Kingston drilling results to feed into resource upgrade

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

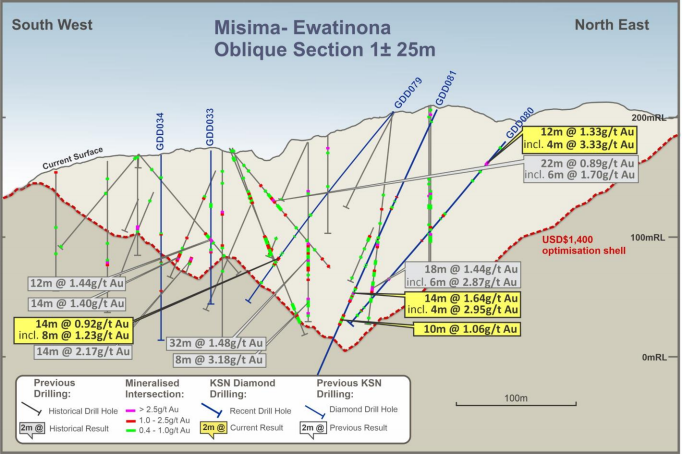

Kingston Resources Limited (ASX:KSN) has advised that latest diamond drill core assays from resource definition drilling at the Ewatinona deposit, part of the 2.8 million ounce Misima Gold Project in PNG, have returned significant zones of mineralisation.

These included 14 metres at 1.6 g/t gold from 163 metres and 12 metres at 1.3 g/t gold from 22 metres.

There were also some higher grade intersections such as 4 metres at 2.5 g/t gold from 144 metres and 2 metres at 4.7 g/t from 95 metres.

This means that all five holes drilled by the company at the site have intersected the mineralised structures that confirm the excellent tenor and continuity of the resource in the East Ewatinona area.

Assays are pending for several additional holes that tested the western extension of the resource.

As a backdrop, Misima was operated as a profitable open pit mine by Placer Pacific between 1989 and 2001, producing over 3.7 million ounces before it was closed when the gold price was below US$300.

Kingston is the first company that has had the opportunity to bring the project back into production, and there could be a better time to do it with the gold price approximately six times what it was when the mine was closed.

Canaccord price target set at 470% premium to current share price

With the gold price now hovering in the vicinity of US$1750 per ounce, there is the prospect of developing a high margin operation that could be fast-tracked if management chooses to opt for a staged development.

Canaccord resource analyst Reg Spencer is upbeat about the company’s prospects, having identified it as a promising emerging gold play in December.

Factoring in higher gold prices, he has upgraded his price target from 60 cents per share to 80 cents per share, representing upside of 66 cents per share relative to the company’s current trading range.

The Misima Project offers outstanding potential for additional resource growth through exploration success targeting extensions and additions to the current 2.8 million ounce resource base.

Results from the drilling program will contribute to an updated mineral resource ahead of the commencement of feasibility studies for the Misima Gold Project.

With the resource definition drilling program now completed, work on the resource upgrade is underway.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.