Lithium Australia and MetalsTech form powerful partnership

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

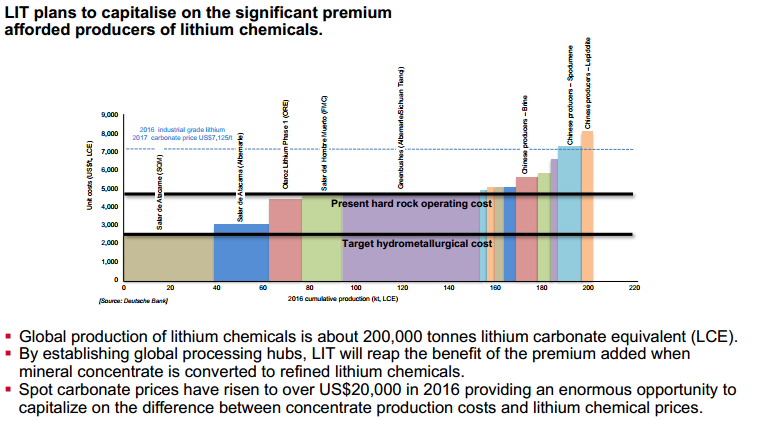

As a lithium explorer and lithium technology play, Lithium Australia, (ASX:LIT) already provided diversified exposure to the lithium theme, but Wednesday’s announcement that the group has partnered with soon to list MetalsTech has given it a whole new dimension, and with that, exposure to some prime assets and liquidity in emerging projects and technologies.

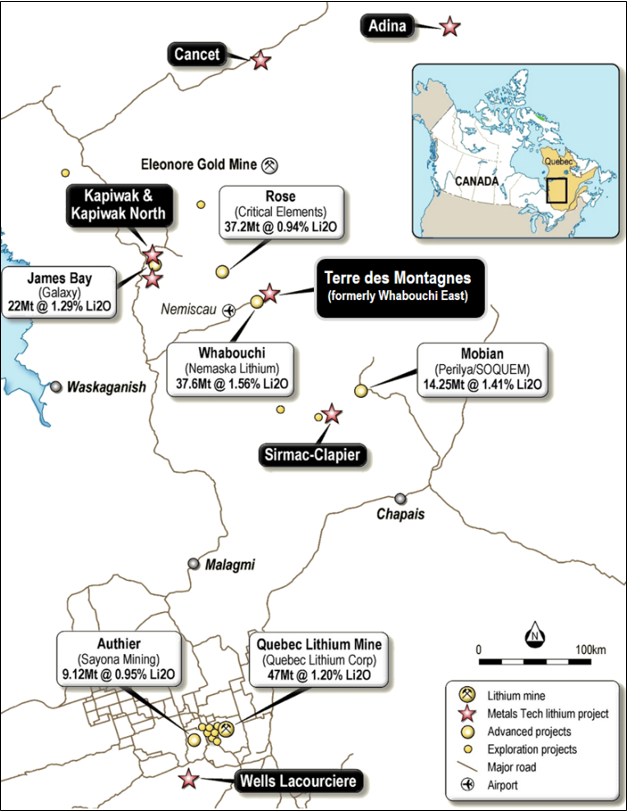

The partnership provides LIT with important equity and technology leveraged across six highly prospective hard rock lithium projects in Québec, a region well known as a ready source of lithium, as well as being a mining friendly jurisdiction.

As part of the deal, LIT shareholders will be rewarded with a $1 million priority offer in the MetalsTech IPO (ASX: MTC).

MTC recently acquired LiGeneration, a group in which LIT was an early seed shareholder. The new partnership agreement with MTC supersedes the previously announced relationship with LiGen.

Under the Strategic Partnership Agreement, MTC will have the exclusive right to use and apply LIT’s proprietary lithium extraction technologies (including Sileach and LieNA) for the processing of spodumene concentrate from its lithium projects within Québec.

As well as the aforementioned priority offer in MTC’s IPO, LIT will receive 1 million MTC shares as a result of its investment in LiGen. It will also receive 1 million shares for entering into the strategic partnership agreement.

Furthermore, LIT will be issued with up to a further 5 million MTC shares and 3 million MTC options subject to meeting various performance milestones.

As part of the agreement, LIT will be entitled to a 2% gross revenue royalty in relation to any products (including lithium carbonate and lithium hydroxide) that are produced by MTC using LIT’s proprietary lithium extraction technologies.

What this revenue figure amounts to is yet to be determined so seek professional financial advice and consider all facts before making an investment decision.

These terms indicate that the financial parameters surrounding the agreement are definitely favourable for LIT shareholders. However, there is more to the story with the prospect of potential blue sky as MTC develops a portfolio of hard rock projects in Québec.

These are prospective for lithium hosted in spodumene bearing pegmatites with the prominent Wells-Lacouciere project recently delivering assays of 7% lithium dioxide from surface including a 200 m2 bulk sample ranging between 2.87% and 4%.

Location, location, location

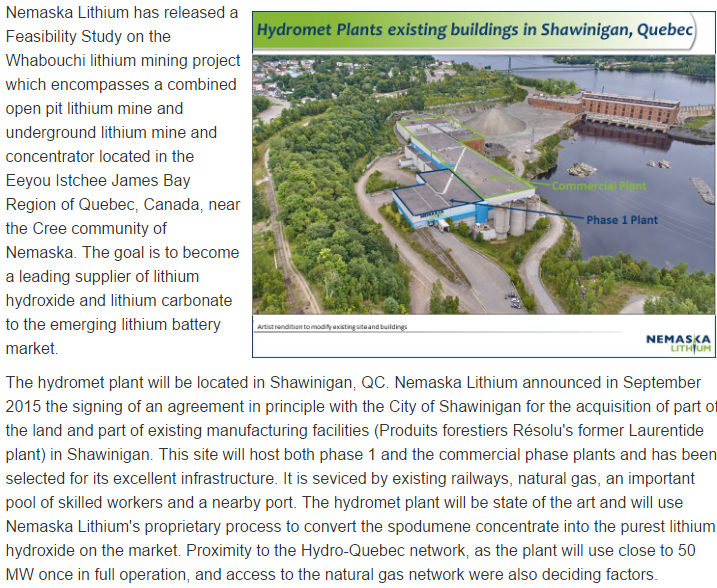

This deposit is in close proximity to the long established Québec Lithium Mine operated by Nemaska Lithium (TSX: NMX). The company claims its future lithium mine (Whabouchi) will produce spodumene concentrate from one of the richest spodumene hard rock lithium deposits in the world, both in volume and grade.

NMX is also looking to set itself up as a miner/tech/manufacturing play with the planned plant planned expected to transform spodumene concentrate into high purity lithium hydroxide and lithium carbonate for the growing lithium battery market.

An outline of the proposed project is shown below, and it is worth noting comments regarding established transport infrastructure and access to low-cost clean energy through the Hydro-Québec network, aspects that are particularly appealing to LIT and MTC.

Other lithium assets

Other assets which form part of the MTC portfolio include the Terre des Montagnes project (formerly known as Wabouchi East), which is contiguous with NMX’s 37.6 million tonnes@ 1.56 lithium dioxide Wabouchi deposit.

The Cancet project, which recently reported lithium dioxide surface assays grading between 1.7% and 3.8% is also part of the portfolio, as is the Adina project with surface assays grading up to 3.1% lithium dioxide.

The map below details the locations of the various projects and associated infrastructure.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.