LIT closes energy metal cycle loop with advanced battery technology

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium storage could be the most significant change in energy management since the industrial revolution.

At the centre of this massive shift towards renewable power and the advancement of lithium-ion battery (LIB) technology is Lithium Australia NL (ASX:LIT), one of Australia’s foremost developers of disruptive lithium extraction technologies.

Last week, Lithium Australia NL (ASX:LIT) revealed its intention to procure advanced Li-ion battery cathode production technology by way of its acquisition of the Very Small Particle Company Limited (VSPC).

VSPC is an unlisted, Brisbane-based researcher and developer of some of the world’s most innovative and respected new era cathode materials for Li-ion batteries.

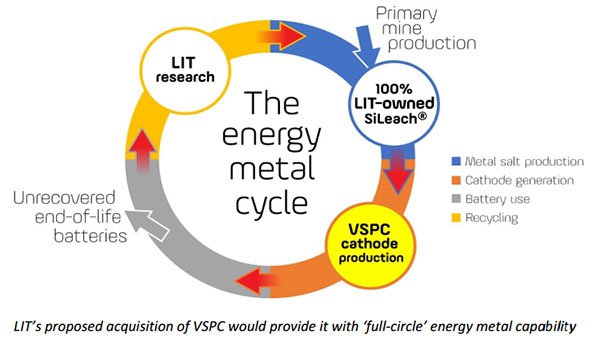

The acquisition will enable LIT to tap into the technologies needed to close the loop of the energy metal cycle.

In the video below, managing director Adrian Griffin discusses the acquisition in more detail.

Of course the acquisition is in its early stages and investors should seek professional financial advice for further information if considering this stock for their portfolio.

The acquisition offers considerable benefits for the renewables-focused LIT. VSPC owns an innovative, patent-protected chemical process, delivering highly precise chemistry to complex metal oxides (cathode materials), which represents a fast track to commercialisation of superior cathode products.

LIT will be able to recommission VSPC’s advanced cathode pilot plant in Brisbane, accessing the world’s most advanced cathode materials and expanding VSPC’s strategic partnerships.

Central to LIT’s plan is to deploy new technologies to produce battery chemicals in the lowest cost quartile. To achieve this, LIT will commercialise its 100%-owned SiLeach® lithium extraction technology develop the world’s best cathode materials via nanotechnology.

Vertical integration of these technologies will provide investors with exposure to high-quality exploration assets, the most optimal lithium extraction technologies, leading edge Li-Ion cathode manufacturing technology, and re-entry into the cycle by recovery of energy metals from spent batteries.

With significant headway made towards commercialisation of its SiLeach® hydrometallurgical lithium extraction technology, and having also embarked on a global exploration program and prepared graphite assets for IPO, 2017 is shaping up to be an auspicious year for LIT.

Using advanced technologies for LIB sustainability

The rapidly expanding battery industry faces a number of considerable challenges, including a susceptibility to supply shortages, the ethical constraints of conflict metals, low battery recycling rates, and under-utilised waste streams.

In Australia, only 10% of batteries are currently recycled, and abundant lithium from mining operations is discharged to tailings as waste.

Mitigation of these kinds of issues is central in LIT’s approach to lithium-ion batteries (LIBs) and sustainability.

LIT strives to achieve a ‘circular energy economy’ in terms of the production and utilisation of LIBs, and aims to integrate the highest performing technologies to do this.

SiLeach® – the most effective processing technology

SiLeach® is an unparalleled processing environment that efficiently digests and recovers all significant metal values from the minerals processed. It can therefore be applied to a wide range of lithium feedstock, with low energy consumption, high metal recoveries and extensive by-product credits.

As a hydrometallurgical process occurring entirely in solution (no roasting is required), SiLeach® reduces energy consumption. It’s also undertaken at atmospheric pressure, so only simple mechanical components are necessary.

All metals within the target minerals are soluble in the SiLeach® process, providing the opportunity to generate significant by-product credits, and to produce very clean lithium solutions.

This versatile technology also has applications beyond the recovery of lithium from silicates. For example, it has been tested on refractory gold ores to remove siliceous gangue material from the ore prior to cyanide recovery of gold.

This versatility suggests that SiLeach® could become the benchmark for extraction of a wide range of metals from silicates.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.