Inca acquires second IOCG Project in Northern Territory

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Through the execution of a Memorandum of Understanding (MOU), Inca Minerals Ltd (ASX:ICG) has acquired a second new IOCG (iron oxide copper gold) focused project called Frewena Fable.

Like Lorna May, the first IOCG-focused project acquired by Inca, Frewena Fable is located in the Northern Territory.

A stand-out feature of Frewena Fable is the walk-up drill target called the Tamborine Anomaly.

This very large scale target contained entirely within the project area is five kilometres in diameter, has a circular shape and has clear IOCG affinities.

The market has responded positively to the news with Inca’s shares surging more than 30% shortly after the announcement was released.

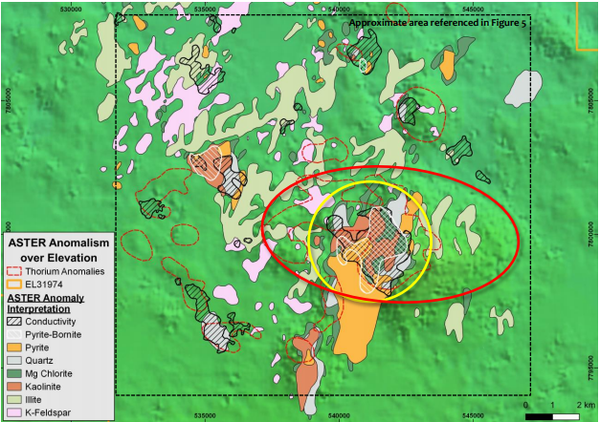

From a geological perspective, ASTER (Advanced Spaceborne Thermal Emission and Reflection radiometry) imagery interpretations identified reflectance modelled as bornite-pyrite.

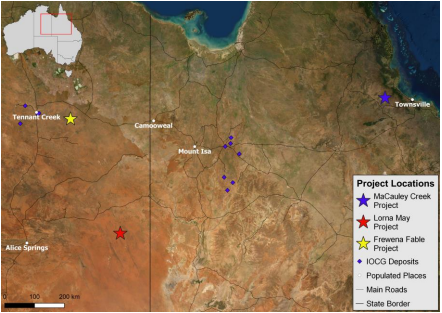

As illustrated below, Frewena Fable joins MaCauley Creek and Lorna May as part of Inca’s Tier-1 IOCG/ porphyry-focused Australian project portfolio.

Focus on early-stage tier 1 targets

The company has focused on early-stage exploration opportunities with Tier-1 credentials within known and developing IOCG/porphyry provinces in Australia.

This not only provides stronger opportunities for exploration success, but it can also assist in attracting partners that can assist in financing and technical support.

Inca has demonstrated its ability to facilitate such arrangements, having secured South32 (ASX: S32) as an earn-in partner at Riqueza in Peru.

Inca is building on its knowledge of this type of mineralisation, as Riqueza is considered prospective for Tier-1 porphyry and skarn deposits.

Management is now replicating the strategy of attracting major mining houses as partners to early-stage projects in Australia.

The MaCauley Creek, Lorna May and now Frewena Fable acquisitions illustrate this strategy is progressing well.

In discussing the promising nature of this acquisition and fit with the group’s broader strategy, managing director Ross Brown said, “With MaCauley Creek and Lorna May, our Australian portfolio of projects with Tier-1 IOCG and/or porphyry potential has reached critical mass.

“Success-based development of these projects, including value-adding, low-cost exploration and upfront partnership talks, is a very clear path for us.

‘’In broad terms, our aspiration as a junior exploration company is to have a significant free-carried position in multiple first-class exploration projects with multiple partners.”

Brown sees Tamborine anomaly as compelling target

MRG Resources which was a party to the MOU has conducted desk-top studies and helicopter-supported reconnaissance.

Desk-top studies included a review of archival exploration data conducted in the vicinity, assessment of the government AEM survey data, mentioned above, and ASTER satellite data acquisition and interpretation.

The helicopter-supported reconnaissance site visit was designed to investigate specific targets generated in the desk-top review.

This work culminated in the generation of a very large target called the Tamborine Anomaly.

As we discussed earlier, Tamborine is viewed as a walk-up target as it has an expression which is considered reminiscent of a near-surface IOCG deposit.

Roughly circular in shape as can be seen below, Tamborine is approximately five kilometres in diameter and hosts several coincident geophysical, ASTER and topographical features.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.