London Calling: Armadale Capital Confirm Tanzanian Graphite Intentions

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Alternative Investment Market (AIM) in the UK is set to be the latest exchange to host a rising wave of graphite explorers, all hoping to take advantage of the interest and growing commercial requirements of companies such as Tesla.

The Tesla story is well reported. Such is the company’s current influence, the electric auto maker was ranked the 10th most valuable global car brand recently with a valuation of $4.4 billion.

Yet Tesla isn’t the only brand or industry player with a requirement for graphite, the key component in lithium-ion batteries, which are driving the electric car revolution and promise to upheave the energy space.

Lithium-ion batteries are shaping as the basis of energy storage solutions, such as Tesla’s Powerwall.

Suffice to say, graphite is part of the solution to completely upend the way the world uses and stores energy.

Australian explorers were quick to cotton on to the growing demand for batteries and energy storage solutions and several small cap Australian listed graphite explorers have rushed into the sector.

Whilst future demand for graphite may appear strong now, there is no guarantee this will continue as fluctuations in the market can occur. There is never any guarantee of success for early stage exploration projects.

While Australian companies and investors have been quick off the mark, their UK counterparts have been relatively quiet in the space.

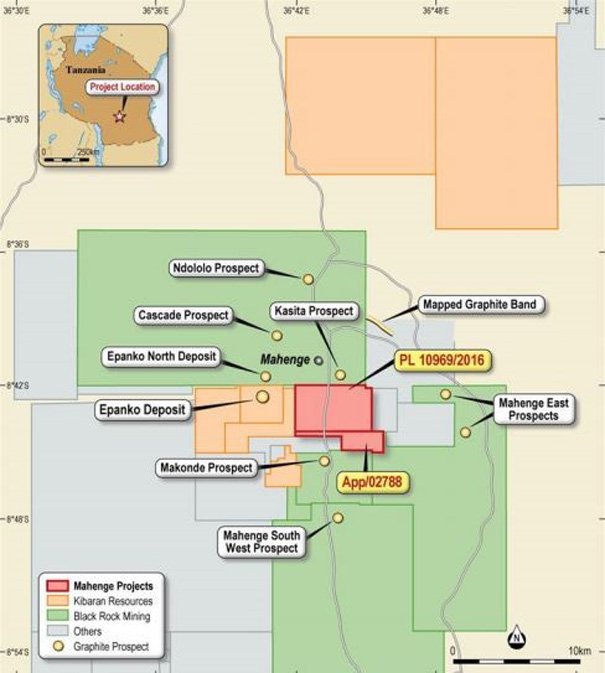

One of the few companies looking to take advantage of the growth in demand for graphite is AIM-listed Armadale Capital (LSE:ACP) – which recently entered into a heads of agreement to acquire the Mahenge Liandu graphite project in Tanzania.

The Mahenge Liandu project is surrounded by a clutch of higher valued Australian companies.

Both Black Rock Mining (ASX:BKT) and Kibaran Resources (ASX:KNL), are currently listed at multiples of ACP’s share price on the back of early work conducted on their high-grade coarse graphite projects.

BKT is currently capped at approximately $A15 million (£7.5 million), while KNL is capped at £26.5 million.

At the time of writing, ACP was capped at just £2.49 million.

It should be noted that Tanzania is a high risk region owing to political instability which can affect mining projects getting off the ground.

While both BKT and KNL can be classed as early-stage companies, the global demand for graphite is such that KNL has bagged binding offtake agreements to the tune of 30,000 tonnes per annum.

This includes 20,000tpa with ThyssenKrupp – a German conglomerate valued at €11.8 billion (£9.27 billion), demonstrating the kind of customers that junior resource companies can sell to in the early stage of the graphite exploration game.

Australian companies in Tanzanian graphite range from the aforementioned BKT all the way up to the $A1.4 billion (£720 million) Syrah Resources.

With the emergence of these explorers, Australian investors have bought into the graphite story.

The share price patterns of some of the Australian players, such as Volt Resources (ASX:VRC) and Magnis Resources (ASX:MNS) paint quite the picture.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

In London, even at this early stage, ACP is generating attention in investor circles, including from brokers. On the back of the Mahenge Liandu deal, ACP was slapped with a ‘speculative buy’ rating from Beaufort Securities.

And since one particular article on ACP’s new graphite plans was released on Monday 6th June, the stock’s share price has moved from 1.325p up to a closing price of 2.5p on 8th June, an 88% gain in the space of a few days.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

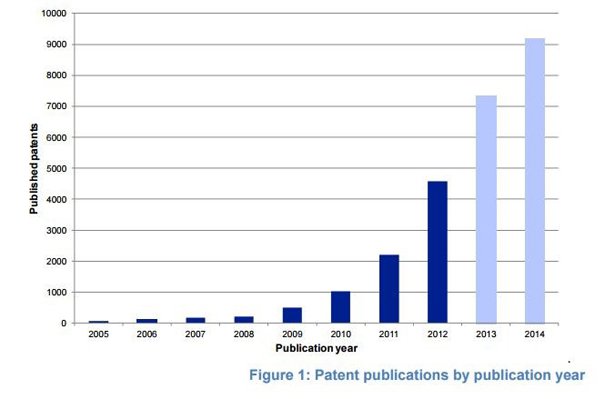

Last year the UK Intellectual Property office produced an update on the worldwide outlook for graphene patents – mostly because there had been such an explosion in patents for the use of graphene that it started to become something worth measuring.

Graphite has been hailed as a so-called ‘wonder material’ because of its malleability, strength, and electrical conductivity.

It maintains integrity at higher temperatures than other metals – which is why it’s being sought after in engine manufacturing.

It’s being looked at in the medical sector in tissue engineering, in integrated electric circuits and in the mining sector as lining for containment ponds.

Increasingly it’s finding its way out of the lab and into the commercial world – with its application in lithium-ion batteries leading the way.

Mid-way through last year Samsung announced that it was playing around with graphene-infused batteries in an effort to double the life of its smartphones range.

Suffice to say, any company which manages to double smartphone life will more than likely be a very profitable one.

Companies in Australia have managed to sell their high grade graphite discoveries to investors through the lithium-ion battery revolution. The question is whether we’re about see a spate of graphite plays on the AIM and LSE trying to tell a similar story.

Early movers such as ACP may be in the best position to tell the story and become leaders in the space and move beyond its current micro market capitalisation.

If that does eventuate, you can be sure there will be a raft of imitators starting to hit the London markets as has happened in Australia.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.