Latin Resources drilling results could see peer comparison rerating

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

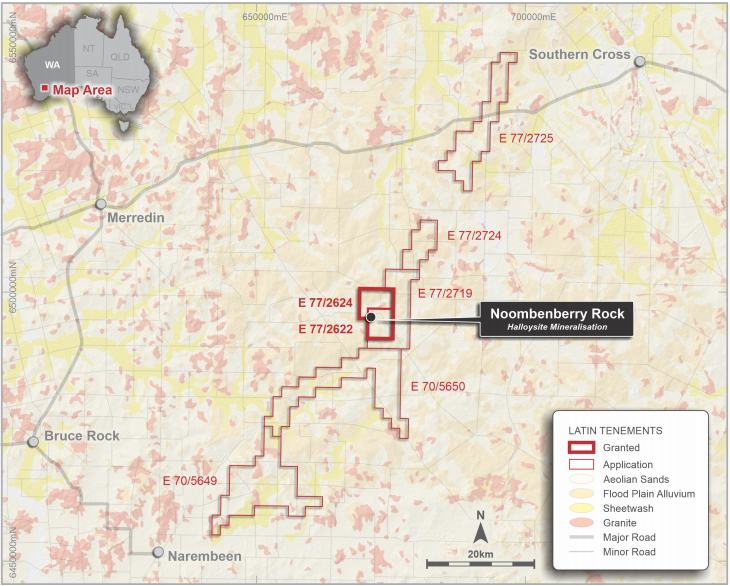

Latin Resources Limited (ASX:LRS) has completed first pass and infill air-core drilling at its 100% owned Noombenberry Project, east-southeast of Merredin, Western Australia.

Investors like what they see, particularly given they have noticed the success of peers such as Andromeda Metals (ASX: ADN), and the company’s shares opened 27% higher on Tuesday morning.

The company completed 197 drill holes for a total of 4,430 metres of vertical shallow air-core drilling over an area of approximately 4.5 kilometres by 4 kilometres (18 square kilometres), to test the extents of a known Kaolinite - Halloysite occurrence where previous sampling has returned results of 38.9% Kaolinite, 15% Halloysite and 31.8% K-feldspar.

The initial phase of drilling on a regular 400m x 400m grid pattern was completed prior to the Christmas break, with a second phase of off-set infill drilling to a nominal 200m x 200m pattern focused on thicker zones of logged kaolinitic clays completed in the first weeks of January 2021.

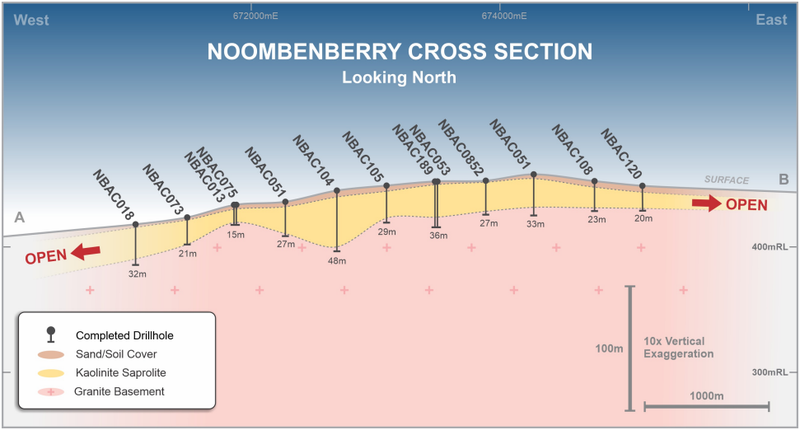

Logging of air-core drill cuttings has confirmed significant intersections of bright white kaolinite across the area tested as shown below, with a maximum logged downhole intersection of 50 metres.

This sequence of well-developed kaolinitic clay (saprolite) beneath a thin layer of soil cover is consistent across the area tested.

Composite samples from the air-core drilling will be sent to laboratories in Perth and Adelaide where they will undergo detailed test work with results expected to be received in February.

Establishment of maiden Resource Estimate

Discussions have commenced with suitably qualified geological consultants in respect to the generation of a maiden Resource Estimate for the Noombenberry Project.

Once all results from test-work have been received, a detailed geological interpretation will be produced by Latin Resources’ geological team including geological and mineralisation domain wireframes to be used in the estimation process.

Reconnaissance prospecting of ‘target dams’ identified in aerial photo-mapping confirmed the presence of additional bright white kaolinitic clays and kaolinised granite some 15 kilometres along strike to the north-east of the drilling area.

Consequently, management is confident of the potential to expand the footprint of this kaolinite occurrence within the company’s considerable tenement holdings as outlined below.

Latin Resources exploration manager Tony Greenaway provided promising details on the drilling program in saying, “Our initial observations from drill cutting are very encouraging, with our logging showing the development of a thick, consistent, flat dipping blanket of bright white kaolinitic clay across the area of our drill testing, just metres below the surface.

"The geometry and consistency of the kaolinite layer as illustrated in the cross-section will bode well for any potential future development.

"We are now able to significantly advance the Noombenberry project to the next stage, which includes a resource estimation and other preliminary studies.

"While we wait for the results from the test work to be returned from the laboratory, we will build our preliminary wireframes and advance our discussions with suitably qualified resource consultants, with the aim of generating a maiden mineral resource for the Noombenberry project as soon as possible.”

Is Latin Resources the next Andromeda

Andromeda Metals is developing the Great White Halloysite-Kaolin project in South Australia.

While Noombenberry is at a much earlier stage than the Great White Project, already there are similarities, as well as promising contrasts emerging.

It is worth noting that shares in Andromeda have increased six-fold since September with a significant catalyst being the receipt of promising assay results featuring bright white kaolin with a minimum igneous of 10 metres extending over an area of 1.2 square kilometres at the Hammerhead deposit.

Importantly, holes with a minimum thickness of 10 metres were drilled at Hammerhead compared with hole thicknesses ranging between 15 metres and 50 metres at Noombenberry.

A maiden mineral resource estimate of 51.5 million tonnes for Hammerhead was announced in late-September provided further share price momentum.

Consequently, should Latin Resources receive promising assay results, paving the way for a maiden resource, the company’s shares could undergo a significant rerating.

On this note, it should be remembered that Latin Resources has undertaken exploration drilling over an area of 18 square kilometres as opposed to 1.2 square kilometres at Hammerhead, a factor that could drive upbeat investor sentiment if like-for-like assays are received.

The other factor that is worth bearing in mind is that kaolin has received increased interest because of its broader industry applications in the production of high-tech components, particularly in areas such as nanotechnology.

Given this backdrop, investors will already have a reasonable understanding of what could be considered a new age commodity with significant upside in terms of demand.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.