Leigh Creek surges 25% as commercialisation nears

Published 27-MAY-2019 11:16 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

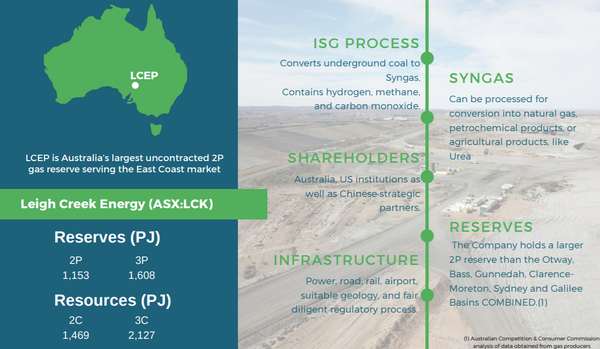

Developer of the Leigh Creek Energy Project (LCEP) in South Australia, Leigh Creek Energy Ltd (ASX:LCK) provided a promising update regarding the progress it has made towards commercialising the project.

There has been plenty of promising newsflow since the company released its maiden 2P Reserve on 20 March, 2019 and this has been reflected in the group’s share price which hit a high of 43 cents in March, up from less than 10 cents in February.

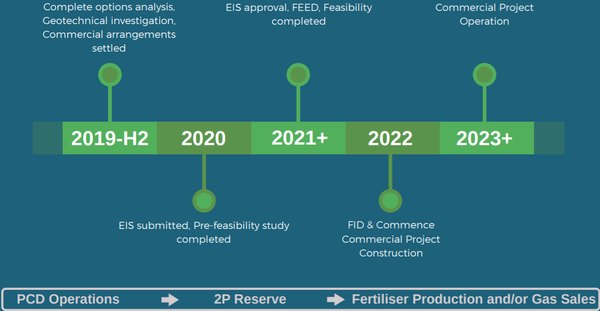

Along with the recent completion of successful operations of the Pre-Commercial Demonstration (PCD), the 2P reserve announcement has allowed the advancement of negotiations with multiple potential strategic partners. These partners have significant energy operations domestically and in key international markets.

Further share price momentum was experienced on Friday 27 May, (+25%) when the company announced that discussions with off-takers and gas purchasers had progressed to the point where it had engaged legal counsel to draft and document commercial arrangements.

Discussions with numerous potential partners

In March, LCK received a PRMS (Petroleum Resource Management System) certification of 1,153 petajoules 2P reserve from MHA Petroleum Consultants, a globally recognised unconventional energy independent engineering firm based in the US.

Utilising In-Situ Gasification (ISG) technologies, LCEP will produce high value ammonium nitrate products that have applications in the production of fertilisers and industrial explosives from the remnant coal resources at Leigh Creek.

The project will provide long term stability and economic development opportunities to the communities of the Upper Spencer Gulf, northern Flinders Ranges and South Australia.

The company had already been in discussions with over a dozen potential partners prior to the announcement and has held a significant number of meetings with those interested parties since then.

Several of these partners have engaged with LCK over a considerable amount of time, however, they required an independent reserve report and production data from the PCD before they could progress negotiations on a commercial basis.

Upon receipt of the 2P Reserves and a review of LCK’s production data, these partners have applied for the regulatory approvals they require to move the project forward and as a result, negotiations with those partners are advancing.

Upon approval being granted by their regulators it is the company’s view that negotiations can be formalised and announced to the market.

Commercial discussions with other parties vary from Gas Sales Agreements and Heads of Agreement to LCK’s willingness to accept an investment or strategic funding and/or project finance.

Significant Interest from Offtakers/Purchasers

Discussions with off-takers and gas purchasers have progressed to the point where LCK has engaged legal counsel to draft and document these commercial arrangements.

These offtake discussions are being held with companies with considerable energy needs or operations that would require the gas from the LCEP to service power, industrial needs and feedstock for major industrial applications.

These purchasers all have considerable assets and operations in Asia and Australia.

Management will be providing further updates regarding these commercial arrangements, potentially providing further share price momentum as certainty grows around commercialisation.

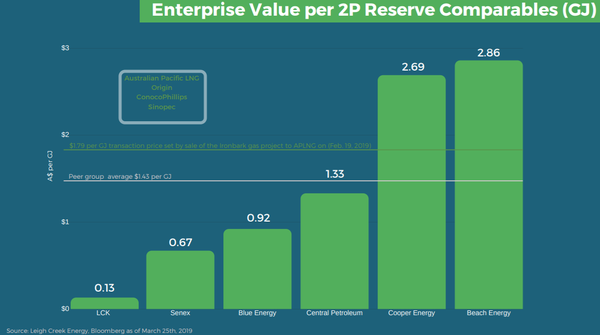

As indicated below, it would appear that such a re-rating is overdue when one takes into account the heavy discount implied by the company’s enterprise value relative to peer 2P reserve comparables.

Financially robust with cash injection imminent

The current major expenditure demands on LCK relate to the finalisation and decommissioning of the PCD, and management is confident that it is financially equipped to meet these costs.

Following the PCD decommissioning, management has made multiple cost reductions in operating expenses such as fuel, equipment rental expenses, staff and contract labour.

LCK is now progressing through the final decommissioning and monitoring phases of the PCD.

In the interim, management has maintained its Research and Development financing facility with the Commonwealth Bank of Australia.

This facility was extended in March 2019 to $4 million, and the balance of that facility remains readily available to the company, should the funds be required.

LCK reported that there have been no adverse environmental issues during the operational phase and the decommissioning phase of the PCD, also an important factor in strengthening the company’s financial position.

As the final environmental monitoring obligations for the PCD are satisfied, management expects environmental cash guarantees held by the regulator to be progressively released.

There is also the potential to generate early-stage revenues from an agreement with Africary, a South African multifaceted resource and technology company owning several energy related interests in South Africa.

The company signed a Heads of Agreement for the lease and option for sale for LCK’s PCD Plant in January 2019.

This has progressed to the point where Africary is coming to Adelaide in June to further its commercial understanding of the PCD plant and discuss its potential interest in the project.

Pathway to commercialisation

Discussing the significance of recent events in terms of clearing the way for commercialisation, LCK managing director Phil Staveley said, “Since the maiden 2P announcement, interest in LCK’s gas reserves has magnified, and the company has progressed with commercialising the LCEP on several fronts.

“Rapid progress is being made with our strategic partners to the point where they have applied for their regulatory approvals and we are pleased with the reception and strong interest we have received from large Australian and international corporations interested in forming commercial arrangements with LCK.

“We look forward to updating the market on these arrangements as they progress to binding agreements that map out LCK’s way forward to its commercialisation path in the very near future.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.