Lithium Australia to ‘close the loop’ on the energy-metal cycle

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

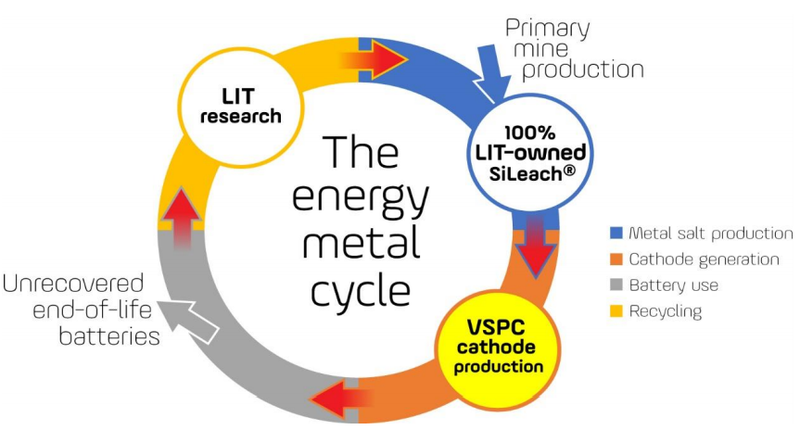

Lithium Australia NL (ASX:LIT) has advanced its acquisition of Brisbane battery cathode developer, the Very Small Particle Company Ltd (VSPC), with LIT and major VSPC shareholders executing a binding Share Sale and Purchase Agreement.

Brisbane-based unlisted public company, VSPC, has researched and developed some of the world’s most innovative and respected new-era cathode material production technology. The simple and cost effective VSPC process has potential to deliver a wide range of cathode materials for lithium-ion batteries, with superior control of product particle size and chemistry.

The process is capable of generating superior cathode powders over a wide range of cathode chemistries. Independent testing at a leading battery laboratory in Germany confirmed that batteries manufactured from VSPC cathode materials outperform industry benchmarks.

The VSPC assets include intellectual property and a decommissioned pilot plant in Brisbane that’s designed to produce complex metal oxides/phosphate powders for the production of lithium-ion batteries. The plant incorporates Australia’s most advanced LIB laboratory/testing facility and equipment for cathode coating and battery-cell production.

However, any news is speculative at this stage therefore investors considering this stock for their portfolio, should seek professional financial advice.

Alternative sources of energy metals = sustainability

The acquisition, which is subject to a minimum acceptance of 75%, will provide LIT with the ability to deliver cathode materials into the global lithium-ion battery supply chain from a number of sources. The initial feed sources include unconventional silicates such as micas contained in mine waste, low-grade and contaminated spodumene concentrates, waste materials from battery manufacturers, and used batteries.

Integration of compatible technologies will ‘close the loop’ on energy-metal usage and re-birth waste materials as superior cathode powders for the manufacture of LIBs.

Managing Director Adrian Griffin said, “The ability to utilise mine waste, unconventional lithium minerals and waste batteries in the production of high-quality cathode materials is the ultimate test of sustainability. This approach will help reduce the pressure on primary sources of energy metals. The integrated technologies available to LIT will allow for better resource utilisation, reduce the quantity of valuable materials going to landfill and enable the rebirth of many materials as new generation LIBs.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.