Kairos lays foundation for resource expansion in 2020

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

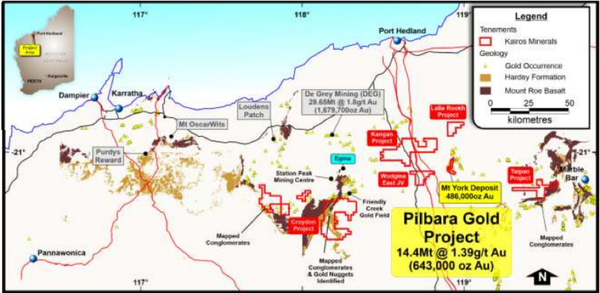

Kairos Minerals Ltd (ASX:KAI) has delineated a 2.5 kilometre long corridor of highly anomalous soils and rock chips, including outstanding surface copper and gold grades from rock chip sampling during recently completed field exploration programs at its Croydon Project, located within its 100%-owned Pilbara Gold Project in Western Australia

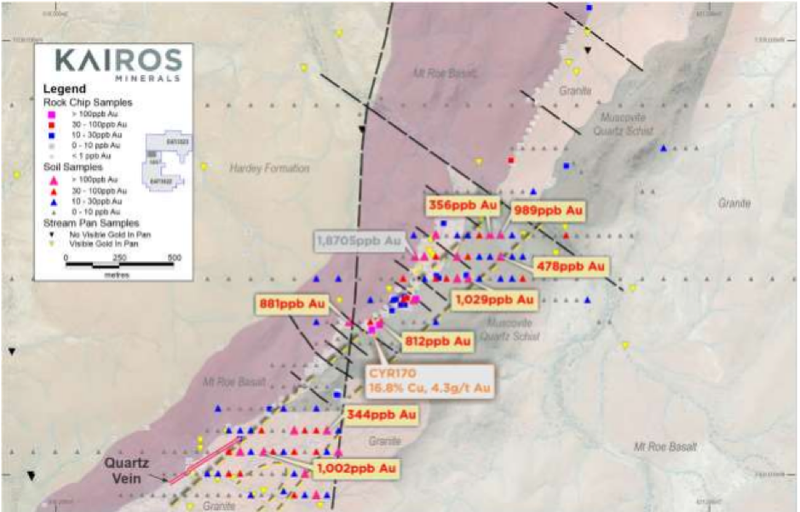

The latest exploration success builds on the extensive gold-in-soils anomaly reported in August and September, and further upgrades the exploration potential of the project for structurally hosted gold and copper mineralisation in the area shown below.

Two rock chips collected 50 metres apart returned high copper-gold results of 16.8% copper and 4.3 g/t gold (CYR170) and 16.3% copper and 1.3 g/t gold (CYR455).

In terms of the geological setting, these samples were collected from veins of approximately 0.5 metres in width where malachite – sulphides – quartz vein is the dominant mineralogy.

These anomalous rocks outcrop at the footwall of an ultramafic unit of the older Archaean basement.

Implications for 2020 drilling program

In drawing together the impressive exploration results and discussing the significance of the geological area in terms of identifying drilling targets with a view to expanding the group’s resource base, executive chairman Terry Topping said, “The delineation of an extensive corridor of anomalous soils and rock-chips along strike from the high-grade copper and gold mineralisation discovered earlier this year represents a fantastic conclusion to our exploration field season at the Croydon Project.

We have confirmed the presence of high-grade copper-gold vein-style mineralisation over a 2.5 kilometre strike length within the Archaean basement with associated high-tenor barium and molybdenum anomalies.

“This means we now have a large conventional gold exploration target and strong copper-gold target within the same part of the Croydon Project.

‘’The scale, tenor and strength of the anomalism identified in this area combined with the presence of extensive nugget patches suggests that several mineralising events may have occurred in the area, further enhancing its exploration potential.

‘’We plan to return in 2020 to progress this exciting project alongside ongoing activities aimed at expanding our significant resource base at Mt York.”

Infill exploration program across 1.5 kilometres of strike

An in-fill soils sampling program was conducted to follow-up on the significant results of the first-pass soils program, which had returned a peak soil result of 1,029 ppb gold.

A high gold-in-soil anomaly has returned from this in-fill program over a strike length of 1.5 kilometres as indicated below.

Nine samples from the older Archaean basement returned elevated gold results above 200ppb gold (0.2 g/t gold), up to a peak of 1,029 ppb gold (1.03 g/t gold).

Over the last four years, Kairos has experienced significant exploration success, demonstrated by its ability to establish a JORC Indicated 6.8 million tonnes at 1.3 g/t gold for 285,000 ounces and Inferred 7.5 million tonnes at 1.5 g/t for 358,000 ounces for a Total Mineral Resource of 14.4 million tonnes@ 1.4g/t Au for 643,000 ounces.

Management’s strong record makes the upcoming exploration program a much anticipated event, and interestingly shares in Kairos are up 10% on Monday morning.

Given the size of its established resource and the potential upside that lies in the upcoming exploration program, it could be argued that Kairos is undervalued with its market capitalisation hovering in the vicinity of $10 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.