Kingston delivers promising news at Quartz Mountain

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

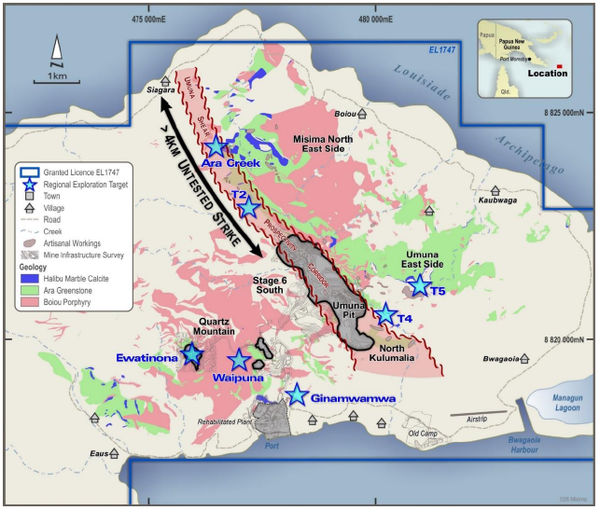

Kingston Resources Limited (ASX:KSN) has provided an update on the current exploration activity at its flagship 2.8 million ounce Misima Gold Project in Papua and New Guinea (PNG).

The world-class Misima project is management’s key focus as it contains a robust resource and a production history of over 3.7 million ounces, as well as outstanding potential for additional resource growth through exploration success.

Kingston currently owns 70% of the Misima project, as well as 75% of the Livingstone Gold Project in Western Australia.

Ewatinona Drilling

Central to today’s update is promising news regarding assays from drilling at Ewatinona that has confirmed the potential of the resource, as well as indicating it is open in all directions.

Drilling highlights included 20 metres at 1.8 g/t gold from 78 metres and 6.6 metres at 1.9 g/t gold from 7.5 metres.

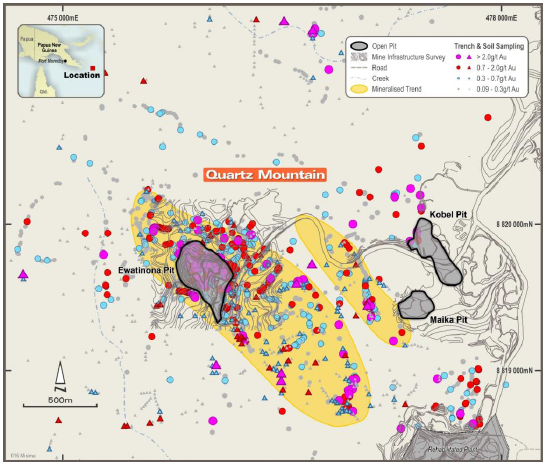

Ewatinona currently contains a resource of 200,000 ounces and as indicated below it sits within the Quartz Mountain area of the Misima Gold Project.

Placer historically mined gold and silver from the Ewatinona, Kobel and Maika pits producing a combined 147,000 ounces at 1.8 g/t gold.

The current Ewatinona resource is less than two kilometres from the historical mill location.

Kingston’s initial 12-hole diamond drill program at Ewatinona was designed to confirm the historical Placer drilling, provide structural data and update the geological model.

The highly encouraging assay results confirm the potential of the resource which remains open in all directions.

The increased understanding of the geology has resulted in an additional hole being recently completed, and assays are pending.

Data evaluation and further drilling at Waipuna

During the September quarter a review of all current and historical data will be completed, including Leap Frog modelling of the resource before the next round of drilling at Ewatinona.

Drilling continues on a second target in the Quartz Mountain area, the Waipuna prospect.

This was recently identified by a modern reinterpretation of historic geochemical data combined with geophysics and LiDAR information.

Looking at the broader picture, the existing 2.8 million ounce Misima resource may already be of sufficient scale to support a potential long-life mining operation.

Current exploration targets are prioritised with a view towards delivering new near-surface mineralisation.

Such targets are likely to have the largest impact on project economics as access to near surface ounces can boost early years’ cash flow while access to the main Misima resource is developed.

While this appears to be a logical approach, it should be noted that feasibility or pre-feasibility studies have yet to be completed to confirm this hypothesis, and investors should be aware that there is currently no certainty of future mine development.

As indicated below, the Quartz Mountain area is one of a number of such targets Kingston plans to drill over the balance of 2019.

Existing resource close to infrastructure

The Quartz Mountain existing resource, extensive surface mineralisation and proximity to the mill site make it an ideal target.

Summing up recent developments, Kingston Resources Limited managing director, Andrew Corbett said, “The Quartz Mountain area is certainly shaping up to be a high priority target.

‘’Our recent Ewatinona drill results have confirmed the historic resource potential and provided current geological knowledge to help our team design the next phase of step out drilling on the Ewatinona resource.

‘’In addition to Ewatinona there are number of near mine prospects that have been identified within the Quartz Mountain area.

‘’These targets are all exciting opportunities for Kingston, with outstanding potential to deliver additional near surface ounces.

‘’Our current exploration strategy is firmly focused on establishing sufficient ounces from these targets to commence mining studies.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.