Invictus captures data for substantial resource upgrade

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Newly defined data released today by Invictus Energy Ltd (ASX:IVZ) has unveiled new opportunities in relation to the group’s Giant Mzarabani Prospect and basin margin fault, the focus of one of the most anticipated global exploration projects in 2019.

This new data could result in the company being able to deliver an even larger increase in the resource estimate in the June quarter, a development that may well provide significant share price momentum.

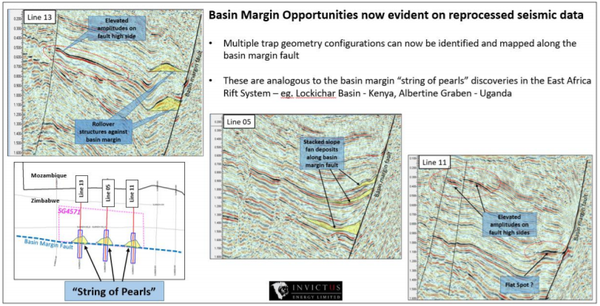

Excellent reprocessed 2D seismic data has enabled Invictus to specifically identify what management described as multiple trap geometry configurations that can be mapped along the basin margin fault.

These play types are referred to in the industry as “String of Pearls” with multiple structural closures.

Such plays have been particularly successful in other rift basins in Africa, providing management with increased confidence regarding a sizeable increase in the prospective resource estimate of the Mzarabani Prospect which currently stands at 3.9 Tcf (trillion cubic feet) and 181 million barrels of condensate.

“Material” increase in prospective resource

Just taking into account the primary target, Mzarabani is already potentially the largest, seismically defined undrilled structure onshore Africa, and it could be argued that a shoring up of management’s understanding of the geology, will perhaps lead to a more significant increase in the resource estimate due in the June quarter, a development that is likely to be market moving.

On this note, Invictus’ managing director Scott Macmillan said, “Once the interpretation of the full dataset is completed, we expect to add materially to the prospective resource estimate base of the Mzarabani Prospect at 3.9 Tcf and 181 million barrels of gas condensate (gross mean unrisked) from further prospect and lead identification within our acreage.”

“Following on from the seismic interpretation work, a Final Independent Prospective Resource Report encompassing the entire SG 4571 area will be delivered.

The company will continue with its geological and geophysical studies including additional basin modelling and a further resource estimate leading into a planned marketing programme to attract a farm-in partner.

In the interim, Invictus is looking to mature the additional potential within the company’s acreage and continue to build on its significant prospective resource inventory.

The negotiation of a farm-in agreement is likely to provide share price momentum as it would significantly derisk the project, and Invictus is already aware of interest from other parties operating in the broader region.

On this note, the data room is likely to be increasingly busy now that Invictus is able to present significantly improved evidence of the valuable resources waiting to be tapped.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.