Indiana’s strike is the tip of a multi-million ounce iceberg

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Indiana Resources Ltd (ASX:IDA) has released promising results from infill and extensional soil geochemistry sampling at the Koussikoto Ouest Licence, part of group’s West Mali Gold Project.

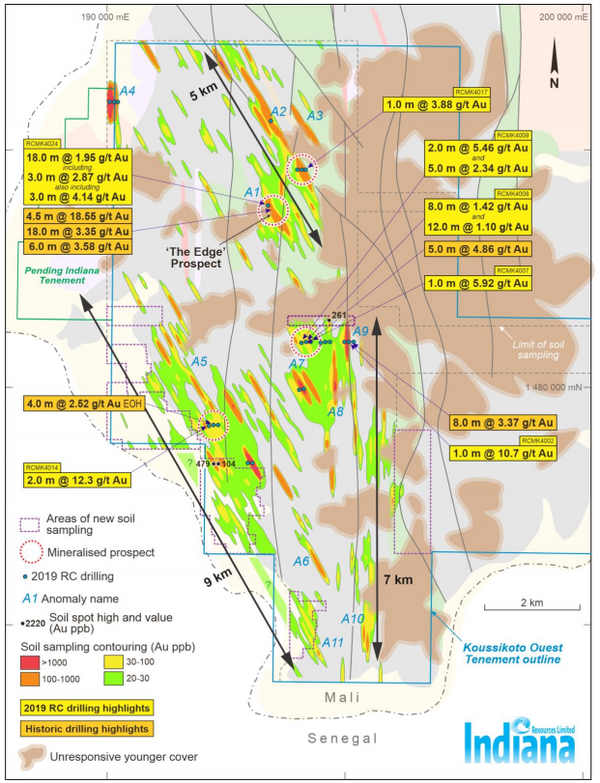

Infill soil sampling was completed in several areas at the southern end of the project, focusing on east-west lines at a 200 metre by 50 metre spacing, covering a total area of 7.4 kilometres.

Assay results from 767 individual sites ranged from four samples at more than 100 ppb gold to 586 samples at less than 20 ppb gold.

Management is now of the view that there is significant gold anomalism across more than 20 kilometres of strike, and this recent program has identified significant extensions to existing anomalies.

Compelling drill targets have been identified that will assist in shaping the next exploration campaign.

The significance of strike extensions can be best appreciated by referring to the following map.

Consolidation strategy pays dividends

The A5 anomaly is now considered to be at least 9 kilometres long when including A6 and the newly interpreted A11, both of which are interpreted to be part of the same anomalous structural trend.

The apparent truncation between the A5 and A11 anomalies in the west of the project is likely due to a lack of sampling outside licence boundaries and the proximity of the river border with Senegal.

In excess of 20 strike kilometres of significant gold anomalism has been identified in the project area to date, across three major trends, the majority of which remains untested by drilling.

As a result of the recent geochemical sampling, anomaly A5 has been extended to the south with 3 samples returning values above 100 ppb Au (peak value 479ppb) over a 150m east-west section.

Significantly, these 3 samples are located approximately 800 metres south of recent RC drilling which returned 2 metres at 12.3 g/t gold, 2 metres at 1.5 g/t gold and 4 metres at 0.6 g/t gold.

Management said that the new southern zone within A5 represents a compelling drill target for the next field season which commences in October 2019.

The new results have also underpinned an extension of anomalies A7 and A8 500 metres north.

In summing up these latest developments and pointing to their medium-term significance, Indiana’s chair, Bronwyn Barnes said, “This latest round of results validates our consolidation strategy for the West Mali Project.

‘’It demonstrates the high potential for further exploration success, with the geochemistry indicating strong potential for the prospective trends to extend over considerable strike lengths.”

There’s more where that came from

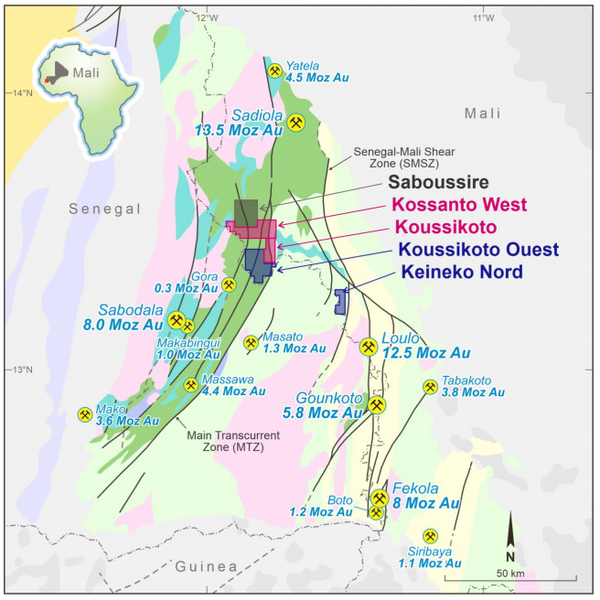

Having such early success is highly promising for Indiana given that the anomalies located are consistent with mineralised structures that have tended to support large discoveries such as Barrick Gold’s 12.5 million ounce Loulou deposit and Teranga Gold’s 8 million ounce Sabodala deposit.

Management said that all persistent anomalies identified-to-date currently appear related to north-south and northwest-southeast trending structures within the Main Transcurrent Zone (MTZ).

The MTZ is interpreted to be one of the major structures which control mineralisation in Western Mali and Eastern Senegal, considered an excellent geological and structural location within the highly prospective Kenieba Inlier of Western Mali, known to host a number of multi-million ounce gold deposits.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.