Lithium Australia’s proposed acquisition of VSPC

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium Australia NL (ASX: LIT) has entered into a proposed acquisition agreement to purchase a minimum 75% stake in Brisbane based battery cathode developer Very Small Particle Company (VSPC), a research and developer of some of the world’s most innovative and respected new era cathode materials for lithium-ion batteries.

Under the terms of the proposed share based acquisition, LIT would acquire up to 100 per cent of the company with a minimum acceptance requirement of 75 per cent.

Expanding on VSPC’s operations a little further, the company’s research and development work has resulted in it supplying high quality cathode material, including lithium-ion phosphate cathode material, widely used in hybrid electric vehicles, power tools and domestic storage batteries, into global test markets.

Acquisition would open up a new industry segment, additional revenue source

Not only would the acquisition tap into an additional market segment and provide another source of revenue to LIT’s business, it would also include a decommissioned pilot plant in Brisbane designed to produce complex metal oxides/phosphates for cathode production.

The plant incorporates Australia’s most advanced lithium-ion battery laboratory and testing facility which can establish the quality, performance and reliability of cells produced using the VSPC technology. The laboratory also includes cathode coating equipment and cell production capacity.

Interestingly, this announcement has coincided with the release of Galaxy Resources (ASX: GXY) half yearly report, a prominent lithium producer.

Similar to LIT, its shares have retraced significantly since the start of the year, but yesterday’s result triggered a rally of nearly 10 per cent.

It should be noted that historical performance and share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering investing should seek independent financial advice.

Strategic benefits of acquiring a complementary business

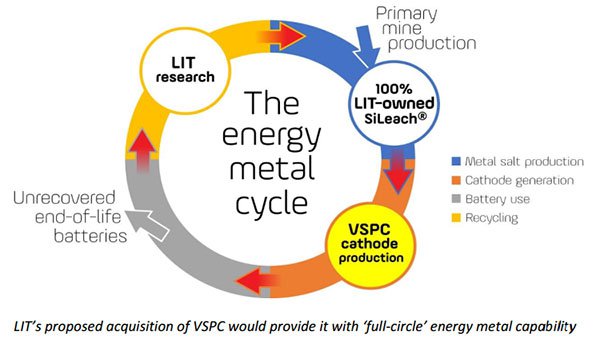

The VSPC acquisition is highly complementary to LIT’s broader-based lithium materials processing technology and emerging production operations, given it would provide the company with ‘full-circle’ capability to deliver source material into the global lithium-ion battery supply chain.

As well as having potential greenfield and brownfield production assets, via its flagship Sileach hydrometallurgical processing technology, LIT is capable of digesting any silicate material. The VSPC acquisition would provide LIT with access to both fresh and waste ore with recycling entry points into energy metals and cathode supply for global battery markets.

Taking the procedure a step further, the infrastructure that would be at LIT’s disposal under the proposed acquisition agreement would give the company the ability to produce existing and newly developed cathode material.

Recycling was the missing link in global lithium supply chain

Part of management’s strategy has been to enter the recycled lithium-ion battery market segment in order to extract energy metals that include lithium and cobalt.

VSPC is instrumental in achieving this goal with Managing Director Adrian Griffin saying, “Recycling closes the loop to create a circular energy economy, addressing a ‘missing link’ which LIT will be able to address through the reintroduction of recovered metals into the global lithium supply chain”.

Griffin went on to say, “The revolutionary cathode technology developed by VSPC provides that ‘missing link’, and the proposed acquisition would provide LIT with the opportunity to participate in the entire life-cycle of energy metals, thereby positioning the company as a leader in the field of not just portable, but also sustainable power”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.