Lithium Australia schedules maiden drill programme at Ravensthorpe

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium Australia (ASX:LIT), a junior lithium explorer based in WA, has announced that its recent fieldwork has identified an Exploration Target of 525,000t – 1,281,000t with a grade range of 0.8% – 1.2% at LIT’s Ravensthorpe lithium project, west of Esperance in southern Western Australia.

LIT is a developer of disruptive lithium technologies and has strategic alliances with a number of companies that could provide access to a diversified lithium mineral inventory spanning three continents.

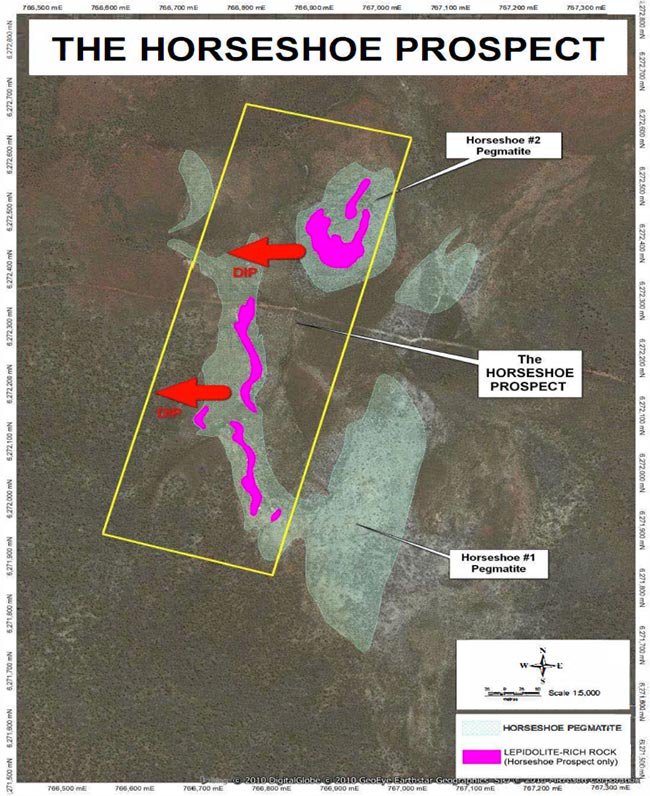

A maiden drilling program of up to 35 holes has been scheduled to commence at LIT’s ‘Horseshoe’ prospect, close to Galaxy Resources Mt Cattlin lithium mine. LIT expects the drilling to commence by October once work permits have been approved.

In a market update, LIT said that its recent field work has confirmed the significance of the size of the Horseshoe prospect, with “its numerous lepidolite outcrops (lithium hosting micas), and its shallow dip with minimal overburden overlying the zone of lithium mineralisation”.

The focus of the maiden drilling will be an area 650 metres long (shown above) containing the northern part of the large 950 metres long and 25 metres thick Horseshoe #1 pegmatite and the adjacent 250 metres long, 25-35 metres thick Horseshoe #2 pegmatite.

Horseshoe #1 has an exploration target of 336,000t – 840,000t while Horshoe #2 has a target of 189,000t – 441,000t.

Accompanying the announcement, LIT Managing Director, Mr Adrian Griffin said, “It is indeed significant that so much un-touched lithium mineralisation is sitting on the surface, within kilometres of the Galaxy-General Mining lithium operations”.

“The more we look, the more of these less-common lithium minerals we find, and what has been the constraint to adding them to inventory? It has been the cost of processing,” added Mr. Griffin.

LIT Managing Director, Adrian Griffin

LIT hopes that its recently announced Sileach process will help the company unearth previously dismissed lithium deposits.

Sileach in detail

The Sileach process has the potential to release the value from stranded lithium silicate deposits – those deposits quarantined by sub-economic grades. It can then transform low-grade spodumene occurrences into viable ore as, due to lower projected operating costs, it is less sensitive to feed grade.

The positive aspect for LIT is that it can expect to see lower cut-off grades when conducting resource calculations and expand existing resource estimates without further exploration.

As the lithium is precipitated from solution in the Sileach process, all impurities in lithium silicate feed can be rejected during the production of lithium chemicals. Spodumene, and other silicates, in which impurity concentrations would otherwise render them unmarketable, can now be considered viable process feed.

In a recent article, International Mining magazine said, “The Sileach process is potentially to lithium what froth flotation is to base metals”.

According to Mr. Griffin, the Sileach process puts an end to the energy intensive process of roasting to recover lithium from silicates. LIT is therefore able to use its 100% owned Sileach process to recover lithium from all lithium silicates, including spodumene.

Over time and with further development, LIT plans to use the Sileach process to unlock stranded lithium deposits on a global basis, in places such as Cinovec in the Czech Republic and Sonora in Mexico.

“Sileach is the start of a processing revolution that will lower the cost curve for the production of lithium chemicals from spodumene, and open the door for the less conventional mica deposits. We see the cost of hard rock lithium chemical production rivalling that of the low-cost the brine producers and we have the technology to make that happen” said Mr. Griffin.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.