IMA deal to be brought before shareholders

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Image Resources (ASX:IMA) has been quietly chipping away on a potentially transformative deal for the mineral sands player – and could soon be one step closer to securing a $40 million value package which could see key projects heading towards production.

The WA-based player has been working on a final proposal to take to shareholders since it received approval from the Foreign Investment Review Board for its potential Memorandum of Understanding with Murray Zircon (MZ) and parent company Guandong Orient Ind Sci &Tech Co Ltd (OZC).

The deal centres around IMA’s Boonanarring mineral sands project, prospective for zircon and has probable reserves of 14.4Mt @ 8.3% heavy minerals, with zircon making up a potential 23% of those heavy minerals.

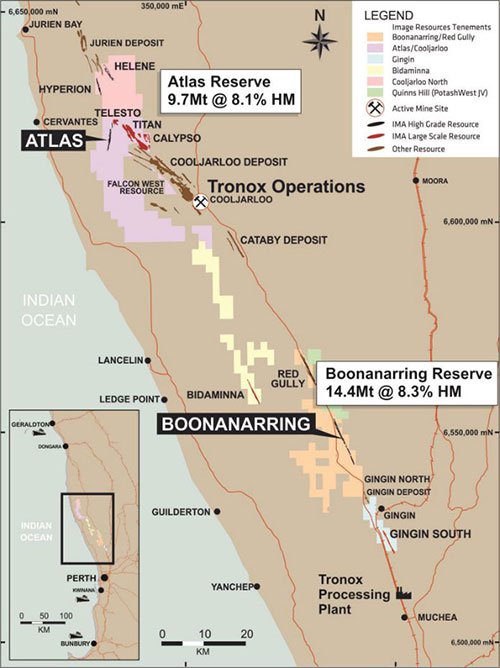

Location of IMA’s projects in WA

IMA’s Boonanarring reserve is sandwiched between US zircon giant Tronox’s processing plant to the south and its operational site to the north, which produces around 700kt mineral sands concentrate per year.

The operational proximity to Tronox has opened up collaborative possibilities for IMA, so much so that the explorer is now working hard towards bringing the Boonanarring reserve into production in 2016, hence the MOU.

Terms of the MOU

The deal not only provides IMA with the impetus to bring Boonanarring to production, but also secures an offtake agreement (albeit non-binding at this stage) with one of the bigger purchasers of zircon in the world.

Subject to the deal being signed off by shareholders, OZC will purchase 90% of the zircon produced by IMA, giving shareholders certainty over potential cashflow into the future.

More practically, IMA will receive a wet plant and ancillary equipment from MZ to help bring the project to production.

It is thought all up, the potential MOU has a value of $40 million, although this could rise from future offtake.

Other key terms include:

* OZC to provide US$8 million ($A11.23 million) in working capital;

* IMA will receive a conditional loan of $4M from MZ which isn’t repayable if IMA doesn’t get into production within the next three years.

* MZ’s key personnel will contribute their knowledge and expertise on IMA’s projects going forward;

* MZ will receive a 42% stake in IMA which could rise to 47% if all project financing is completed and mining begins within two years. Another positive incentive, and;

* Last but not least, IMA will receive an option to purchase MZ’s dry mineral separation plant.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.