Mantle Mining making progress at Morning Star and Rose of Denmark

Published 19-OCT-2017 14:36 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Having established a near term production target at its Morning Star gold mine in Victoria, Mantle Mining Corporation (ASX:MNM) informed the market on Thursday that it would be concurrently working on a conventional decline to achieve longer term production efficiency.

Mantle CEO, Tom de Vries explained, “This work is part of a detailed staged plan which the company is now progressing with the aim of developing future production, and the strategies being employed are ensuring that capital is being used astutely in working towards this goal.”

The first stage involves the concurrent recommissioning of the shaft and winder to prepare for trial mining at Morning Star, preparing designs and permitting for a conventional decline, and commencing a diamond drill program at the Rose of Denmark mine.

MNM then plans to commence trial mining of a component of the Stacpoole zone, using that ore to commission and process the plant prior to committing to a conventional production decline.

Location of new Stacpoole zone important in identifying a reduction target

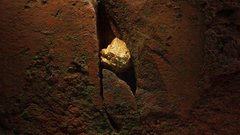

Overlooked by prior operators of the mine, the location of the new Stacpoole zone and its subsequent confirmation by recent diamond drilling by Mantle is a major advancement towards identifying a production target that is shallow, easily accessible and can lead to more timely production.

Management has determined that the most cost and time effective means to a bulk sample with trial mining is via level two of the existing Morning Star shaft.

This bulk sample will allow MNM to obtain a more reliable estimate of gold grades in the Stacpoole zone in comparison to the grades returned in diamond drilling, especially bearing in mind that most mined zones at Morning Star returned significantly higher production gold grades than those returned in drilling of the same zones.

Of course it should be remembered that MNM is still an early stage player and investors should seek professional financial advice if considering this stock for their portfolio.

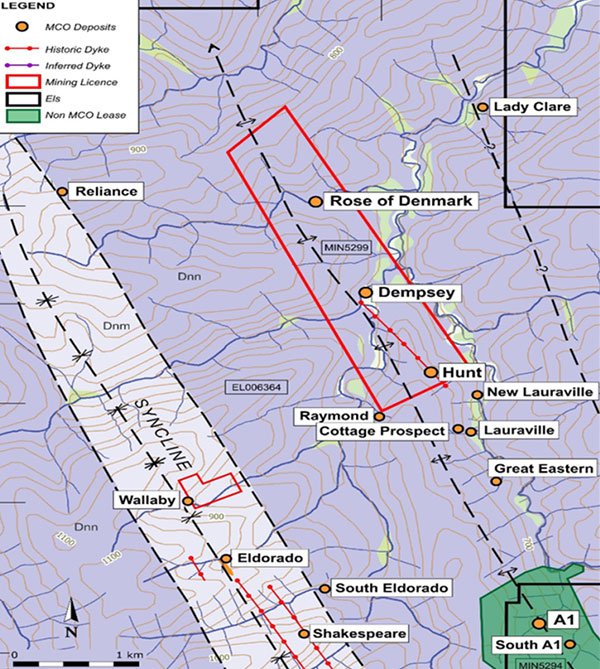

In tandem with the Morning Star developments, MNM is progressing plans to commence a diamond drilling program at the Rose of Denmark gold mine where management has identified many clear gold targets.

This mine represents a second potential source of the easily accessible ore as a second independent source of plant feed for the Morning Star processing plant. Management noted that the style of mineralisation at Rose of Denmark points towards the possibility of mechanised mining in the style presently described at the A1 mine (ASX:CTL) and diamond drilling is required to fully confirm this possibility.

The following map illustrates the relative proximity of Rose of Denmark to the A1 mine.

Management noted today that discussions are ongoing between MNM and its joint venture partner Shandong as to how best to maintain its involvement in the Rose of Denmark project and Mantle’s other regional assets.

Shandong, through its wholly-owned subsidiary, Minjar Gold is a 51 per cent joint venture partner of the Rose of Denmark mine lease with MNM managing the project on behalf of the JV.

On this note, management said it was encouraged by Shandong’s interest in maintaining a presence in one of Australia’s premier gold districts, namely the Walhalla to Woods Point goldfield, an area that is significantly underexplored.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.