Increased resource bodes well for Vulcan’s PFS

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

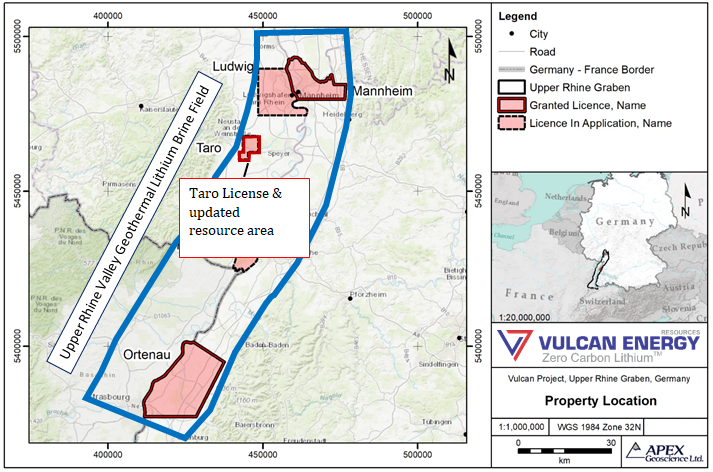

In a materially significant development, Vulcan Energy Resources (ASX:VUL| FRA: 6KO) has released updated Indicated and Inferred lithium-brine (Li-brine) Resource Estimations for its Taro License in the Vulcan Zero Carbon LithiumTM Project area in the Upper Rhine Valley.

In conjunction with this, Vulcan has re-totalled the collective Mineral Resource estimations for the Upper Rhine Valley Project (URVP) area within the Zero Carbon LithiumTM Project.

Following the acquisition and interpretation of seismic and well data, the updated and reclassified Taro Indicated JORC Resource Estimation is 830,000 tonnes contained Lithium Carbonate Equivalent (LCE) at a grade of 181 mg/l Li.

The updated Taro Inferred JORC Resource Estimation has been revised upwards to 1.44 million tonnes contained LCE at a grade of 181 mg/l Li.

Vulcan’s Upper Rhine Valley Project (URVP) Li-brine resource is now estimated to collectively contain 16.19 million tonnes LCE at a grade of 181 mg/l Li (Indicated & Inferred, 90% of which is in the Inferred Resource category), making it the largest JORC lithium resource in Europe.

The large resource size is significant in that it provides Vulcan with the opportunity to become a major supplier of lithium chemicals into European Union markets.

Vulcan aims to use its project to produce the lowest CO2-eq. footprint lithium hydroxide for electric vehicles in the world from its unique Zero Carbon LithiumTM Project in the Upper Rhine Valley.

Astute move by management allows Taro resource to be included in PFS

As well as being highly beneficial for the company, this further highlights management’s strong business acumen in taking the initiative to purchase high quality seismic data.

From a broader perspective this will increase confidence in a large portion of the Taro Resource to a JORC Indicated category, which allows it to be taken into account when the prefeasibility study (PFS) is undertaken.

It is worth noting that the Inferred part of the Taro Resource has also grown with the new interpretation from the data.

Overall, the Taro Resource has grown by 60% since Vulcan released the maiden resource in August.

Commenting on the significance of these developments, Vulcan managing director Doctor Francis Wedin said, “Using our recently acquired seismic data to advance the 3-D geological model and well data to advance fault zone hydro-dynamics, we’re pleased to have upgraded a 39% portion of the Taro Resource to the “Indicated” category, as well as increasing the size of the Taro Inferred Resource.

‘’This higher confidence resource area is being integrated into our PFS, which is on schedule for completion.

‘’This is in line with our strategy to become a supplier of our unique Zero Carbon Lithium® hydroxide to the European battery electric vehicle market.”

Vulcan has majority joint-venture interest with GGH

The Taro Exploration Licence as shown on the following map has been granted to Global Geothermal Holding UG (GGH).

Vulcan has an agreement with GGH to earn a 51% interest by spending €500,000 within two years of the license grant (Initial Expenditure).

The company has met this Initial Expenditure requirement, allowing for a Joint Venture to be formed, with Vulcan owning 51% and GGH 49%.

Vulcan will now spend a further €500,000 to earn an additional 29% (Second Earn-In Expenditure) within two years to take its JV interest to 80%.

GGH can then elect to co-fund the project on a pro-rata basis or be diluted by an industry-standard formula whilst Vulcan continues to develop the project.

Should GGH be diluted below 5%, its share will be converted to a non-diluting 2% net royalty.

Prior to this development Hamburg-based Alster Research analyst Oliver Drebing reaffirmed his buy recommendation in October, upgrading his price target from $2.45 to $2.55 (€1.45 to €1.55).

This price target is now looking increasingly within Vulcan’s reach with its shares having surged 60% from approximately $1.00 a week ago to more than $1.60.

The PFS should be the next major catalyst, and this could well see the stock trading not far shy of Drebing’s price target.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.