LIT signals increased hunt at rare metals project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium Australia (ASX:LIT) has celebrated its recent name change by announcing that it would now expand exploration in the northwestern section of its Seabrook Rare Metals Venture project after promising geochemistry results came in.

Since it the grant of the E77/2279 permit area earlier this month, LIT and joint venture partner Tungsten Mining Ltd (20%) have conducted surface reconnaissance of pegmatite swarms in the northwestern corner of the permit.

Analysis found that the swarms could be an extension of the mineralised system previously identified further to the northwest.

Lithium pegmatites up to 300m in length were identified, and fall within the zone in which soil geochemistry indicates high prospectivity.

LIT told investors this morning that the result would spur on its exploration work on the permit, to try and unlock the value in the pegmatites.

The geochemical work will also be replicated at LIT’s Coolgardie Rare Metals Venture as well.

The news comes shortly after Lithium Australia (ASX:LIT), formerly Cobre Montana (ASX:CXB), officially changed its name with the Australian Stock Exchange (ASX) with a view of becoming Australia’s premier lithium producer.

The name change was approved by its shareholders on July 15th with the ticker code changing from ASX:CXB to ASX:LIT on August 4th.

Now operating as Lithium Australia, LIT wants to become the most dominant lithium company in the world, backed by technological supremacy in how lithium carbonate is produced.

Backed by breakthrough technology first developed by Strategic Metallurgy that has the potential to revolutionise how lithium is explored, mined and processed, LIT has been on a path to commercialising its unique technology since 2014.

In alliance with technology partners Strategic Metallurgy, LIT has discovered a way of commercialising a disruptive lithium extraction technology, based on recovering lithium from lepidolite – an abundant lithium mica. Micas have never been used as a source of lithium chemicals amongst existing lithium producers globally.

Finfeed.com initially covered LIT in the article, ‘285% resource upgrade for CXB’s Czech Republic lithium project’ as part of a series of articles over the past 6 months.

Results Checkpoint

Since July LIT has been eagerly awaiting results from continuous testing and commercial testing of its lithium carbonate final product.

Initial results show LIT is able to produce 99.57% pure lithium carbonate with a 94% recovery rate. As part of collaborative activity with several junior explorers, LIT is working Focus Minerals (ASX:FML) in Eastern Goldfields in Western Australia to conduct continuous lithium extraction tests using hydrometallurgy on hard rock.

The technology being conjured up by Strategic Metallurgy is being carefully licensed to selected explorers vis-à-vis joint-venture agreements. Strategic Metallurgy is in the process of repackaging its brand and technology into new company Lepidico – headed by Executive Chairman, Mr. Gary Johnson.

LIT Welcomes New Chairman

As part of LIT’s strategy to disrupt and dominate the global lithium industry, the company has recruited an industry veteran into its ranks.

Mr. George Bauk is a resource industry veteran with more than 25 years’ experience in developing mining projects with a strong specialisation in critical metals and rare earth elements. Mr. Bauk also brings significant expertise in raising capital and attracting funding partners including experience in negotiating offtake agreements internationally.

Supplementary to becoming LIT’s Chairman, Mr. Bauk also serves as Managing Director of ASX-listed Northern Minerals (ASX:NTU). Currently, NTU’s market capitalisation is $90 million with the company on track to commence supply of heavy rare earth elements for sale following a 5 year development path from a $6 million exploration company in 2010 to a $90 million producer today.

Prior to Northern Minerals, Mr. Bauk held global operational and corporate roles with WMC Resources, Arafura Resources and Western Metals.

Lithium Australia Chairman, George Bauk

Following the appointment, LIT’s Managing Director Adrian Griffin spoke to Finfeed.com and confirmed that, “George brings highly valued expertise and critical business acumen to Lithium Australia. His [Mr.Bauk] experience and networking will be invaluable for us going forward. We are gearing up with resources and people to generate and deliver on our strategy”.

His contribution is expected to be pivotal in paving LIT’s path to successfully commercialising its disruptive strategy.

LIT’s L-Max Technology and Strategy

One key strategic aspect is LIT’s aim to control a substantial lithium inventory which is made possible by effectively processing abundant mica material from existing mining operations around the globe.

LIT wants to secure a large hard-rock lithium deposit at either Cinovec (in partnership with EMH) or an alternative location elsewhere. LIT is able to record healthy sale margins given its ability to process raw mica material for US$2,000 per tonne of lithium carbonate produced while current lithium prices remain upwards of US$6,000 per tonne.

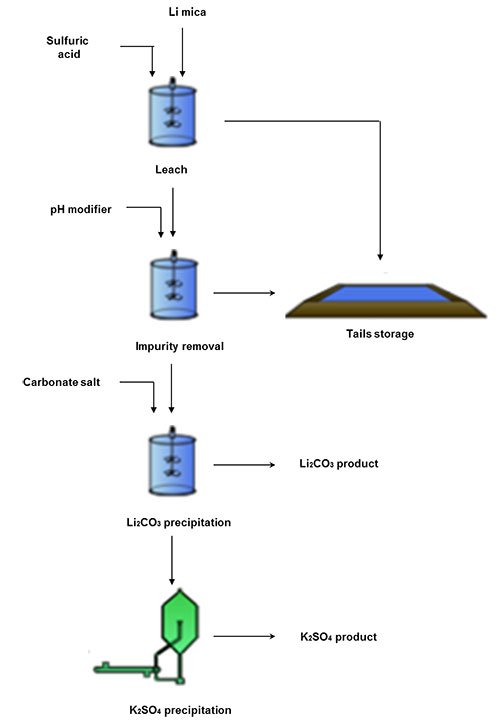

The standard method of producing lithium carbonate involves a costly, high-energy ‘roasting’ component which LIT can avoid by using a low-energy processing method outlined below:

The L-Max Method

The ‘L-Max’ Process involves grounding the test ore, digesting it in sulphuric acid, removing impurities and then extracting the lithium carbonate. This alternative way of lithium production is expected to allow LIT to undercut traditionally competitive brine producers such as Argentina-based Orocobre and Chile-based ‘SQM’ & ‘Rockwood’, all of whom are able to produce lithium carbonate at around $2,000 per tonne.

Continuous testing of lithium carbonate created via the L-Max method has so far delivered positive results. In tandem with its technology ally Strategic Metallurgy, LIT is now awaiting laboratory results from a 400kg batch submitted for commercial product evaluation in June.

Results are pending and their publication could provide renewed interest in this emerging Australian lithium player.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.