Kingston strikes trifecta with exceptional gold recoveries

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

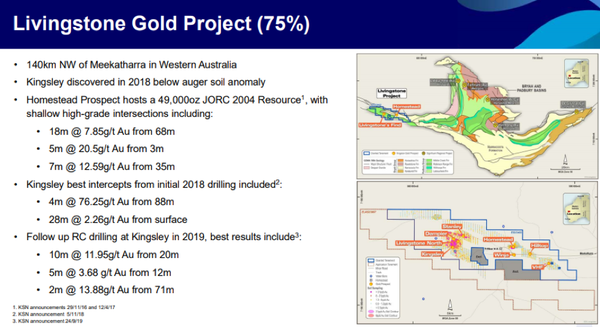

Kingston Resources Limited (ASX:KSN) has released outstanding preliminary metallurgical test work data in relation to gold recoveries from its 75%-owned Livingstone Gold Project, 140 kilometres north-west of Meekatharra in the Bryah Basin region of Western Australia.

The test work which was based on 16 ore samples collected from recent Reverse Circulation (RC) drilling at the Kingsley prospect delivered gold recoveries averaging 93.8%.

Importantly, there were robust recoveries across three types of gold mineralisation, and on this note, managing director Andrew Corbett said, “Achieving average gold recoveries of 93.8% from preliminary metallurgical test work is an outstanding result.

‘’Kingsley has the trifecta of high grades in oxide, transitional and primary mineralisation, with this first-pass metallurgical test work indicating that each of these ore types is amenable to conventional cyanide extraction methods.’’

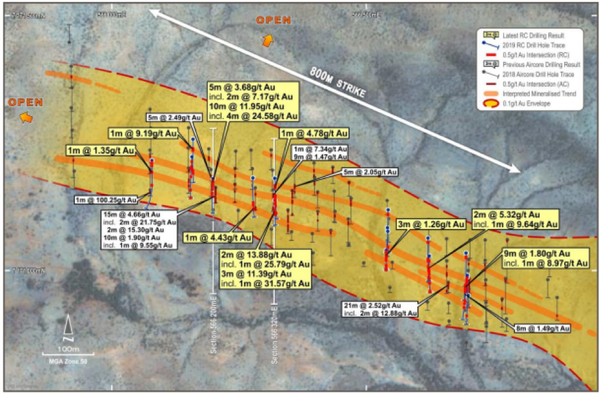

The samples were selected from 10 RC holes across the prospect area, with intervals selected aimed at providing varying grades, lithologies and weathering profiles.

The LeachWELLTM Accelerated Cyanide Leach test provides an indication of potential recoveries in metallurgical processes and circuits.

Gold recoveries averaged 89.5% in the primary mineralisation, 95.6% in the transitional mineralisation and 94.9% in the oxide mineralisation.

The results from the Accelerated Cyanide Leach indicated that the oxide, transitional and primary gold mineralisation at the Kingsley prospect are amenable to conventional cyanide extraction methods.

800 metre diamond drilling program imminent

A regional structural mapping and interpretation program conducted by Dr Greg Cameron over the western portion of the Livingstone Project area, including the Kingsley and Livingstone North prospects, is now nearing completion.

The work undertaken to date has already provided an enhanced understanding of this previously under-explored part of the Western Bryah Basin.

An 800 metre diamond drilling program is due to commence at Kingsley before the end of October, with rig mobilisation imminent.

This program is co-funded up to $75,000 through the Western Australian Government Exploration Incentive Scheme.

The purpose of the drilling is to enhance management’s understanding of the controls on the mineralisation at Kingsley and to facilitate further metallurgical test work.

It will also underpin the next round of RC drilling and contribute towards the estimation of a maiden JORC Mineral Resource Estimate.

With a potentially market moving maiden Mineral Resource Estimate on the horizon, Corbett said, ‘’Structural information on the orientation and controls on the mineralisation will help us more accurately target the next phase of RC drilling as we work towards the delivery of a maiden JORC compliant Mineral Resource.’’

Running in tandem with these initiatives is an extensive exploration program at Kingston’s 2.8 million ounce Misima Gold Project in Papua and New Guinea.

Having had substantial drilling success across a number of exploration targets, positive news from the Livingstone Project, in particular a maiden Mineral Resource Estimate could deliver a significant share price rerating.

Kingston traded as high as 2.2 cents on Monday morning, representing an increase of nearly 40% since September.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.