Mako’s shares soar on back of assay results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Mako Gold Ltd (ASX:MKG) traded as high as 11 cents on Thursday morning, up 26% on the previous day’s close.

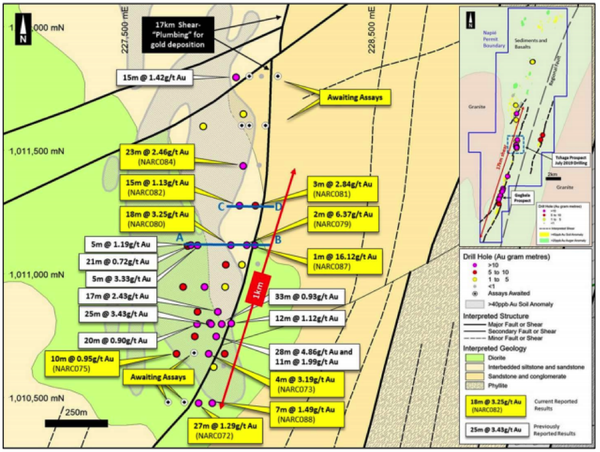

This was in response to highly promising assay results from the first 16 holes of the company’s 27 hole reverse circulation (RC) drill program at the group’s Napié Project in Côte d’Ivoire.

Drilling featured both broad sections of mineralisation and high grades, complementing previous results which included 28 metres at 4.9 g/t gold.

Assay results released today included 18 metres at 3.2 g/t gold and 23 metres at 2.5 g/t gold from depths of 39 metres and 15 metres respectively.

This constant flow of promising news sees the company trading some 40% above where it was trading at only a month ago.

The exploration results have doubled the length of the gold mineralised zone from 500 metres to 1 kilometre on the Tchaga Prospect, along the interpreted 17 kilometre long shear as indicated below.

Importantly, these results have been achieved simply through shallow drilling, and traditionally the broader region hosts high-grade mineralisation at depth.

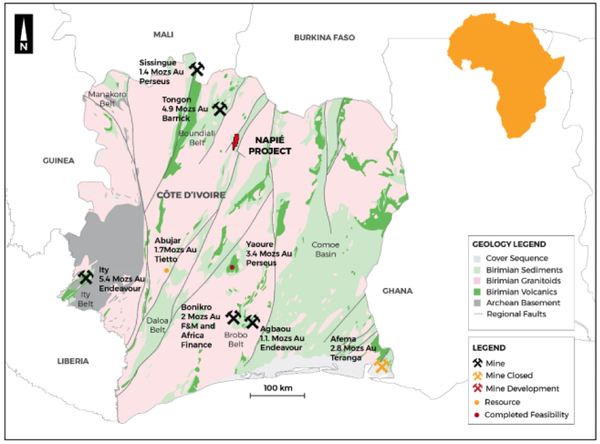

Mako’s gold projects in Côte d’Ivoire and Burkina Faso lie in the gold bearing West African Birimian Greenstone Belts which host more than 60 gold deposits of more than 1 million ounces.

As indicated below, there are multi-million ounce projects surrounding the Napié Project which are being operated by some of the world’s largest miners.

Potential for extension of mineralised zone

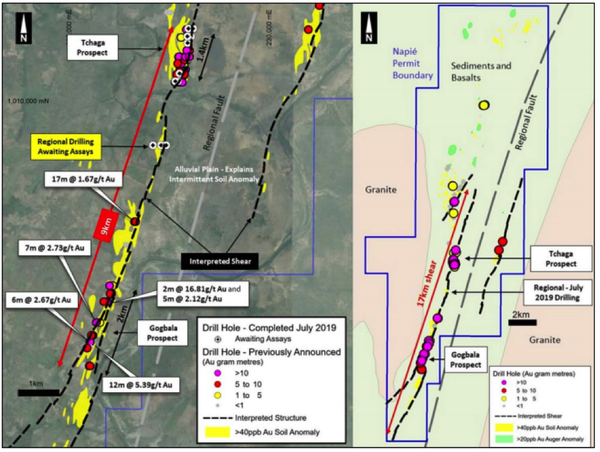

Significant drill intersections encountered to date are spatially related to gold soil anomalies coincident with the 17km-long interpreted shear, which is sub-parallel to the deep-seated regional fault that extends through Côte d’Ivoire north into Burkina Faso.

Assay results from the final eight holes on the Tchaga Prospect are imminent.

Positive results from the remaining drill holes may further extend the mineralised zone on Tchaga, a development that could provide further share price momentum.

Management’s decision to undertake a small regional drilling campaign may also pay dividends as it could point to new mineralised zones, or ideally provide additional evidence that the Tchaga prospect and the Gogbala prospect are part of the same system with both lying along the 17 kilometre shear.

Significant gold intersections on the Gogbala Prospect from previous wide-spaced drilling included 12 metres at 5.4 g/t gold and 2 metres at 16.8 g/t gold at shallow depths.

Consequently, assay results from regional drilling could also be a share price catalyst.

Highlighting the significance of both the Tchaga and regional drilling, Mako’s managing director Peter Ledwidge said, “We are encouraged by the results received to date from our recent drilling program on Tchaga which has doubled the strike length of gold mineralisation and further enhanced the potential of the project.

‘’We eagerly await the remaining assay results from our Tchaga drilling which may extend the mineralised trend even further, as well as our regional drilling results."

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.