Lake Resources commences drilling at Kachi lithium project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lake Resources N.L. (ASX:LKE) today informed the market that it had commenced drilling at its highly prospective Kachi lithium brine project in Catamarca Province, Argentina.

The highly anticipated drill program has now kicked off with diamond drilling over the lithium-bearing salt lake at the project, covering an initial 1000 meters, with the capacity to expand depending on interim assay results.

The company has received all signed approvals from regulators for the maiden programme at Kachi, a site covering 50,000 Ha of mining leases owned 100 per cent by LKE’s Argentine subsidiary, Morena del Valle Minerals SA.

Commenting on the announcement from the site, Lake Resources’ Managing Director, Steve Promnitz said: “This is an important milestone for the company and the local community with the drilling program a key catalyst to unlocking the burgeoning value in these well-located lithium assets.

“We eagerly anticipate the first set of assay results which we will report as soon as possible. Should the initial results be positive, we will extend drilling beyond the first 1,000 metres.”

Drill rig at the Kachi project

Prior surface sampling at Kachi has revealed positive lithium results which the company hopes to expand on through the current drilling program as well as geophysics. Earlier in the year, the project was selected by the State of Catamarca to be accelerated to ensure appropriate development.

It should be noted though, that this is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

Kachi is located in one of Argentina’s most prospective lithium regions, currently receiving interest from several major and small-mid cap players. There have been significant recent corporate transactions in leases adjacent to the Kachi project, with companies such as SQM, Orocobre and Lithium Americas developing a number of large-scale projects. LSC Lithium raised over $60 million on a large lease package in similar areas to LKE’s tenements.

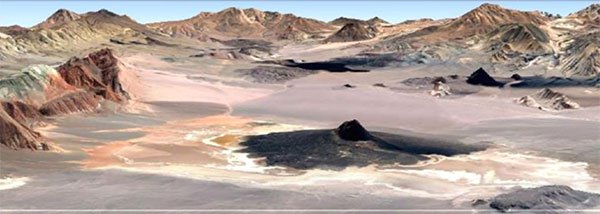

Landscape photo of the Kachi Project location in Catamarca Province, Argentina.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.