Kingston eyes off starter pit at Misima

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Less than a fortnight after moving to full ownership of the 2.8 million ounce Misima Gold Project in Papua and New Guinea, Kingston Resources Limited (ASX:KSN) has released an updated geological model for the highly prospective Quartz Mountain region taking into account recent drilling and exploration data.

An extensive internal review of existing Quartz Mountain geological data complemented by recent drilling, geochemical data and structural mapping undertaken by Kingston has concluded that mineralisation in the area is primarily structurally controlled.

The new geological interpretations open up new targets for Kingston to explore, and Stage II drilling is already underway.

Central to the company’s revised strategy is increasing the Ewatinona Resource as this would represent a key element of Kingston’s redevelopment strategy for Misima with the potential to underpin a starter pit for the project.

It is worth noting that geochemistry work at Ewatinona revealed outstanding surface grades of 1.5 metres at 29.5 g/t gold and 1.2 metres at 21.5 g/t gold.

Numerous share price catalysts in 2020

Management certainly has plenty to work with in terms of prioritising its plans for 2020, having identified further gold mineralisation in established areas, while also having significant drilling success in other zones that tend to support assumptions regarding extensions to known trends.

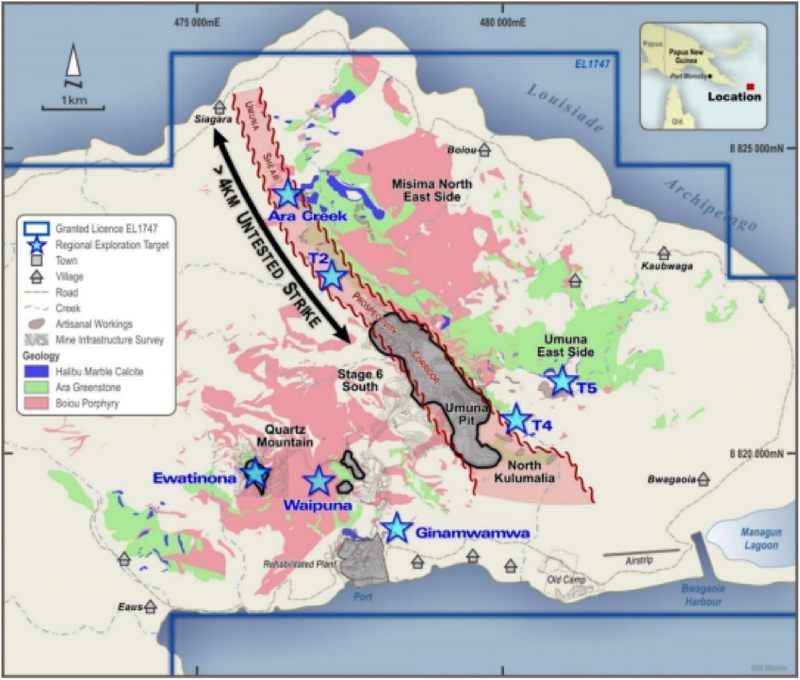

The following map highlights the sizeable amount of ground Kingston has to work with in 2020, and particularly given the group has multiple targets in its sights the company is shaping up as a news flow driven story over the next 12 months.

Reflecting on the successful year of exploration, managing director Andrew Corbett said, “It is fantastic to see our recent work on advancing our understanding of the Misima geology paying off at Quartz Mountain.

‘’This work is expected to help upgrade the existing 220,000 ounce Inferred Resource at Ewatinona to Indicated status, which is an important step in delivering a starter pit for the project.’’

Historical drilling ill-directed

Many of the historic holes at Quartz Mountain are interpreted to have missed or poorly tested the mineralisation, as they were drilled at a near vertical angle reducing the likelihood of intersecting the vertical structures.

Kingston’s updated interpretation presents new opportunities and will inform exploration activities in the region going forward, including the current Stage II drill program which is focused on the Ewatinona and Abi areas.

Drilling at Abi will follow-up on the high-grade intersection from Hole GDD044, which returned 23.6 metres at 2.9 g/t gold from 7.4 metres, including 13.5 metres at 4.6 g/t gold from 17.5 metres, as well as testing structural targets identified from the initial drilling program and recent fieldwork.

Specifically referring to Ewatinona and Abi, Corbett said, “We are also pleased to be back drilling in the Quartz Mountain area, with the aim of upgrading and expanding the Ewatinona Resource and following-up our exciting first hit at Abi.

‘’The potential to delineate high-grade, near-surface ounces within this region is outstanding, with the Quartz Mountain area representing a high priority target to build on our existing 2.8 million ounce resource base.

‘’The close proximity of this area to existing roads and the short haulage distance to the historical mill location could provide material benefits to our future development strategy.’’

Corbett said that the company should also be relaying further drilling results from both Misima North and Umuna East in the near term.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.