LIT JV strikes in the Goldfields

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium Australia’s (ASX:LIT) decision to tie up with Cazaly Resources has borne fruit – with the pair snagging new lithium ground right next door to a promising project.

The pair formed the Goldfields Lithium Alliance (GLiA) back in May as a way for both parties to scale up and take advantage of acreage opportunities in the region.

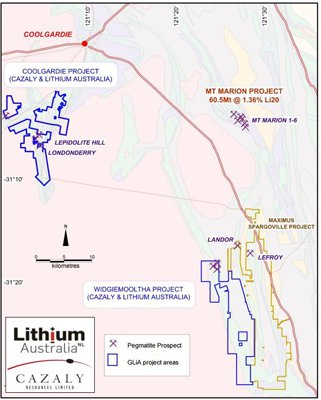

The alliance has made its first move, picking up over 81 sq.km in the goldfield, just 25km south of the global-scale Mount Marion Lithium project, which has a resource of 60.5 million tonnes at 1.36% lithium oxide.

Crucially, the new ground is just 2km away from a project being explored by Maximus Resources (ASX:MXR) – which recently reported rock chip samples averaging 3.55% Li2O.

GLiA is currently undertaking a desktop study of all the available data, and is also in the field to conduct initial fieldwork.

The ground itself has never been explored for lithium, despite the Geological Survey of WA finding a 1.8km stretch of exposed pegmatites.

Map showing the new project picked up by the GLiA

LIT told the market today that aerial photographs also “suggests the area has potential for several other pegmatite bodies bodies not mapped to date.”

Managing director Adrian Griffin said the acquisition showed the value of the partnership with Cazaly.

“The acquisition further cements the partnership with Cazaly as it brings complementary expertise to our efforts in the Goldfields enabling greater penetration into the opportunities offered by the region,” he said.

“Furthermore, the infrastructure within the Kalgoorlie mining region will be a significant advantage to any potential development opportunities.”

About the GliA

LIT and Cazaly formed the joint venture back in May as a way to combine their powers in the region.

Existing and future holdings in the region will be combined to form a 50/50 alliance for a minimum of five years and Cazaly now has access to 50% of LIT’s rights to the Coolgardie Rare Metals Venture (CRMV) including Lepidolite Hill.

The CMRV is a Lithium Australia initiative with Focus Minerals Limited (ASX:FML) and includes the historic lithium production centres of the Lipodilite Hill and Tantalite Hill mines.

LIT will also grant a SileachTM license to the Alliance for application of LIT’s 100% owned processing technology, to projects within the alliance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.