KAI’s drill results reveal significantly larger gold system at Mt York Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Kairos Minerals Ltd (ASX:KAI) today announced it has received outstanding initial assay results from the recently completed 2600 metre Reverse Circulation (RC) drilling program at its 100%-owned Mt York Gold-Lithium Project in the Pilbara region of WA.

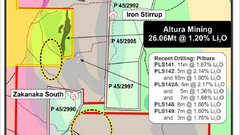

KAI’s location, tenements and key targets at the Mt York Project (source: Kairos Minerals)

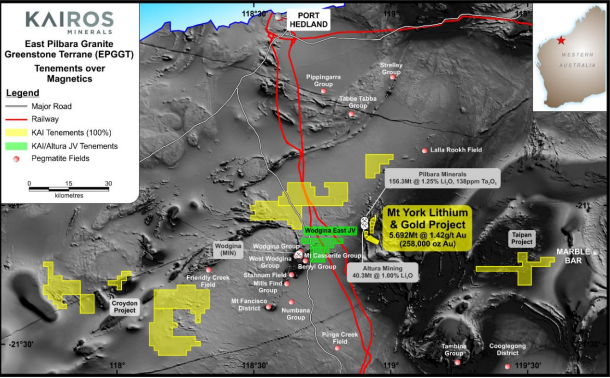

The drilling program, which comprised 21 holes, focused initially on testing for potential extensions to the Main Hill and Breccia Hill deposits, over a further one kilometre of strike eastward to Gossan Hill between surface and a maximum vertical depth of 150 metres (as seen below).

(Source: Kairos Minerals)

It should be noted, that this is an early stage tech company and success is no guarantee. Investors should seek professional financial advice before making an investment.

KAI’s technical team identified a data ‘shadow’ of some 400 metres in strike immediately east of the Breccia Hill pit. Subdued aeromagnetic responses and a lack of outcrop seemingly led previous explorers to assume that the BIF, which hosts the Main Hill – Breccia Hill deposits, had been structurally terminated at this location and, consequently, the area remained unexplored.

Assays from the first seven holes confirm visual assessment that the drilling has intersected wide zones of shallow BIF hosted gold mineralisation within a previously untested area immediately east of the historical Main Hill – Breccia Hill open pits.

Pleasingly, results extend the full zone of gold mineralisation to 3.5 kilometres.

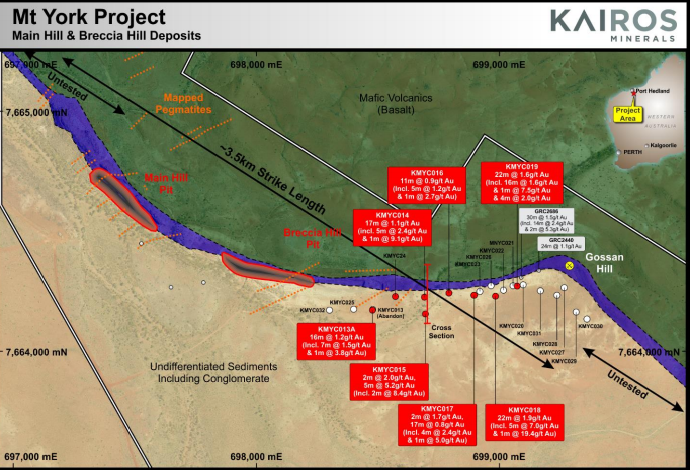

Significant assays included:

- KMYC018: 22 metres at 1.93 grams per tonne gold from 106 metres, including 5 metres at 7.02 grams per tonne gold from 113 metres; and 1 metre at 19.41 grams per tonne gold from 115 metres

- KMYC019: 22 metres at 1.56 grams per tonne gold from 96 metres, including 16 metres at 1.95 grams per tonne gold from 102 metres; and 1 metre at 7.48 grams per tonne gold from 110 metres

- KMYC013A: 16 metres at 1.21 grams per tonne gold from 137 metres, including 7 metres at 1.53 grams per tonne gold from 146 metres; and 1 metre at 3.84 grams per tonne gold from 151 metres

- KMYC014: 17 metres at 1.05 grams per tonne gold from 86 metres, including 5 metres at 2.38 grams per tonne gold from 98 metres; and one metre at 9.06 grams per tonne gold from 101 metres

- KMYC015: 5 metres at 5.17 grams per tonne gold from 188 metres; including 2 metres at 8.40 grams per tonne gold from 190 metres

Results have now been received for the first seven holes of the program. All holes have successfully established continuity of the targeted BIF sequence, and assays have supported the visual assessment of KAI’s site supervising geologists that the holes intersected wide zones of strong gold mineralisation at shallow depths.

Importantly, each of the intercepts include narrower intervals of high grade gold (up to 19 grams per tonne of gold hole KMYC018) within the broader mineralised envelope, suggesting the potential development of high grade ‘shoots’.

The recent drilling demonstrates strong potential for a significant upgrade of the current JORC 2012 Indicated and Inferred Mineral Resource of 5.692 million tonnes at 1.42 grams per tonne for 258,000 ounces of gold at the Mt York Project.

KAI executive chairman, Terry Topping, said: “Mt York is rapidly emerging as a potential game-changer for Kairos.”

“Early indications are that our drilling has delivered a major breakthrough, with all of the first seven RC holes returning significant widths and grades of shallow gold mineralisation – we’ve confirmed that the BIF is there, it’s well mineralised and open in all directions, indicating outstanding potential to expand the resource along this horizon.”

“What is even more exciting is that there are further immediate drilling targets to the south-east of this zone and to the west, with the total strike length of prospective BIF horizon amounting to at least 3.5km. The current resources account for less than 50% of that, extending over just 1.5km. This clearly shows that the BIF-hosted gold system at Main Hill-Breccia Hill is much larger than previously thought, with outstanding potential to delineate significant shallow resources along the entire strike length.”

“There are also strong similarities between what we see at Mt York and other significant BIF-hosted gold systems in Western Australia, such as the Westralia deposit at Dacian Gold’s Mt Morgans Gold Project near Laverton. The rapid growth of that gold system into a 1.6Moz deposit has been an outstanding achievement and is something we have watched closely. We believe there is outstanding potential to pursue a similar strategy at Mt York.”

“Once we develop a better understanding of the plunge controls and orientation of the mineralisation, we intend to target depth extensions of the shallow mineralisation we are uncovering along the BIF horizon. That represents an exciting future growth opportunity for us at Mt York.”

Currently, the company is awaiting assays for an additional 13 holes, and will report results as they are received.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.