LIT makes board appointments for proposed IPO of Graphite Australia NL

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Two of Western Australia’s most experienced mining business identities have been appointed to Graphite Australia NL’s initial board, to drive the public float and ASX listing of this graphite explorer.

The new company will be birthed from a spin out of Lithium Australia’s (ASX:LIT) 100% owned subsidiary graphite interest in Western Australia.

The idea behind the split is to allow LIT to focus exclusively on bringing its advanced Australian and international lithium interests and exclusive lithium processing technologies to commercial markets around the world.

The new entity, Graphite Australia NL, can focus on developing the graphite prospects located in WA to service global battery markets and other demands for the resource.

Marque board appointments

The two well-known identities appointed to the board the Board of Graphite Australia as inaugural Directors are Mr Tom Revy and Mr George Bauk.

Appointed as an Executive Director, Mr Revy comes with over 30 years mining experience and has been tasked with driving the pre-listing requirements, followed by the Initial Public Offering (IPO).

Mr Revy’s rap sheet includes being a current and former senior executive with listed resource companies including Ferrum Crescent, Energio subsidiary KCM Mining, Worley Parsons, JB Were & Son, GRD Minproc, Empire Resources and CopperMoly.

The new Executive Director has worked on projects in Papua New Guinea, Australia, the Americas, Africa and China.

Mr Bauk, the current non-Executive Chairman of LIT, has over 25 years’ experience in the mining industry.

Highly regarded for his strategic management, business planning, establishment of high-performing teams and capital-raising skills, Mr Bauk has held senior operational and corporate positions with WMC Resources and Arafura Resources and was Managing Director of Indigo Resources (formerly Western Metals). Since 2010, Mr Bauk has also been Managing Director and CEO of Northern Minerals Limited.

Planned IPO structure

Through the float of Graphite Australia, LIT is expected to emerge as a significant shareholder and will also continue to provide both technical and administrative support to the newly listed entity.

As this is yet to occur, it is important to take a cautious approach to any investment in LIT and seek professional financial advice for further information.

LIT shareholders will be offered priority entitlement to the IPO share subscriptions in Graphite Australia when it floats.

Further details on the IPO will be announced to the market in the near future.

Graphite Australia’s assets

The graphite assets formerly held by LIT were part of the strategic plan to explore and develop the raw materials necessary to meet the growing demand for emerging battery technologies around the world.

Namely in lithium batteries, which require the two main materials in lithium and graphite.

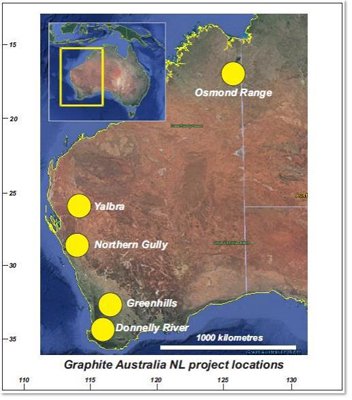

LIT has made applications for a total of eight exploration licenses in Western Australia in five project locations covering a total area of 589km2.

All the projects are greenfield in nature and are currently awaiting exploration grants.

The tenements are 100% owned by LIT.

The location of the projects to be held by the new entity

Yalbra (Gascoyne, 280km east of Carnarvon)

The Yalbra Project is located some 5km along strike from Buxton Resources’ JORC compliant Inferred Mineral Resource of 4Mt @ 16.2% TGC1 (total graphitic carbon). The deposit was reported by Buxton to be the highest grade JORC graphite resource in Australia. The LIT ground overlies 20km of the high grade metamorphic unit, the Warrigal Gneiss which is host to most of the graphite elsewhere at Yalbra. The unit is an immediate priority for investigation using advanced airborne electromagnetic (EM) methods.

Donnelly River (Southwest WA, near Manjimup)

These three ELAs are located over prospective high grade gneiss in an area where graphite mining dates back to 1904. Public domain EM surveys partially cover the tenements and indicate strong conductive responses within the LIT ground. These positive signatures may well represent graphitic horizons at depth and as such present as drill ready targets.

Northern Gully (40km northeast of Geraldton)

This is located in an area that has a long history of lead mining with lesser amounts of copper, zinc and silver exploited from around 1850. The Lady Sampson Lead mine lies within the application and exploration in 1972 reported graphite as a common accessory mineral in strained quartz reefs and brecciated pegmatites in areas adjacent to the mine. This occurrence was neglected with the focus being set solely on base metals. LIT believes Northern Gully is prospective for graphite discovery based on the favourable geological environmental and historic recorded graphite occurrences.

Osmond Range (northwest Kimberley)

This covers a series of EM targets within the Ahern Formation and Helicopter Siltstone. There are no known graphite occurrences within the tenure and the closest occurrence is the Mabel Downs prospect some 25km to the west. Public domain EM surveys show a strong east-west conductor possibly related to graphite. The EM targets indicate conductivity at depth and warrant further exploration.

Greenhills (South West Terrane of the Yilgarn Craton, 25km east of York)

The applications cover metamorphic rocks containing a number of historic graphite occurrences known as the Greenhills Graphitic Zone. A graphitic zone in the Greenhills area extends for up to 20km in an east-northeasterly direction from Greenhills railway siding towards Doodenanning. Historic sampling of graphite occurrences provided encouraging carbon results and LIT is of the opinion that the area is worthy of further exploration.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.