Kairos release positive Roe Hills drilling results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

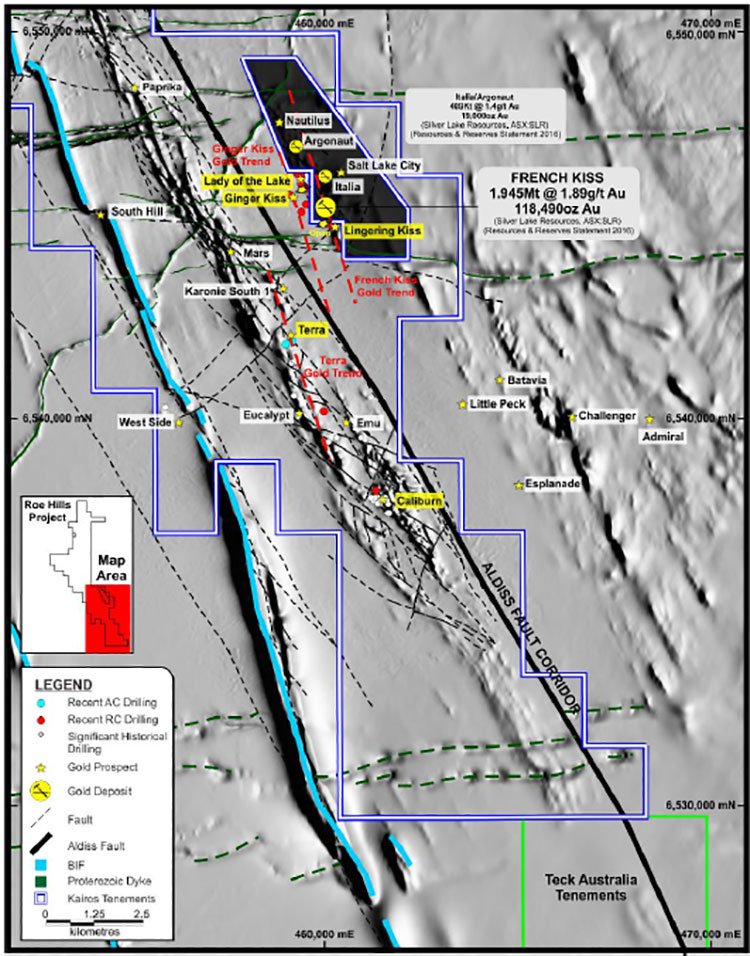

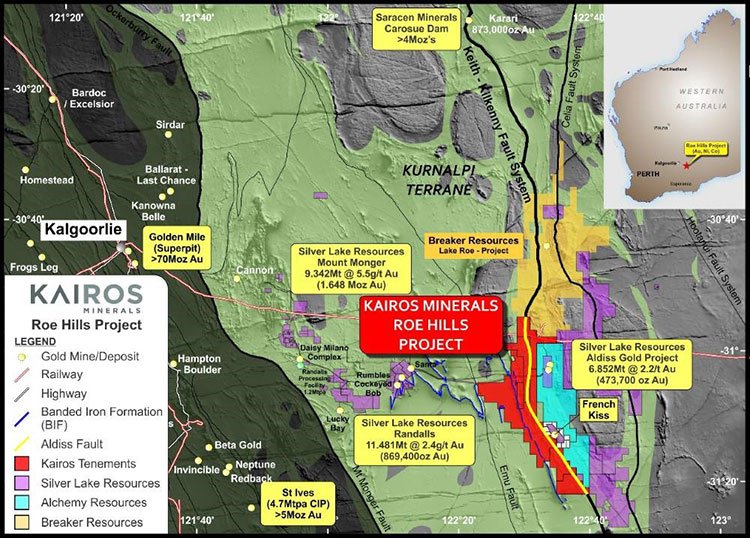

Kairos Minerals (ASX:KAI) announced on Monday that it had intersected a significant new zone of high-grade gold mineralisation at its Roe Hills Project, located 120 kilometres east-south-east of Kalgoorlie in Western Australia’s Eastern Goldfields.

Significant high grade primary gold mineralisation has been intersected in maiden reconnaissance drilling at a newly identified prospect located only 350 metres from another prominent deposit.

Of course KAI is still in its early stages so investors should seek professional financial advice if considering this stock for their portfolio.

Assay results included 6 metres grading 3.6 grams per tonne gold from 102 metres and 2 metres grading 29.1 grams per tonne gold from 120 metres. Of note is the fact that wide spaced drilling was completed along a single section, circa 250 metres in width with the mineralisation remaining open in all directions.

Assay results are pending for the balance of the recently completed 2800 metre gold focused drilling program at Roe Hills where a number of high priority gold targets have been investigated.

Geological data suggests Lingering Kiss is an extension of French Kiss

The new prospect, named Lingering Kiss, is located just 350 metres south of the French Kiss Gold Deposit owned by Silver Lake Resources (ASX: SLR), which hosts a published Indicated and Inferred Resource of nearly 2 million tonnes grading 1.89 grams per tonne gold for 118,490 ounces. SLR plans to bring this into production in fiscal 2019.

The Lingering Kiss Prospect is a highly ranked structural target identified from detailed airborne magnetic and ground gravity survey data. It is situated proximal to an east-west trending Proterozoic Dolerite Dyke, at the confluence of the interpreted north-south trending French Kiss Shear Zone and a major regionally recognisable north-east trending structure now described as the ‘Crossbow Fault’.

These latest results tend to demonstrate the extensive gold endowment within the project, which as well as being in close proximity to the French Kiss deposit, is also located just south of Breaker Resources’ (ASX: BRB) emerging Lake Roe/Bombora discovery.

Hence, this can now be considered a highly prospective area, and Lingering Kiss represents an important new addition to the growing pipeline of strongly mineralised zones recently identified by KAI at Roe Hills, all of which offer excellent potential for the near term definition of significant gold resources.

Drill results speak for themselves

Three wide-spaced reconnaissance Reverse Circulation drill holes completed at Lingering Kiss as part of the Company’s recent gold-focused drilling program at Roe Hills all intersected multiple zones of significant primary gold mineralisation including very high grade intervals (more than one ounce per tonne gold) within broader low-grade mineralised envelopes across a single section approximately 250 metres wide.

Given the broad lateral extent and quality of the mineralisation, which returned assays grading up to 43.34 grams per tonne gold, its proximity to the French Kiss Gold Deposit, the favourable geological setting and the fact that the mineralisation remains open in all directions, the result is a significant development at Roe Hills.

Commenting on these developments, KAI’s Managing Director, Joshua Wellisch said, “Coming up with strong primary mineralisation of significant grade over multiple stacked lodes is a very exciting development and provides an immediate focus for our team as a near-term resource development opportunity”.

Wellisch also highlighted the fact that the Roe Hills project has had little exploration activity despite having widespread mineral endowment. Given these results and the outstanding progress made by Breaker Resources in the same region, Wellisch is eagerly awaiting the balance of results which should assist in shaping the next phase of exploration.

On this note, he highlighted the fact that KAI controls a continuous 40 kilometre strike length of the same prospective package which hosts Breaker Resources’ discovery to the north, with the company now aiming to home in on areas that will provide the best chance of making a world-class discovery.

With news such as this in the pipeline, it would appear that KAI’s share price could be in for a sustained rerating as further assay results come to hand.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.