LCL identifies significant porphyry targets at Chuscal target in Colombia

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Colombian-focused gold exploration company, Los Cerros Limited (ASX:LCL) today announced that geochemical 3-D modelling has identified a significant porphyry target.

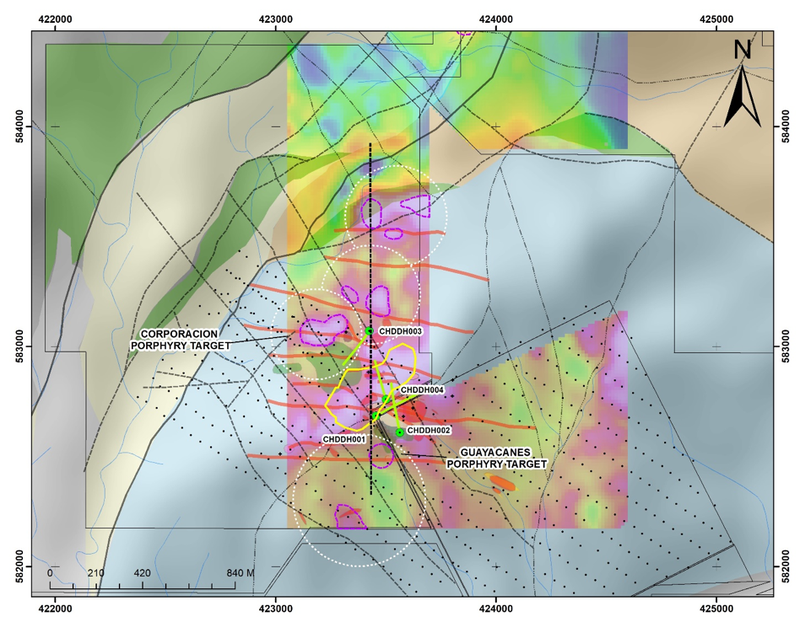

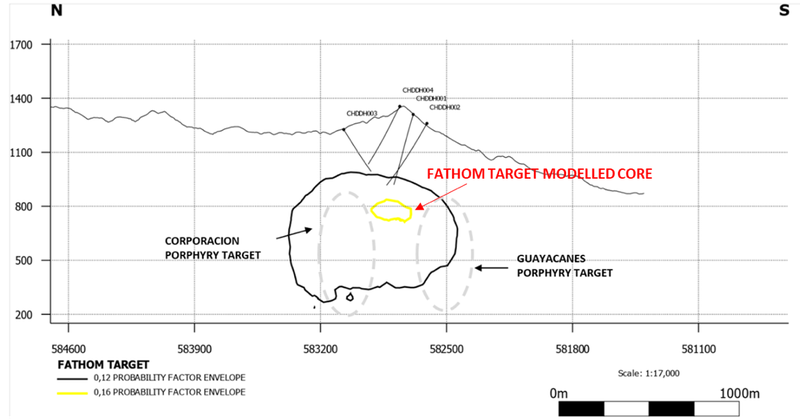

The independent 3-D geochemical modelling has revealed that the Guayacanes and Corporacion porphyry targets at the Chuscal prospect form part of a substantial porphyry target below and untested by recent drilling.

The 3-D model plus ongoing geological modelling will inform porphyry and epithermal drill program planning for the second half of 2020, assuming ongoing easing of COVID-19 restrictions.

The Chuscal prospect at the Quinchia Project is part of LCL’s Quinchia Gold Portfolio, along with the Andes Project, and is located within the same structural trend as the 14Moz Marmato Gold Mine and the 29Moz La Colosa gold project.

Los Cerros, in conjunction with its technical advisor Dr Steve Garwin, recently engaged Fathom Geophysics to apply a sophisticated 3-D multi-element geochemical modelling technique to the Chuscal geochemical data set.

Dr Garwin has successfully used this technique previously to fine tune porphyry targets such as SolGold’s Tier One Alpala discovery in Ecuador. The technique has identified a high probability porphyry target (Fathom target) immediately below and adjacent to recent drilling.

The technique compares eleven selected porphyry pathfinder elements from Chuscal surface samples and drill core assays to the distribution of the same pathfinders at the Yerington porphyry - an internationally studied Cu-Mo-Au porphyry deposit in Nevada.

Porphyry Cu-Au deposits are amongst the most studied in the world and it is now generally accepted that there is a zoned element signature common to most porphyry systems. Understanding that signature is critical in focusing drilling towards the high-grade Cu-Au core of what can be very large mineralised porphyry systems.

The Fathom simulation considers the element profile of a Chuscal data point and places that data point in the context of the vertical dispersion of the Yerington geochemical profile. Through multiple iterations of this process the modelling forms a probability ‘best fit’ that identifies how close the distribution of Chuscal geochemical results matches the Yerington model, and specifically where the porphyry core is likely to be located within the Chuscal porphyry system.

Based on probabilities, it then generates a 3-D target of where the high-grade zone of Chuscal is likely to be based on similarities with the Yerington analogue.

The exercise generated a compelling ‘high quality target’, the Fathom target, incorporating the previously identified Guayacanes and Corporacion porphyry targets, at a depth of approximately 500m, some 50-100m below the four holes drilled in the 2019 drilling program.

The ‘high probability’ Fathom target core (extrapolated from comparison to the Yerington model), lies midway between the Guayacanes and Corporacion targets and extends to the northeast of previous drilling.

Los Cerros Managing Director, Jason Stirbinskis explained “Fathom’s work is based on the provision of raw geochemical data only. It is a credit to our technical team that the Fathom work supports the existing Corporacion and Guayacanes porphyry targets generated from the entire geological and geophysical database including porphyry alteration signatures, veining styles and magnetics and adds a third target of higher probability that lies between these two targets.

“Our Colombian geological team continues to tweak both epithermal and porphyry targets ahead of our planned resumption of drilling in H2 2020.”

Today’s announcement follows news on 30 April that Los Cerros will take a 100% interest in Chuscal in a deal that saw AngloGold agreed to exchange its Chuscal JV interest for a shareholding in LCL.

Subject to a formal agreement, the deal will provide AngloGold with exposure to the broader Los Cerros portfolio via a 4.3% relevant interest in LCL and the right to increase that shareholding to 10%.

It will see Los Cerros gain a 100% interest in the Chuscal Project for a 100% holding of the entire Quinchia Project, plus the addition of AngloGold to its share registry. It also gives Los Cerros access to AngloGold’s regional IP geophysics dataset and unlimited use of its IP equipment for 1.5 years.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.