Lithium Australia makes strides in war on waste

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

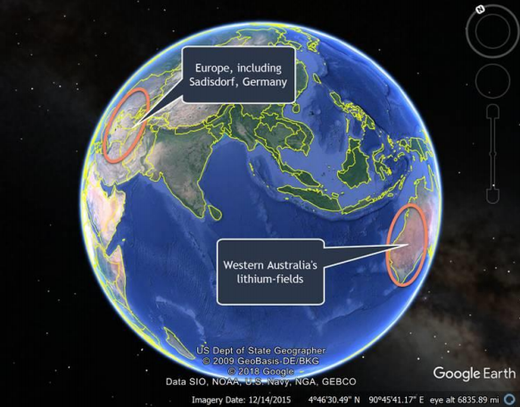

When it comes to global gold production, Western Australia’s prestigious goldfields rank second after China. By way of contrast, WA is now the world’s largest lithium producer, given the state’s “lithium fields”. These host abundant pegmatites, many of which contain lithium micas – which have long been considered waste by the mining industry.

This prestigious location is also home to Lithium Australia NL (ASX:LIT), which is developing disruptive technologies for the sustainable and ethical production of battery materials.

LIT specialises in the process development of waste materials, including lithium micas. While the company considers the lithium fields highly promising, it has also identified prospective regions in Europe – including a maiden lithium Resource in Germany, on the doorstop of the EU automotive industry.

As the company revealed to the market this morning, LIT has been making excellent progress across its tech and resource development business streams.

It should be noted LIT remains a speculative stock, so investors should seek professional financial advice if considering this stock for their portfolio.

FEED study

In conjunction with CPC Project Design and ANSTO Minerals (a division of the Australian Nuclear Science and Technology Organisation), LIT anticipates completion of its FEED study during the September 2018 quarter. Location trade-off evaluations are currently afoot in conjunction with this study.

LSPP feed source

LIT has identified a number of lithium mica occurrences as potential feed sources for the LSPP. These include lithium mica deposits in France and Germany, and two deposits located in WA’s Eastern Goldfields.

LSPP front-end engineering and design (FEED) study nearing completion

Substantial bench-scale and pilot plant trial test work has been undertaken on the Lepidolite Hill deposit (80% Lithium Australia, 20% Focus Minerals). To date, however, far less test work has been undertaken at a second deposit that has been called Waste2. Laboratory tests have shown that the metallurgical characteristics of concentrates produced from Waste2 vary from those of other micas tested. That variation is a consequence of the fact that Waste2 concentrates have a higher ratio of muscovite (a common mica devoid of lithium) and lepidolite (a common lithium-rich mica).

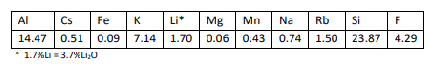

Data acquired during the test run will be used to finalise FEED criteria. The Waste2 concentrate has the following chemical composition, expressed as a weight %.

Pilot plant test at ANSTO Minerals

The concentrates generated from Waste2 will be tested in a SiLeach® pilot plant located within the ANSTO Minerals facilities at Lucas Heights in NSW. The pilot plant is configured for operating conditions that reflect those of the latest SiLeach process, which includes recovery of lithium by way of phosphate precipitation.

The pilot plant run is set to kick off in early August. The aim is to produce lithium products to commercial specifications, using the data obtained during the test run to finalise FEED design criteria.

LIT managing director, Adrian Griffin, said: “Lithium Australia continues its war on waste. In processing the Waste2 material, we will clearly demonstrate that we can take the particular waste provided, run it through the SiLeach pilot plant and create a commercial lithium chemical.”

“But that's only step 2 in ascending the value chain. Subsequently, the lithium chemical will be sent from Lucas Heights to our VSPC Brisbane plant for processing into battery cathode material. The cathode powder will then be tested at VSPC's in-house battery testing facility. We hope to report on its performance with respect to battery applications in coming months.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.