Kingston has early stage success at Misima North

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Kingston Resources Limited (ASX:KSN) has reported highly encouraging initial assay results from drilling at the Misima North prospect, part of the 2.8 million ounce Misima Gold Project in Papua and New Guinea.

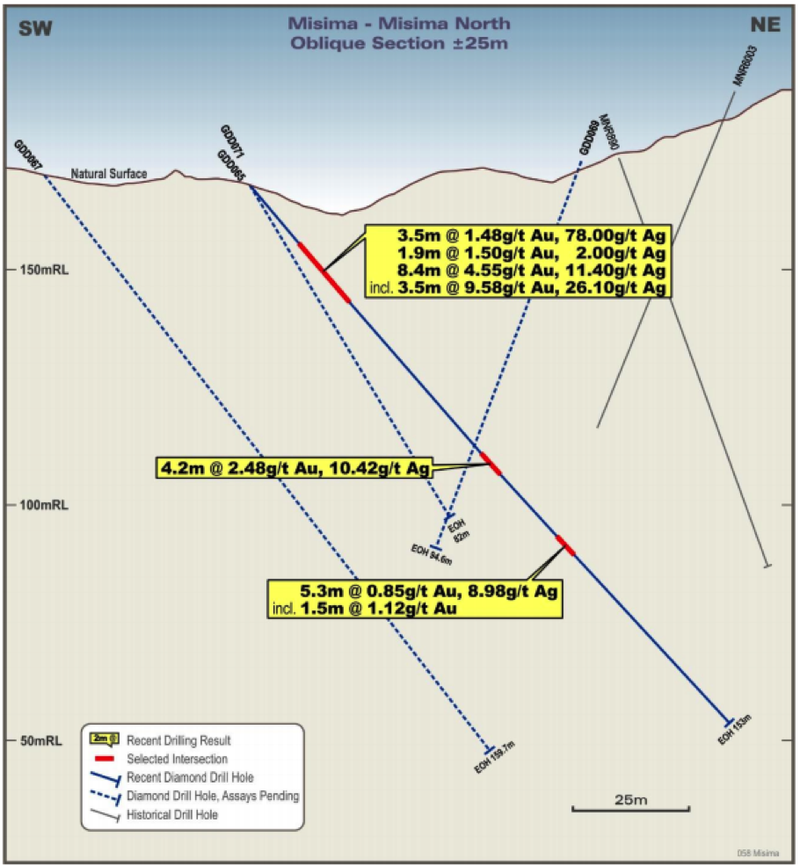

Ironically, it was a diamond drill hole (GDD065) that experienced some core loss that returned impressive multiple high-grade intercepts.

These included 8.4 metres at 4.5 g/t gold and 11.4 g/t silver from 24 metres including 3.5 metres at 9.6 g/t gold and 26 g/t silver.

Another promising shallow intercept of 3.5 metres at 1.5 g/t gold also featured 78 g/t silver.

Importantly, the core loss occurred within a mineralised section between approximately 16 metres and 32 metres of GDD065, and management expects that this 16 metre section may represent a continuously mineralised zone.

A follow-up hole (GDD071) as indicated below has been drilled to confirm the true width and continuity of the zone with assay results due in the near term.

The follow-up hole can be seen entering at the same point as GDD065, running almost parallel to the areas of mineralisation indicated by the red intersections in GDD065.

Prospect of large Misima North corridor intensifies

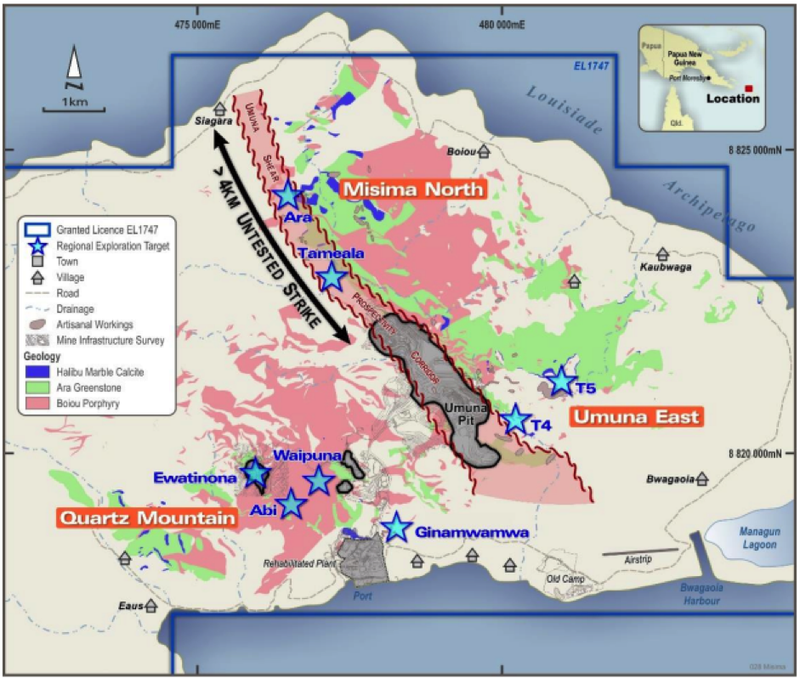

Looking at the big picture, Misima North is a four kilometre prospective target corridor trending north north-west from the former Umuna open pit.

Field work and structural analysis had elevated the potential at Misima North, suggesting that previous drilling had not properly tested the shear position and subsidiary structures.

Known anomalism and mineralisation at Misima North is indicative of supergene enrichment within structures adjacent to and within the Umuna Fault Corridor.

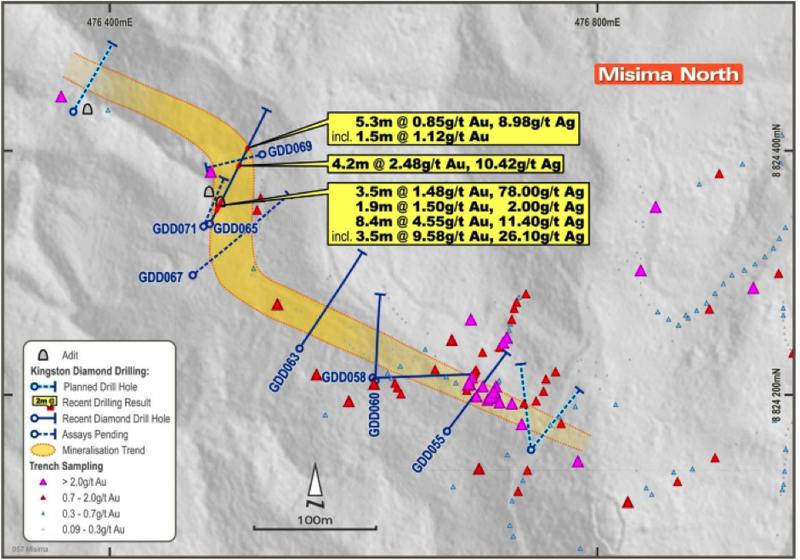

As indicated below, GDD065 was part of the initial 8-hole drill program at the Ara Prospect within Misima North.

The program was targeting an interpreted north-west-trending breccia with anomalous surface geochemistry, within the interpreted extension of the Umuna Fault Corridor.

It is interpreted that drill holes GDD055, GDD060, GDD58 and GDD063 may have drilled below these near-surface targets, and as a result, the area requires further drill testing.

The high-grade gold results returned from Misima North confirm that the project hosts all the geological features that have been identified as conducive to gold endowment in Umuna-style mineralisation.

Silver values are also high in GDD065, with the intercept of one metre at 2.2 g/t gold and 201 g/t silver from 17.7 metres among the highest-grade silver intersections reported at Misima.

Follow-up drill holes (GDD067, GDD069, GDD071) have been completed below and across GDD065 to test continuity of interpreted structures and achieving maximal recovery of brecciated and oxidised material, positive signs from a geological perspective.

All drill holes have intersected structures and breccia bodies that are interpreted as extensions of those in GDD065.

Assay results could drive share price higher

Samples from the recent drill-holes and outcropping structures have been dispatched and assays are awaited.

The Umuna Fault Corridor remains highly prospective with outcropping mineralised structures and anomalous surface geochemistry to the north-west of GDD065 remaining untested, and follow-up drilling is planned in the June quarter of 2020.

Commenting on these developments and their significance in terms of potentially identifying sufficient new surface mineralisation for a starter pit, as well as outlining the group’s broader exploration program, managing director Andrew Corbett said, “We’re delighted to see such encouraging results from one of our first Misima North holes, with these assays confirming the presence of high-grade gold mineralisation 2.5 kilometres north of the existing Umuna Resource boundary, and highlighting the prospectivity of the broader Umuna Fault Corridor which hosts both the Umuna and Misima North target areas.

The areas Corbett refers to are illustrated on following map.

Corbett went on to say, ‘’The entire 4 kilometre strike length of the Umuna Fault Corridor (see above) remains largely untested, providing a large, high-quality exploration target for the company to progressively drill.

“Importantly, Misima North represents the second new area discovered by Kingston in recent months, coming after the previously reported discovery at Abi, part of the Quartz Mountain region.

‘’Such successes are a strong credit to the excellent work being done by our geological team in pursuit of our strategy to identify near-surface mineralisation to provide early mill feed for the Misima mine plan.

“We currently have two rigs drilling at Ewatinona in the Quartz Mountain area as we look to upgrade and potentially expand the existing Resource in this area, with drilling also planned to follow-up on the initial positive results at Abi.

‘’Once those campaigns are complete, we then expect to return to Misima North for a second round of drilling.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.