Lake Resources progresses permitting at lithium brine project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

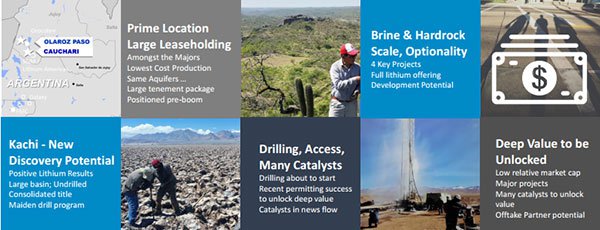

Argentinean focused lithium exploration company Lake Resources N.L. (ASX:LKE) has confirmed the successful permitting progress of circa 49,000 hectares of exploration applications at its Olaroz – Cauchari Lithium Brine Project in the Jujuy Province, Argentina.

The applications adjoin the production leases owned by Orocobre and SQM/Lithium Americas and have the potential to display lithium in the same aquifers.

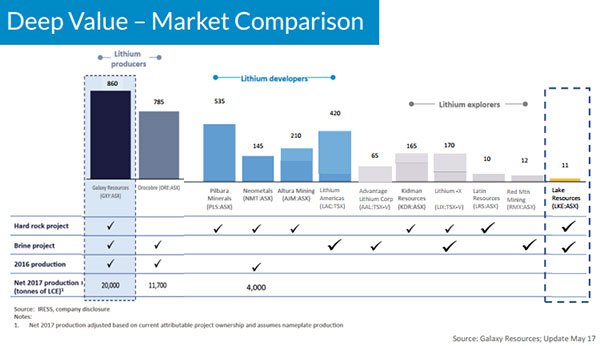

This development could be the trigger for a share price rerating, as the company’s market capitalisation does not appear to reflect the current value of its assets or the exponential value that could be realised during the exploration stage.

It should be share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

A private company acquired by LKE in November 2016 showed good foresight in applying for nearly 50,000 hectares of prime lithium brine areas prior to the lithium boom, a dynamic that has substantially increased the cost of areas prospective for the commodity.

LKE’s Managing Director, Steve Promnitz conceded that administrative issues had led to delays in the applications being processed, however these have been resolved with the applications now successfully moving to permitting stage.

LKE noted that its subsidiaries are working closely with the local regulators to promptly progress the applications to allow access to the areas.

In commenting on this development, LKE’s Managing Director, Steve Promnitz, said, “This is a very significant development for Lake Resources, particularly given the applications are situated in an area that can only be described as first grade with their true valuations likely to be realised through comprehensive exploration”.

LKE is also undertaking an aggressive exploration programme to explore/develop prime 100% owned lithium projects in Argentina, situated among some of the largest players in the lithium sector.

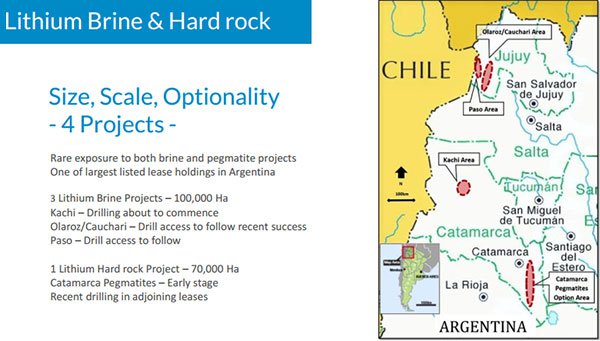

As indicated on the following map, LKE holds three key lithium brine projects located in the Lithium Triangle which produces half of the world’s lithium. LKE also holds one large package of lithium pegmatite properties which were an unappreciated source of lithium in Argentina until recently.

The three key brine projects held by LKE have similar settings to major world class brine projects being developed – Olaroz/Cauchari, Paso and Kachi in the highly prospective Jujuy and Catamarca Provinces.

One project is located next to Orocobre’s Olaroz lithium production and Lithium Americas’ Cauchari project, with another south of FMC’s lithium operation.

While LKE is only in the early stages of developing these projects, the quality of their landholdings in terms of proximity to existing high profile producers could make it one of the most highly sought after plays in the sector, and perhaps the subject of corporate activity.

In the interim, the following potential catalysts are worth pencilling in given the prospect of multiple news flow emerging across the company’s assets.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.