Lithium Australia buys into another WA hotspot

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium Australia (ASX:LIT) has continued its upstream drive – doing a deal with US Masters Holdings (ASX:USH) which sees the lithium player in the box seat at a key WA field.

The emerging lithium player told its shareholders this morning that it had managed to swing a deal with the gold and nickel explorer for lithium rights in two key tenements near Lake Johnson in WA.

While USH holds the gold and nickel rights to the tenements the deal will see it transfer lithium exploration rights to LIT in exchange for 9 million LIT shares.

In return, USH will get nickel and gold exploration rights to a tenement LIT currently has under application in the area in exchange for 3 million USH shares – when the permit is granted by the WA government.

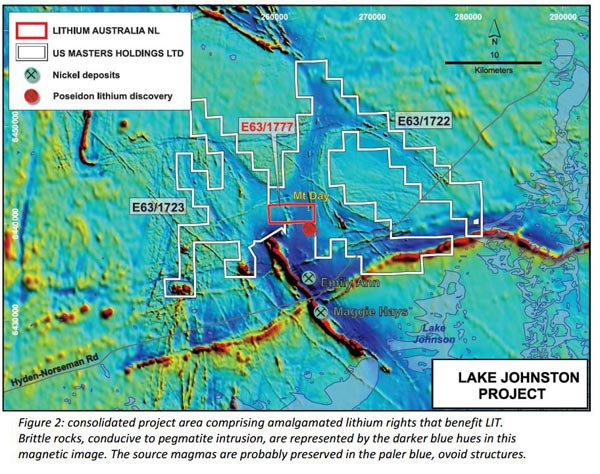

Map showing LIT’s latest WA play

Back in May, listed exploration player Poseidon Nickel (ASX:POS) announced that sampling from lithium pegmatites close to the border of the USH permits had brought up high lithium grades.

The samples are interpreted as extending northeast into one of the USH permits.

The deal effectively gives LIT a foothold in another emerging WA lithium hotspot, and managing director Adrian Griffin said it put the company in “the box seat”.

“Lake Johnson is a significant addition to LIT’s Yilgarn asset base, and the deal with USH puts us in the box seat in the area,” he said.

“While previous exploration ignored the lithium potential of the pegmatites, recent exploration has demonstrated conclusively the prospectivity of the area.

“It’s a great deal for LIT and USH.”

Recently it announced plans to drill up to 35 holes in an area subject of a $700 million merger between Galaxy Resources (ASX:GXY) and General Mining Corp (ASX:GMM) – at Ravensthorpe which is south of the Lake Johnson plan.

The first drill target for LIT is just 18km away from the Mount Cattlin mine, and includes the Horseshoe prospect.

LIT has been increasingly active on the upstream side of the business – having reinforced its position in several promising areas including Mexico and Greenbushes, the latter the site of the world’s largest supply of lithium.

About LIT and Sileach

While LIT remains active in the upstream, it’s downstream where it hopes to truly makes its mark.

It is working to prove up its ‘Sileach’ process – a way of processing lower-grade silicate deposits normally considered sub-economic.

The Sileach process involves grounding the test ore, digesting it in sulphuric acid, removing impurities and then extracting the lithium carbonate.

If LIT is able to prove up the technology, then it could open up a raft of resource which were previously considered too poor to mine.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.