Mako poised to extend strike length at Napié

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Today’s release of Mako Gold Ltd’s (ASX:MKG) quarterly result for the period ending 30 June 2019 comes at a pivotal time for the group, as it has released outstanding drilling results in July with the potential for more positive news to emerge as further assays are processed.

Assays results from the final eight holes on the Tchaga prospecthave the potential to further extend the mineralised zone.

The Tchaga prospect is part of the Napié Project in which Mako has an interest of 51%. Under a farm-in and joint venture agreement with Occidental Gold SARL, a subsidiary of West African gold miner Perseus Mining Ltd (ASX:PRU , Mako can increase its stake from 51% to 75%.

The quarterly report has provided updates on both the Napié Project in Côte d’Ivoire and the Niou Project in Burkina Faso.

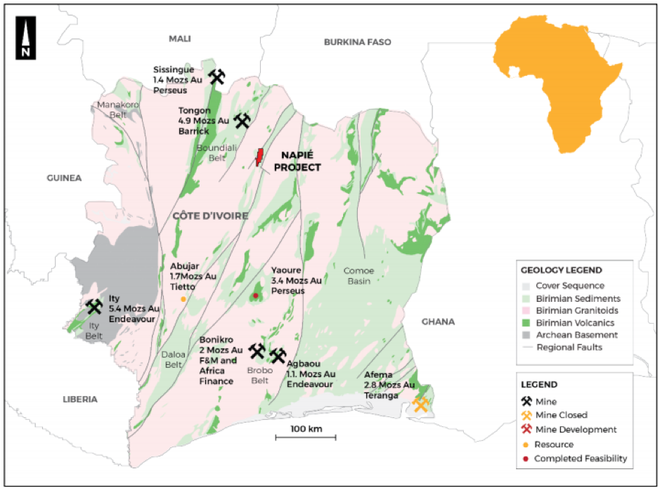

Looking specifically at the Napié Project, the highly prospective tenure stands out with Barrick Gold’s 4.9 million ounce Tongon project lying to the north-east and Perseus Mining’s 3.4 million ounce Yaoure project situated to the south.

These attributes haven’t been lost on the investment community with major ASX listed gold producer Resolute Mining (ASX:RSG) having a 19.9% stake in Mako.

Of further significance is Peter and Ann Ledwidge’s stake of nearly 10%, indicating they have plenty of skin in the game.

It is worth noting that Ann Ledwidge is a geologist and when I had the opportunity to discuss the project with her at the Noosa Mining Conference she was able to provide significant technical information on Mako’s tenements, as well as the broader region which she is familiar with through previous experience.

Upcoming assays could extend strike length

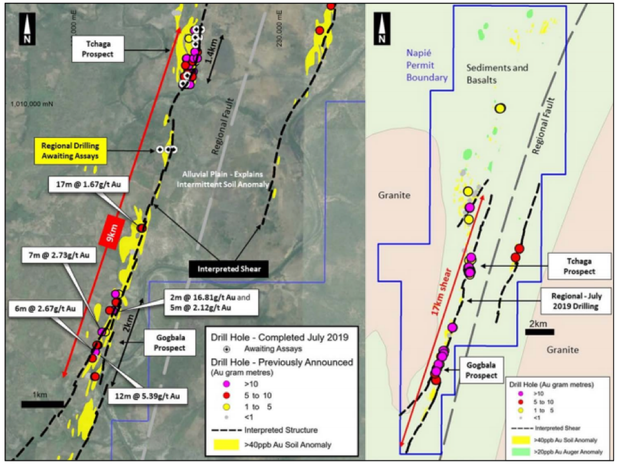

From an exploration perspective, 24 reverse circulation (RC) drill holes were completed for a total of approximately 3670 metres on the Tchaga Prospect.

In addition, three RC holes were completed on the regional trend for a total of 480 metres drilled to test mineralisation between the Tchaga and Gogbala Prospects.

The purpose of the regional drilling is to test the interpreted shear in an undrilled area between the gold mineralised Tchaga and Gogbala prospects.

Management suspects that gold mineralisation intersected at the Tchaga Prospect and the Gogbala Prospect, are part of the same system and both lie along the recently interpreted 17 kilometre-long shear zone.

Hole locations from the regional drilling program and select previous drill results that are shown below tend to support management’s conclusions.

This would be highly significant given that gold intersections from the Gogbala prospect have featured promising widths and high grades, including 12 metres at 5.4 g/t gold, 17 metres at 1.7 g/t gold and 2 metres at 16.8 g/t gold.

However, not accounting for the outcome of future assays it has been a highly successful drilling campaign.

The program was designed to extend mineralisation outlined over a 500 metre strike length by previous drill programs, and even based on current assays, the strike length has been doubled to 1 kilometre.

Newy Niou could be diamond in the rough

Further upside could stem from drilling at Niou in Burkina Faso, which is likely to commence towards the end of the year after management recently completed a geological mapping program.

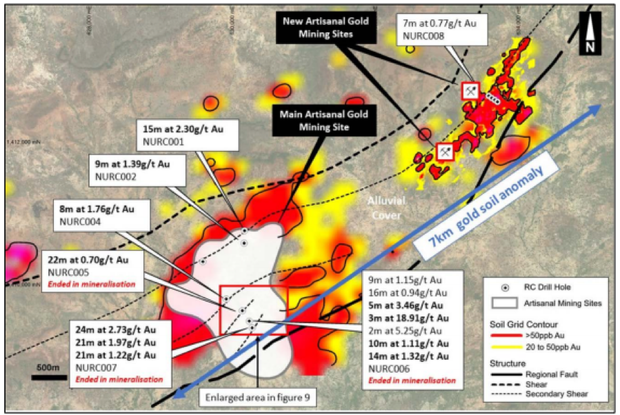

Drilling will follow up on assay results delineated from the maiden drilling gold discovery in January 2019 which included 15 metres at 2.3 g/t gold, 24 metres at 2.7 g/t gold and 3 metres at 18.9 g/t gold.

As shown below, the planned reverse circulation (RC) and/or diamond drilling (DD) program will target extensions from the best gold intersections in NURC005, NURC006 and NURC007 from the recent maiden drilling program.

Shear zones such as these commonly host economic gold deposits in Birimian greenstone belts.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.