Koppar aims to tap into high demand EU battery market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Koppar Resources Ltd (ASX:KRX) released its quarterly result on Tuesday, highlighting the transformational acquisition of the Vulcan Zero Carbon LithiumTM Project.

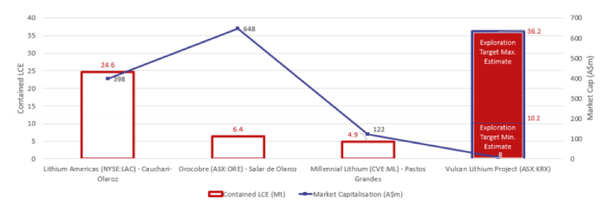

Following an initial geological study, the company announced a substantial Exploration Target, ranging between 10.73 to 36.20 million tonnes of contained LCE (Lithium Carbonate Equivalent), making it potentially the largest lithium project in Europe, and globally significant.

It should be noted that the Exploration Target’s potential quantity and grade is conceptual in nature, and that there has been insufficient exploration to estimate a Mineral Resource, making it uncertain whether further exploration will result in the estimation of a Mineral Resource.

Koppar has commenced a confirmatory brine re-sampling programme from well-head sites within the brine field, with a view to establishing a maiden JORC resource.

The results of this program are expected within the coming weeks.

Accelerated conversion to maiden mineral resource

The company intends to convert some of the Exploration Target to a maiden Mineral Resource Estimate as soon as possible, by generating new geochemical data and evaluation of existing seismic and well data.

Work has commenced to achieve this goal.

The company has also commenced a scoping study at the Vulcan Zero Carbon LithiumTM Project, and during the September quarter it appointed Hatch Ltd. as process engineering lead.

In line with its strategy of developing its European projects, management is also evaluating a potential dual listing on a European exchange.

It could be argued that this would be a very beneficial initiative given capital markets in the Northern Hemisphere regions tend to have a good understanding of new age metals, as well as being in close proximity to Koppar’s project based in Germany.

Unique technology likely to drive investment

As well as being in a stable jurisdiction located in close proximity to relevant industrial markets, Koppar’s goal of becoming Europe’s and the world’s first zero carbon lithium producer is likely to attract plenty of attention.

In recent years, investors have demonstrated their thirst for companies with exposure to new age battery/power storage materials, flocking to lithium, cobalt and vanadium stocks to name a few.

Consequently, if Koppar is onto the next big thing in that space it may be well supported.

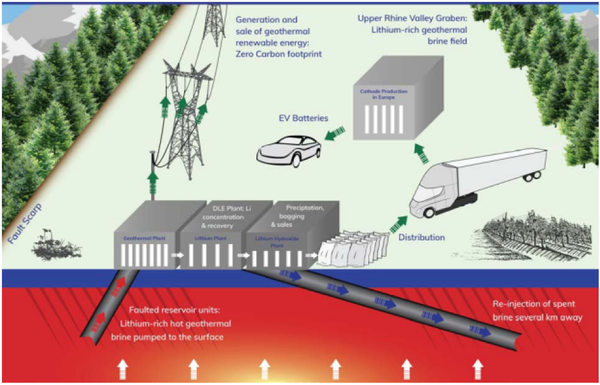

The company aims to produce battery-quality lithium hydroxide from hot, sub-surface geothermal brines pumped from wells, with a renewable energy by-product fulfilling all processing energy needs.

The following is a schematic of what Koppar’s zero carbon lithium project would entail.

The Vulcan Zero Carbon LithiumTM Project is strategically located within a region well-serviced by local industrial activity, at the heart of the European auto and lithium-ion battery manufacturing industry, just 60 kilometres from Stuttgart.

The burgeoning European battery manufacturing industry is forecast to be the world’s second largest market for such a product.

There is the scope for Koppar to experience exponential growth as there is zero domestic supply of battery grade lithium products, providing the company with a first mover advantage.

The company recently commenced a scoping study at the project and is targeting a maiden JORC resource by year-end, indicating there potentially are near term share price catalysts.

Compelling supply/demand dynamics

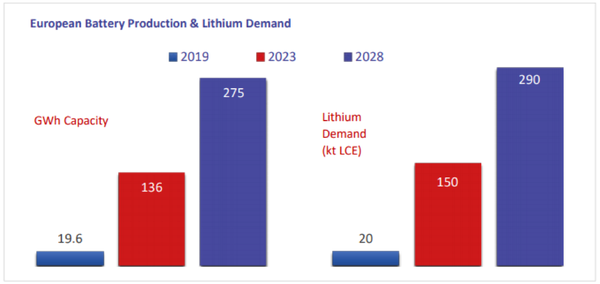

Management noted that there is an unprecedented ramping up of lithium-ion and associated cathode production in Europe.

The company pointed to forecasts showing that the European Union (EU) is set to require the equivalent of the entire current global battery quality lithium demand by the mid-2020s, with 2023 being the main inflection point.

There is currently zero European Union production of battery-quality lithium hydroxide, let alone a CO2-neutral product.

Consequently, a severe battery-quality lithium chemical supply shortfall is developing in the European Union, creating ideal conditions for Koppar.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.