Los Cerros identifies new target within the Quinchia Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Los Cerros Limited (ASX:LCL) has provided details regarding a new, developing porphyry target within the 100% owned Quinchia Gold Project in Colombia, a cluster of porphyry targets surrounding the Miraflores Gold Deposit that includes the Tesorito surface porphyry and the porphyry targets at Chuscal.

With significant funding in place and three diamond drill rigs continuously drilling, the company has experienced considerable exploration success of late.

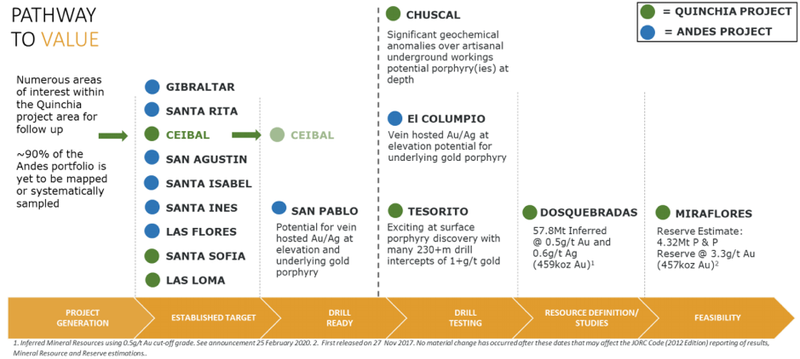

Much of Los Cerros’ attention has understandably been on the Tesorito and Chuscal areas, but management has also been running a prospect generation program with a view to identifying early-stage targets to add to the existing robust prospect pipeline as shown below.

However, Ceibal has emerged as an early-stage prospect, generating significant momentum to warrant its escalation as a new 2021 drill target.

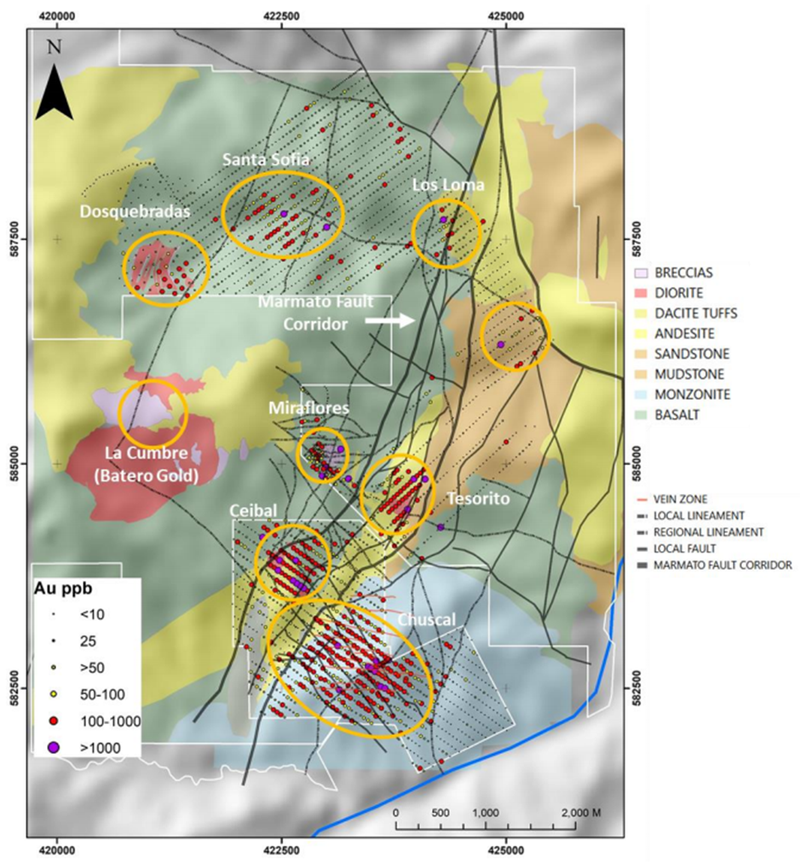

Ceibal is a substantial 800 metre x 600 metre gold, copper and molybdenum near-circular surface soil and rock chip geochemistry anomaly on the shoulder of a geophysics magnetic anomaly, one kilometre south and south-west of Miraflores and Tesorito respectively.

Its proximity to those two key areas can be seen on the map featured below, and management goes on to outline the Ceibal area’s consistencies with other high profile regions in terms of geological characteristics.

More specifically, the Ceibal surface geochemical anomaly is broadly comparable in size and tenor to Tesorito, and like Tesorito, Ceibal is located within the Marmato Fault Corridor.

A field program launched last year logged outcrops and float of andesites and diorites similar to those encountered at Tesorito.

Rock chips have reported very high values for porphyry pathfinders such as molybdenum and copper including one sample of 2.95g/t gold, 776ppm copper and 273ppm molybdenum.

Trenching across the anomalous zone is underway with results of the channel samples from the first line reporting 75 metres at 1.2 g/t gold and 25 metres at 1.2g/t gold.

Most discoveries, and almost all major, multi-million ounce gold discoveries of the mid-Cauca porphyry belt of Colombia, have links to regional north-south trending faults.

These are deep, major tectonic faults running the length of South America and caused by the ocean plates colliding with continental South America.

Tesorito, Miraflores, Chuscal and Ceibal are all within, or very close to, the Marmato Fault Corridor, with one such fault set extending north from Quinchia to the 4 million ounce Marmato Gold Mine.

As can be seen on the map we featured earlier, north-west to north-north-west secondary faults cross each of the company’s zones of interest at Quinchia including Tesorito, Chuscal and Ceibal and also targets further north.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.