Los Cerros drilling results exceed all other drilling in Quinchia District

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

One of the most compelling gold-copper explorers on the ASX is Los Cerros Ltd (ASX:LCL) is drilling for gold in Colombia in a place called the Mid Cauca Porphyry Belt.

This region is home to many multi-million ounce gold discoveries.

Today, LCL announced it has hit a “spectacular” intercept of 460.9m @ 1.11g/t Au, with gold mineralisation starting from surface at TSDH16 (drill hole 16).

The outstanding results delivered so far from its Tesorito South exploration campaign continue to exceed expectations.

Better still, this seems to be just the start of what is unfolding as a spectacular gold system.

Drill hole 16 is the best ever recorded in the entire Quinchia District.

Such was the positive response to today’s news that the company shares opened more than 20% higher and continued to trade strongly throughout the morning session.

Here is LCL CEO Jason Stribinskis speaking at the CGS Mining conference (aka the Diggers n Dealers for Latin America) about the long high-grade porphyry intercepts at Tesorito.

Drilling results tell the story

As stated, TSDH16 delivered an outstanding intercept of 460.9 metres grading 1.1 g/t gold from surface within a broader intercept of 582 metres at 0.94 g/t gold from surface.

Not only did this hit previous results out of the park, but it eclipsed any other drilling results conducted by any explorer in the broader Quinchia District - effectively, this elevates Tesorito South to a globally significant gold porphyry discovery.

Porphyry associated mineralisation is now demonstrated to continue below and south-west of a fault structure at 356 metres downhole, introducing the opportunity for more deep mineralisation in all directions.

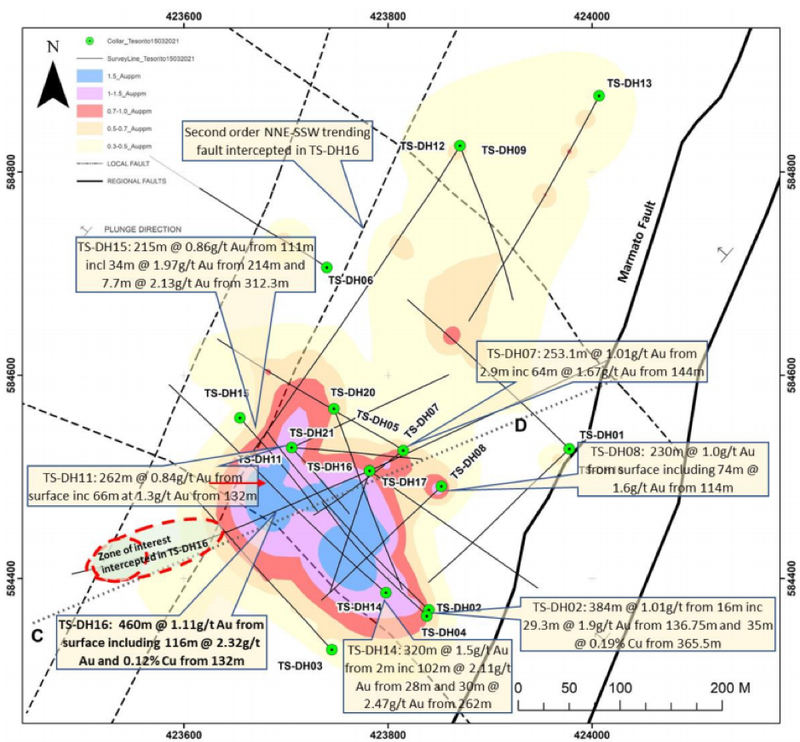

The following plan view shows modelled gold envelopes and major controlling structures.

34 metre interval grading 3 g/t gold

Whilst gold mineralisation started from surface, the drill core revealed higher grade mineralisation of the target porphyry suite from 90 metres down hole as indicated by increased porphyry signatures such as vein density.

This included 254 metres at 1.6 g/t gold from a relatively shallow depth of 92 metres, including an even higher grade interval of 116 metres at 2.3 g/t gold and 0.12% copper from 132 metres.

One of the features of the drilling results was a 34 metre zone grading just over 3 g/t gold and 0.1% copper, the highest grade porphyry style mineralisation intersected at Tesorito South to date.

To put this in perspective, the west.com.au got pretty excited by Hot Chili’s results at its Cuerpo 3 porphyry prospect also in South America (Chile) when it delivered a drill result of 972 metres grading 0.5% copper and 0.2 g/t gold, saying that it ranked “up there with some of the all-time remarkable drill intercepts and is most likely the best hit anywhere in Australia, possibly even around the globe, for 2019.”

These grades pale into insignificance compared with the drilling results delivered by Los Cerros.

As a further means of comparison the multi-billion-dollar Newcrest Mining’s (ASX:NCM) highly economical Cadia Valley gold-copper porphyry operation in Australia has been delivering gold head grades of between about 1% and 1.2% over the last five years.

While these grades may seem modest, the low cost project (did by copper credits) is a cash cow for Newcrest.

The resource as at 31 December 2019 was 37 million ounces of gold grading 0.36 g/t gold and 8.2 million tonnes of copper grading 0.26%.

This makes the grades that Los Cerros is delineating look pretty outstanding.

Also, bear in mind that the Quinchia Gold Project hosts the Miraflores Gold Deposit with a Resource of 877,000 gold ounces at 2.80 g/t gold with a reserve of 457,000 gold ounces at 3.29 g/t gold.

Miraflores is in advanced stages of approvals for mine development, and within three kilometres of Miraflores is the Tesorito near surface gold porphyry and the Chuscal porphyry target.

Consequently, in our mind a combination of the value of the in-ground resource, the fact that drilling results will feed into a much enhanced resource across multiple deposits, and the potential for further exploration upside provides an implied valuation well above that represented by the company’s current share price

Pending assays suggests there are further catalysts on the horizon

Results at depth have greatly enhanced the potential for Tesorito to be further expanded to the south-west, and will require a more thorough assessment, including multi-element analysis, to better understand the relationship between this new porphyry suite and the Tesorito South porphyry.

Assays are pending for an additional four completed holes at Tesorito South, all of which tested the lateral and depth extensions of the porphyry system.

We believe Tesorito South is developing into an exciting addition to the mid-Cauca porphyry belt which hosts many multi-million ounce gold porphyry discoveries as shown below.

Upcoming assay results are potential share price catalysts and we see Los Cerros as representing outstanding value even after this morning’s share price increase.

It should be remembered that the company has traded as high as 23 cents in the last 12 months, and when put into perspective, the retracement from 20.5 cents in January can be attributed to a decline in the gold price.

However, as most mining investors will be aware, the copper credits that feed into a gold-copper operation such as that which may be established as part of the Quinchia Project make for a very economical gold mining operation.

Consequently, these mines can deliver strong shareholder returns even during periods of lower gold prices.

Managing Director Jason Stribinskis summed up situation well in saying, “On a gram/metre basis TS-DH16 is the best hole ever recorded in the entire Quinchia district and has raised exciting questions about the potential scale of this gold system.

“The near surface (first 411 metres of this hole) has expanded to the south-west the modelled gold envelopes described by the high grade intercepts reported in the TS-DH02, ’14, ’11, ’15 drill fence and mineralisation still remains open to the south west.

“Follow-up drilling will further explore this region of relatively sparse data.

“The company will offer further detail on interpretation of the porphyry suite intercepted below and south-west of the fault in coming weeks as we assimilate new drill data as it arrives.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.