Kairos targeting new prospect at Croydon and extensions to Mt York

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

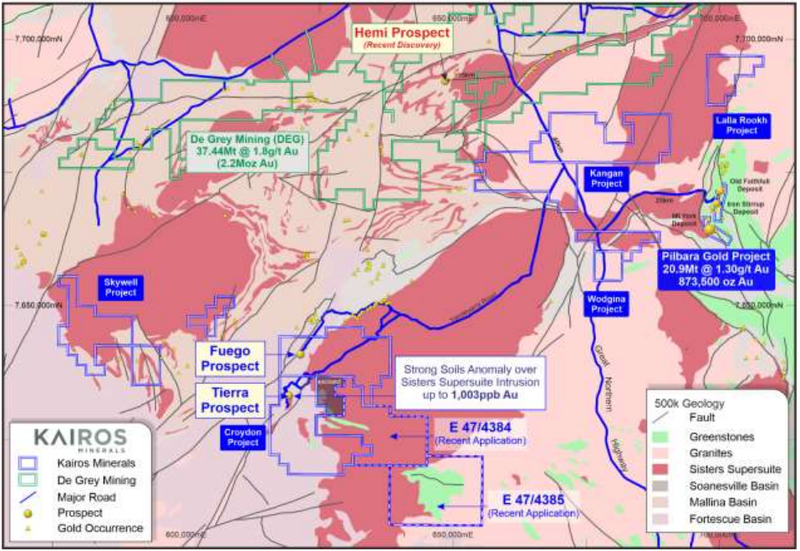

Kairos Minerals Ltd (ASX:KAI) has substantially increased the size of the ongoing reverse circulation (RC) drilling program at its 100%-owned Pilbara Gold Project in Western Australia following its recent $9 million capital raising.

The current program, comprising approximately 5,000 metres of RC drilling, has been doubled in size to about 10,000 metres.

Drilling at the large Fuego gold target located on the Croydon Project is now complete and an additional 1,500 metres of drilling is planned at the Tierra prospect at Croydon.

The rig will then relocate to Mt York to undertake a program of approximately 5,000 metres, targeting extensions of existing deposits and potential new discoveries.

The company has completed 20 RC holes for a total of 3,815 metres at the Fuego prospect.

Tierra shaping up as fresh new target in highly prospective area

The rig has been mobilised to the Tierra prospect, with approximately 10 reconnaissance holes planned to be drilled in this first-pass program.

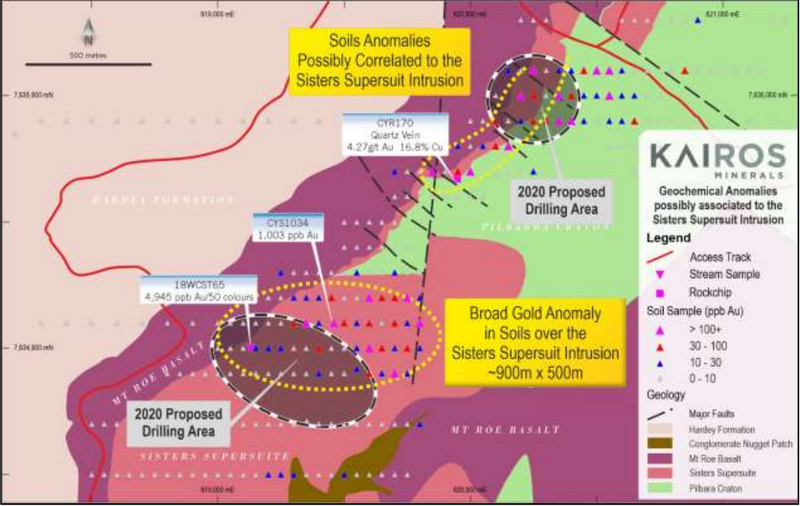

There is no previous drilling at Tierra prospect, and the targets are supported by strong geochemical anomalies coincident with geophysical features defined by Kairos’ recently completed Sub-Audio Magnetic (SAM) survey.

The previous rock chips and soils sampling programs at the Tierra prospect delineated a three kilometre long corridor of highly anomalous soils and rock chips, including the outstanding surface copper and gold grades from rock chip sampling in the areas shown below.

Granitic units related to the Sisters Supersuite intrusion outcrop directly near the anomalous soils and rock chip samples, enhancing the potential of the prospect for intrusion-related gold mineralisation similar to the De Grey Mining’s (ASX: DEG) Hemi discovery.

Another RC program is to be completed before the end of the year with approximately 5000 metres of drilling designed to test targets at Mt York, Iron Stirrup and Old Faithful deposits, as well as the Green Creek and Zakanaka prospects.

This could potentially increase the group’s 873,000 ounce resource at the Pilbara Gold Project.

Preliminary results from the SAM survey conducted at Iron Stirrup and Old Faithful deposits have generated new targets along strike of the previously defined mineralisation.

Highlighting the multiple upcoming share price catalysts, Kairos executive chairman Terry Topping said, “The net result of all of this increased activity is that shareholders can look forward to strong and regular news flow with drilling updates and assay results from now through until Christmas and into early next year.

‘’This is a really exciting time for Kairos as we move closer to our goal of hopefully uncovering a significant new Pilbara gold discovery while also expanding our resource position at Mt York.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.