Inca Minerals diversifies into battery metals

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Very few junior exploration companies are finalising a circa US$10 million earn-in agreement with a major. Nor do they have a genuine first mover advantage to a nearby country particularly in a sector as hot as battery metals. However, Inca Minerals Ltd (ASX:ICG) ticks both boxes.

Only 24 hours after the management of Inca Minerals informed the market of its intention to pursue opportunities outside its established Peruvian operations, the company has lodged three Exploration Licence Applications (ELA) in the Democratic Republic of Timor-Leste (commonly known as East Timor).

In particular, Inca Minerals intends to look for exposure to battery metals in East Timor.

Consequently, projects being targeted, including those announced today are prospective for metals such as nickel, cobalt, copper and vanadium.

The Paatal ELA will be focusing on vanadium and phosphate as these two commodities are often found together in that area, similar to deposits in the US and Peru.

Inca has also generated the Ossu multi-commodity project which is targeting gold and silver as well as cobalt and copper.

The other ELA relates to Manatuto which hosts known podiform chromium mineralisation extending over a 2.5 kilometre strike length with grades between 35% and 51% chromium identified in prior sampling. It will also be looked at for Ni and Co.

Inca to remain active in Peru

Until now, Inca Minerals’ strategy has been to acquire and explore base and precious metal projects in Peru with a view to developing these projects into possible mines or demonstrating their value to others.

To that end, Inca currently has two polymetallic exploration projects located in Peru, Greater Riqueza (Riqueza) and Cerro Rayas, each of which has its own characteristics.

Riqueza has been highly successful, resulting in the discovery of a mineralised system comprising zinc, silver and lead replacement mineralisation; high-sulphidation, epithermal gold and silver and skarn copper mineralisation covering a 25 square kilometre area.

Riqueza has advanced from an early-stage, single concession 1000 hectare project to a nine-concession, 6000 hectare project with many dozens of mineralised veins, mantos, breccias and stockworks across six prospect areas.

South32 funded geophysics survey yielded results

A South32 (ASX:S32) funded geophysics survey was completed at Riqueza in 2018 resulting in the discovery of a considerable number of large porphyry and porphyry-skarn targets.

In turn this led to the commencement of negotiations between Inca and South32 of an earn-in agreement (EIA).

This is being negotiated and the first-year exploration program designed.

On completion of those negotiations, and commencement of an agreed first year exploration program, Inca will manage the exploration and expects the vast majority of this exploration to be funded through the earn-in funding amount.

The negotiations have already delivered an agreed earn-in funding amount of $US8 – 10 million for South32 to acquire 60% of the project.

Consequently, the company remains extremely active in this area and by no means will its diversification into battery metals dilute its interests in Peru. Indeed, Inca is fully aware that Peru is prospective for battery metals.

Cerro Rayas could follow in Riqueza’s footsteps

Exploration at Cerro Rayas has to date focussed on the known mine workings historically exploited for zinc-silver-lead.

These metals featured strongly in Inca’s sampling which led to a broader mapping and sampling program resulting in the identification of several additional mine workings and highly prospective geology in proximal areas.

Management believes Cerro Rayas could follow a similar if not more rapid trajectory than Riqueza.

In the event this occurs, Inca’s exploration in Peru will and must remain extremely active, and the company has the ability to ramp up activity as required.

With the relevant commodity prices forecast to remain attractive, both projects have the potential to significantly add value and underpin future growth.

Diversification into high demand commodities

Being mindful of the global appetite for a diverse range of resources, management has recently refined its strategy to consider new and additional projects with commodities such as vanadium, cobalt, nickel and phosphate.

The Board, senior management and its technical advisory panel has experience with many of these commodities and believes that, provided it can secure the right project in the right jurisdiction, it is well placed to explore, build and demonstrate value through careful investment of shareholder funds.

This brings us back to the company’s foray into East Timor where it should have a first mover advantage.

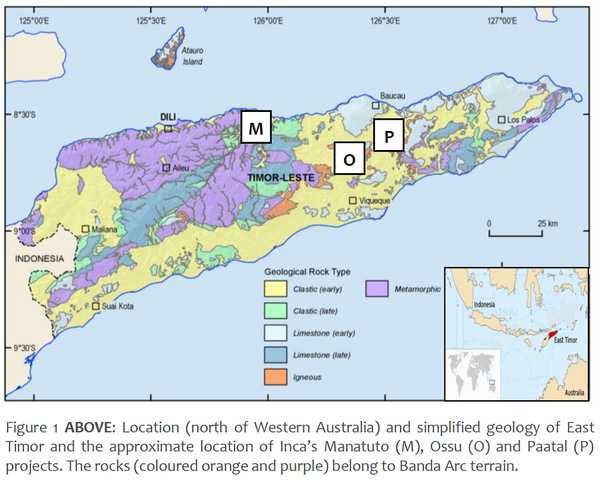

As indicated below, East Timor lies to the north of Western Australia.

Manatuto possesses high-grade chromium

The project area at Manatuto hosts known podiform chromium mineralisation extending over a 2.5 kilometre strike length with grades between 35% and 51% chromium identified in prior sampling.

Manatuto is located inland from the northern coastline of East Timor, 40 kilometres east of the capital city Dili, and it can be accessed via a sealed national highway.

As well as following up on the significant chromium mineralisation, the company plans to test the occurrence of ophiolite-sulphide nickel-cobalt-copper mineralisation associated with the ophiolite sequence and gold associated with the quartz veins.

High-grade gold and silver at Ossu

The Ossu Project is considered prospective for cobalt, gold, silver, copper and zinc mineralisation, comprising Banda Arc ultramafics and hosting known massive sulphides.

Mineralisation at grades of between 3.0 and 4.0g/t gold, 70.0g/t silver and 10% copper have been recorded in a UN Report in large in situ boulders within the Ossu ELA.

Ossu is 14 kilometres north of the provincial town of Viqueque, 80 kilometres south-east of Dili and it can be accessed via a sealed national highway.

In terms of gold and silver mineralisation at Ossu, there are the Lerokis and Kali Kuning gold-silver deposits (2.2 million tonnes at 5.5g/t gold and 146g/t silver and 2.9 million tonnes at 3.5g/t gold and 114g/t silver respectively) on Wetar Island, Indonesia, which serve as analogues for the Ossu Project.

Wetar is located immediately north of East Timor within Banda Arc terrain.

Vanadium and phosphate at Paatal

The proposed Paatal Project target area is considered prospective for vanadium and phosphate mineralisation.

According to a 2003 United Nations report the target area hosts phosphate rocks grading between 9% P2O5 and 22% P2O5.

Paatal is 100 kilometres east of Dili, close to the northern coastal town of Baucau, and it can be accessed via a sealed national highway.

The phosphate mineralisation at Paatal is characteristic of sedimentary marine or upwelling-style phosphate deposits with the phosphate occurring in unconsolidated marine sediments (limestones, marls, shales) as dark brown nodules.

As well as following up on the significant phosphate mineralisation, Inca plans to test the occurrence of related vanadium mineralisation.

In the US as well as in Peru, vanadium and phosphate may occur together under certain depositional conditions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.