traction.

With regard to peer comparisons, the following table outlines Mineral Resources in different global jurisdictions ranked by the grade of the resource, represented as percentage TGC.

In 2017, CSA Global undertook a survey of 29 graphite deposits in different jurisdictions which determined that the average grade of the graphite resources surveyed was 8.9% TGC. These are tabulated below, and it is worth noting that the average percentage TGC of 9.1% is substantially surpassed by Lac Rainy.

Importantly, nearly half of the projects listed above are in jurisdictions that carry significant sovereign risk, while Lac Rainy has the distinct benefit of being located in Canada, one of the premier regions in the world in terms of welcoming and supporting projects at a regulatory level, as well as having the human resources and infrastructure required to progress all facets of the project.

Resource follows excellent assays

The announcement of today’s maiden JORC Resource, comes just weeks after Metals Australia identified a new high-grade graphite zone located parallel to the existing high-grade Carheil Graphitic Trend.

Sampling along the West Carheil Graphitic Trend identified a number of high-grade graphitic outcrops, with samples collected being outside the existing defined drilled area and outside the channel sampled zones, highlighting the significant exploration upside that exists at Lac Rainy.

High-grade sample results from the West Carheil Graphitic Trend include:

▪ 26.2% Cg within rock sample ID: 66002

▪ 22.4% Cg within rock sample ID: 66008

▪ 25.6% Cg within rock sample ID: 66009

▪ 28.5% Cg within rock sample ID: 66015

▪ 25.0% Cg within rock sample ID: 66022

Out of 51 samples collected, 11 rock samples returned assay grades in excess of 20.0% Cg and a further 10 rock samples returned assay grades in excess of 15.0% Cg.

D’Anna said of the results, “The exploration completed throughout 2018 and 2019 continues to demonstrate the pedigree of this project, which hosts high-grade graphite mineralisation starting at surface and encountered across significant widths.

“The identification of the West Carheil Graphitic Trend has demonstrated that the full scale of this project is yet to be identified. Our Lac Rainy project covers in excess of 4,600Ha and we have only just started to scratch the surface.”

Global graphite market

The global graphite market is expected to reach $21.6 billion by 2027, registering a CAGR of 5.3% from 2020 to 2027.

Growth in this market is expected to come on the back of rising sales of smartphones, electric vehicles (EVs), in which graphite will be critical for production, and a growing demand for lithium-ion batteries.

Industrial uses such as refractories manufacturing and growth in steel and aluminium production and processing will also see demand for graphite increase.

Metals Australia is now looking to capitalise on these macro events.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.