Kairos nearly doubles Mt York gold resource

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

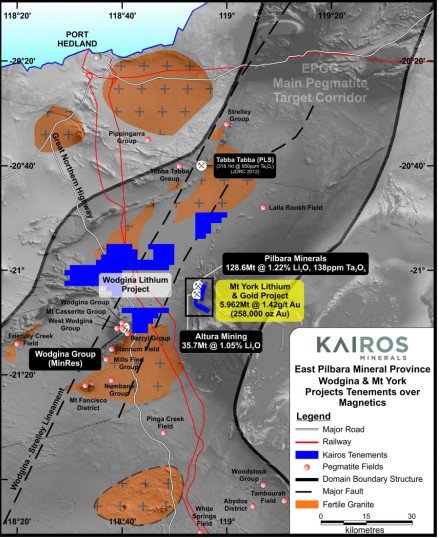

Kairos Minerals (ASX: KAI) has announced a substantial increase in resource at its Mt York lithium gold project which encompasses deposits at Iron Stirrup, Old Faithful, Breccia Hill and Main Hill deposits.

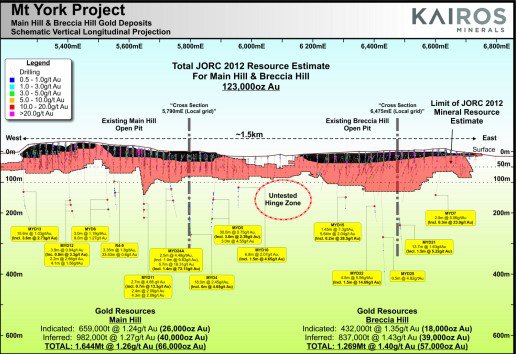

Results released today include the newly completed Indicated and Inferred Resources for Main Hill and Breccia Hill, resulting in the overall resource for the Mt York project increasing from 135,000 ounces to 258,000 ounces.

Not only is this a substantial increase in resource, but it comes only two months after the company announced its Indicated and Inferred Resource for Iron Stirrup and Old Faithful, demonstrating that management is moving quickly through the exploration stage, laying the foundation for the all-important studies which will potentially demonstrate the commercial viability of the project.

On this note it is also important to take into account the fact that a resource estimate for the Zakanaka deposit is still outstanding and this represents a high priority exploration target for the group.

The highly prospective nature of this territory has now been proven and the fact that all deposits remain open along strike and at depth within well-defined mineralised zones indicates there is the prospect for rapid resource expansion.

This is however, still an early stage play and caution with professional financial advice should be exercised when considering this stock for your portfolio.

Providing further for KAI confidence is the fact that there have been high grade historical intercepts below both the Main Hill and Breccia Hill boundaries, suggesting the prospect of delineating high-grade shoots within the broader mineralised envelope.

Taking all these factors into account, management is embarking on an aggressive drilling program at Mt York with the initial focus being on the Old Faithful and Iron Stirrup gold deposits.

From a broader perspective, management will be targeting depth and strike extensions and repetitions to the known gold mineralisation at the Old Faithful deposit, as well as investigating mineralisation in close proximity to the current base of the Iron Stirrup pit in order to assess the potential for near-term expansion opportunities.

In conjunction with these initiatives KAI will be testing depth and strike extensions that could represent future underground mining opportunities, as well as examining open pit potential to the north and south along strike.

While the doubling in resource in such a short period of time is significant in its own right, Managing Director Joshua Wellisch pointed to the potential upside in saying, “The known deposits cover roughly one third of a strongly mineralised 10 kilometre long horizon which offers outstanding potential for new discoveries”.

The other potential blue sky is reflected in recently completed soil sampling results which have outlined numerous highly anomalous gold and lithium-tantalum trends which will add to KAI’s growing list of high priority drill targets.

In particular, Wellisch referred to the soil survey which outlined strong lithium-caesium-tantalum anomalies and extending over at least 2 kilometres, providing compelling evidence for continuation of the Pilgangoora LCT Pegmatite corridor within the group’s southern tenements.

This leaves the company exposed to two of the best performing commodities over the last 12 months, and with regard to lithium, arguably the most important new age mineral in terms of the anticipated exponential growth in medium to long-term demand.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.