Los Cerros outlines drilling and geological modelling campaign

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Los Cerros Limited (ASX:LCL) has updated the market in relation to its endeavours to better understand the epithermal vein hosted component of its Chuscal prospect.

This forms part of the recent and planned activity at the company’s Quinchia Project in the prolific mid-Cauca gold porphyry belt of Colombia.

Management has three main areas of focus ahead of the next drilling campaign.

In short, these are Chuscal drill targeting, Tesorito drill targeting and Miraflores geological modelling.

Los Cerros completed the Chuscal maiden drilling program in January 2020, the results of which continue to yield important information which is being incorporated into regional datasets and geological models.

Porphyry associated gold and epithermal veins

Chuscal’s appeal is the presence of two styles of mineralisation, porphyry associated gold providing a low grade disseminated background level of mineralisation which is overprinted by epithermal veins, including a final pulse or episode of vein emplacement which is higher grade gold associated with carbonate base metal (CBM) style mineralisation.

It is the overlap of one style of mineralisation over the other that has the potential to produce bulk zones of economic grade.

The application of pathfinder elements/minerals, mineral alteration and various signature ratios has refined the potential drill targets and provided further validation that both remain compelling targets for the discovery of gold porphyry mineralisation.

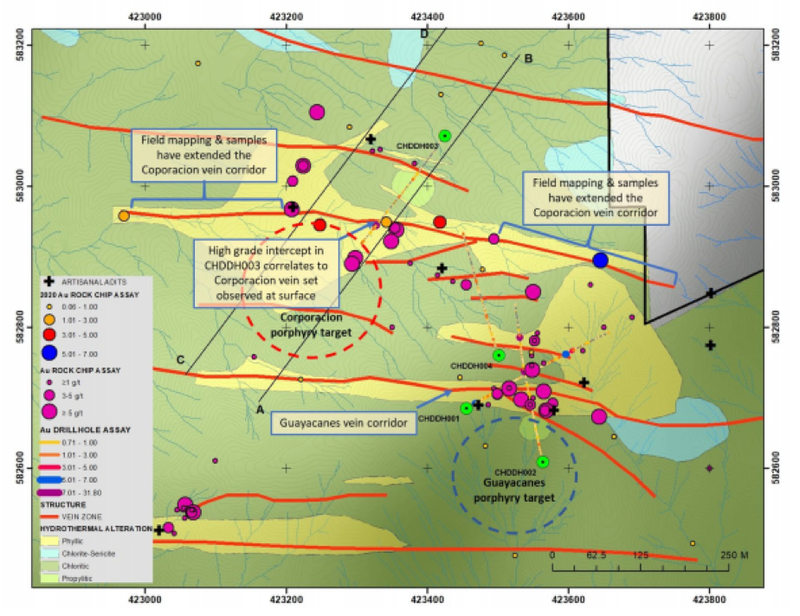

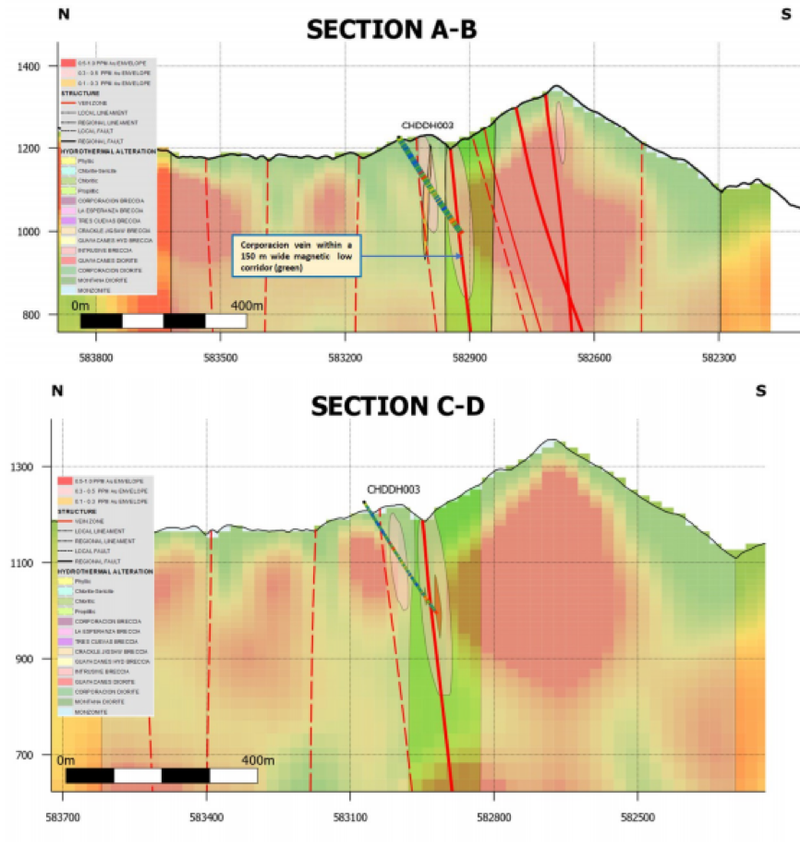

Current field programs have also sought to improve management’s understanding of the epithermal vein hosted component of the Chuscal prospect, particularly the east-west trending Corporacion vein set intercepted in DDCH003 which assayed 0.4 metres at 31.8g/t gold from 253.3 metres within a wider zone of 6 metres at 2.97g/t Au from 250 metres.

This intersection is extrapolated to surface to correlate with a high grade zone of soil anomalism and an artisanal mine and is extrapolated at depth to potentially intersect the Corporacion porphyry target as illustrated below.

Results of recent field work

Management has received some encouraging results from recent field work, resulting in an extension of the Corporacion vein set to the east and west to a strike length of 800 metres.

High-grade surface grab samples have been a feature of the field work that has been conducted and these included 6.68g/t, 4.73g/t and 4.62g/t gold.

As highlighted below, management has also been able to demonstrate an association with a 150 metre wide ground magnetic low that extends along the strike of the Corporacion vein set and might represent a wide fluid pathway of which the Corporacion vein is a part.

As indicated above, DDCH003 is the only hole which has intersected the Corporacion vein and further drilling along the 800 metre long strike to test for shallow high grade gold is clearly warranted.

Corporacion vein metal zoning, the presence of carbonate base metal (CBM) assemblages and alteration assemblages are interpreted to represent the final mineralised pulse from a buried causative porphyry.

This provides further justification for drill testing of the Corporacion porphyry target below and south of the Corporacion vein.

Commenting on these findings and outlining the company’s exploration strategy, managing director Jason Stirbinskis said, “We are thinking both tactically and strategically with this next drill program.

‘’Tactically we want to establish that the epithermal vein pulse - the veins that have sustained the artisanal workers for several generations - can be targeted.

‘’If these higher grade veins are close to surface and show continuity they offer a supplemental feed to boost the economic viability of the Miraflores Project and a pathway to early production.

‘’Strategically, the pursuit of the porphyry source(s) responsible for the extensive background gold throughout Chuscal might elevate Quinchia (Chuscal, Tesorito, Miraflores) to the ranks of the large scale discoveries of the Mid-Cauca Porphyry belt.’’

In addition, the completion of current modelling and near-term planned field work, including IP, are likely to also elevate Tesorito to part of the next drill program.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.