Los Cerros forges services agreement ahead of drilling

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Small cap gold exploration group Los Cerros Limited (ASX:LCL) has executed a Strategic Partnership Agreement for the provision of IP survey services, drilling services, drilling equipment, personnel and consumables with Hong Kong Ausino Investment Limited.

The key driver for seeking the SPA is to assist Los Cerros in driving down its in-country exploration costs, maintain cash, improve efficiencies and facilitate significant drilling and IP programs over the company’s 100,000 hectare holding in the prolific mid-Cauca gold belt of Colombia.

Under the terms of the agreement, Ausino will provide a new, fit for purpose, diamond core drill rig, drill rods, consumables and extended after sale support in the form of expert senior drillers on site to build the company's internal capabilities.

Ausino will also provide two sets of specialist Induced Polarisation (IP) equipment and a specialist geophysics team to conduct IP surveys over targets within the company’s portfolio.

Forging the strategic partnership and bringing more exploration capability in-house will give Los Cerros a significant long term advantage, as well as providing flexibility to navigate the immediate Covid-19 induced pressures that junior explorers are facing.

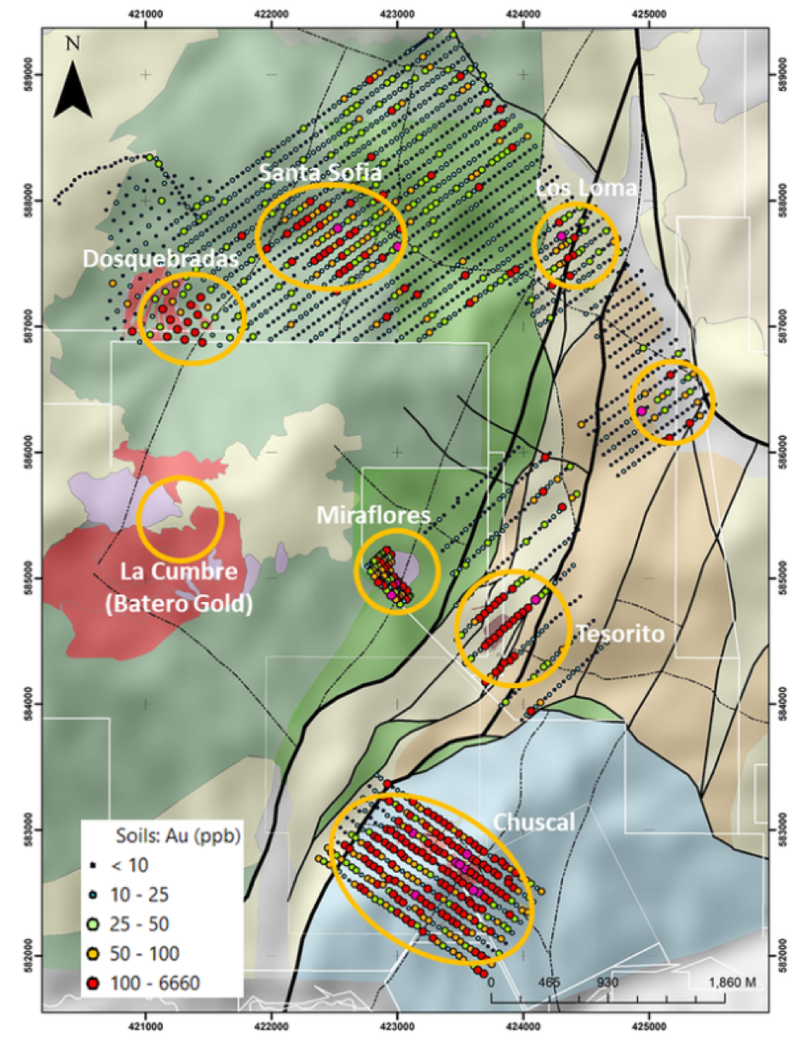

Under the structure of the SPA, the company is currently building its first purchase order for long lead time items while the technical team prepare for an IP survey over the priority Tesorito and Chuscal targets.

The IP program results are the last critical input before finalising the next drill program.

Management expects to be drilling early in the second half of 2020 under the SPA and subject to the progress of the Covid-19 pandemic and usual regulatory permits.

Longer term, Los Cerros has aspirations to extend the IP program over other targets within the Quinchia Project and within the 90,000 hectares of the Andes Project where the company has identified many compelling targets through extensive surface sampling and mapping.

Agreement preserves cash

Ausino’s willingness to accept shares at no discount to the VWAP (volume weighted average price) for capital items and services provided will allow the company to conduct significant exploration programs without the commensurate impact on cash reserves.

The agreement includes a 6-month trial period so both parties can test the concept of the agreement and the operating detail.

The agreement will commence upon the company placing the initial purchase order.

Management will assess prior to making each purchase order whether the order will be satisfied by way of share issue or cash, and whether such an issue will be made subject to shareholder approval or out of its placement capacity under ASX listing rules.

There is no obligation on the Los Cerros to issue shares under the SPA.

However, subject to shareholder approval, management will issue Ausino up to 12 million options if it satisfies minimum performance obligations under the SPA.

The options will be exercisable at either $0.04 or $0.07 depending whether Ausino completes 10,000 metres of drilling during the term.

COVID-19 field work restrictions lifted

In an important development, the Colombian Ministry of Mines and Energy has announced that mineral exploration work may now resume in Colombia, subject to the company complying with certain national health authority guidelines pertaining to the management and mitigation of the Covid-19 pandemic.

For Los Cerros, the immediate action is for the geologists to return to Tesorito to complete field work related to understanding the regional structure and the possibility of extensions of the Tesorito mineralised porphyry to the north and north east.

Field crews will also resume ground preparation for the IP surveys across Chuscal and Tesorito.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.