Hot Chili releases strong copper exploration update

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Copper junior, Hot Chili (ASX:HCH), has released a positive quarterly report for the three months to 30 September 2018, showing strong progress on its exploration activities across its portfolio.

HCH said it is open to further project acquisitions and has completed a maiden 5,000m drilling program across two of its three recently secured high-grade copper mines in Chile: San Antonio and Valentina.

HCH pursuing further project acquisitions

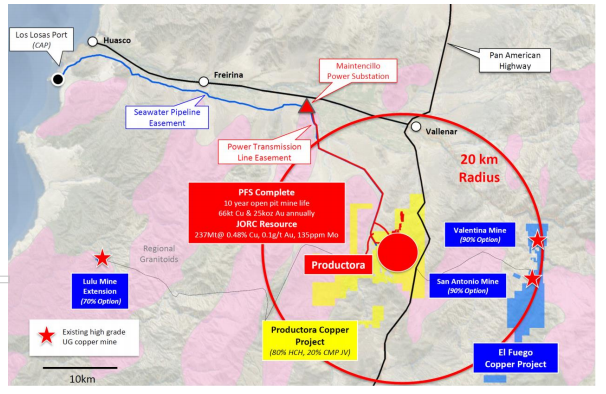

HCH has informed shareholders that it is well-positioned to take advantage of any potential acquisition opportunities within trucking distance of its flagship Productora Copper Project in Chile.

Several assessments in regards to potential acquisitions are advancing, as the company also investigates other partnership opportunities that can leverage Productora’s planned future large-scale, low-cost processing facilities.

San Antonio mine

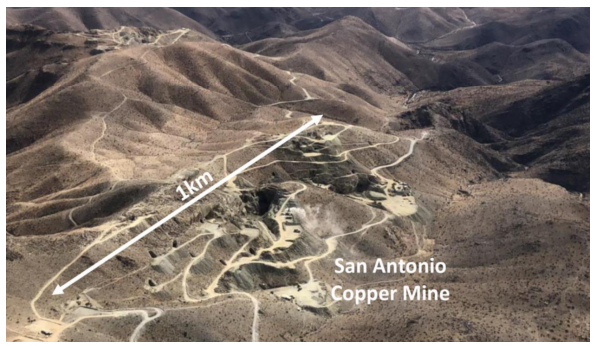

The San Antonio mine lies 20km east of HCH’s Productora copper project and forms part of the company’s consolidated El Fuego high-grade growth project (below):

Recently completed drill work at the San Antonio mine has confirmed large extensions of high-grade copper below the shallow developed region of the mine.

Thanks to the highgrade nature of mineralisation and low strip ratios, San Antonio looks to be a key addition to HCH’s large-scale open pit inventory.

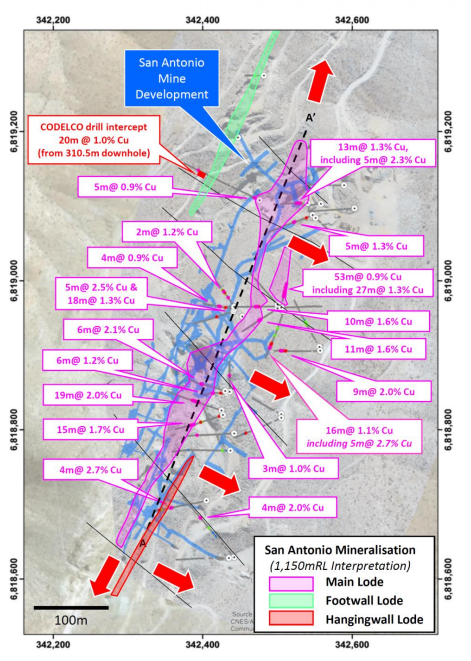

Final drill results from the maiden drilling campaign at San Antonio include:

- 19m grading 2% copper from 61m down-hole (including 11m grading 2.4% copper)

- 15m grading 1.7% copper from 80m down-hole

- 13m grading 1.3% copper from 17m down-hole (including 5m grading 2.3% copper)

- 53m grading 0.9% copper from 72m down-hole (including 27m grading 1.3% copper)

- 10m grading 1.6% copper from 58m down-hole (including 4m grading 2.7% copper)

- 5m grading 2.5% copper from 31m down-hole (including 2m grading 4.3% copper)

- 18m grading 1.3% copper from 52m down-hole (including 5m grading 2.1% copper)

- 11m grading 1.6% copper from 83m down-hole

- 9m grading 2% copper from 132m down-hole

- 16m grading 1.1% copper from 93m down-hole (including 5m grading at 2.7% copper), and

- 6m grading 2.1% copper from 65m down-hole

The results highlight the strong continuity of shallow high grade copper mineralisation over 700m strike, as demonstrated in the map below.

The company is now in the advanced stages of submission to commence follow-up and resource definition drilling.

As a result of the maiden program, HCH believes the San Antonio mine could have a considerable impact on the head grade of its future copper production plans.

The San Antonio underground mine has reportedly produced approximately 2Mt grading 2% copper from shallow depths.

Coming in at 1.5Mt copper and 1.0Moz gold, the mine is shaping up as the first of several high-grade copper deposits that the company is looking to incorporate into its large-scale bulk tonnage Productora copper development, which is 20km to the west.

Valentina copper mine

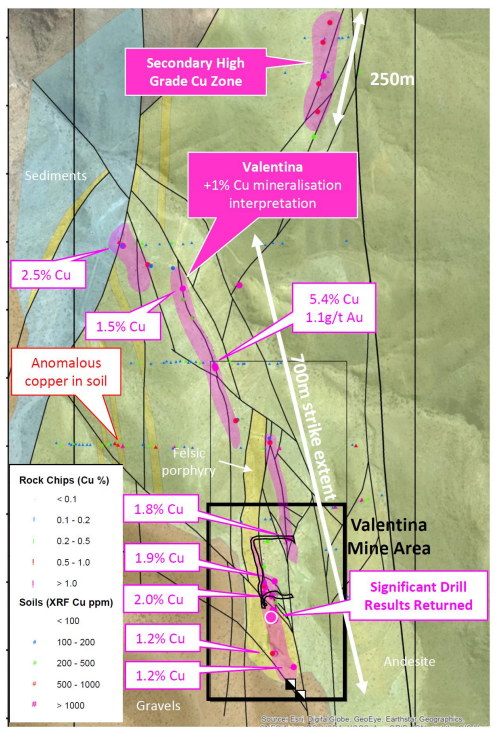

In addition to the program at San Antonio, three shallow drill holes were completed in the southern region of the Valentina copper mine.

Valentina, which is located 5km north of San Antonio, returned some promising results:

- 12m grading 1.5% copper from 28m down-hole (including 6m grading 2.7% copper), and

- 8m grading 2% copper from 124m down-hole (including 2m grading 4.8% copper)

The holes have confirmed significant strike and depth extension potential to high-grade mineralisation (as seen below) and close association with chalcopyrite and bornite:

HCH notes that extensive work in the lead-up to drilling at Valentina revealed the following:

- Certified mine production from 1997 reported small-scale underground mining extracted sulphide ore parcels with grades ranging between 3.4% and 4.8% copper

- Widths of mineralisation within Valentina mine area range from 1-5 metres, with mine development centred across 230 metres of strike extent

- Seven historical drill holes across the mine area, which included an end-of-hole significant drill intersection of 11m grading 2% copper (including 7m grading 2.7% copper) from 120m down-hole, had not been followed up

- Surface rock chip results and mapping have defined over 700 metres of strike potential along the main Valentina trend

The company has noted that mineralisation intersected in historical drilling has been successfully located and is fault-hosted, dipping towards the east within volcanic-sedimentary units.

The company intends to undertake follow-up drilling to expand coverage across the larger striker potential of Valentina ahead of resource definition activities.

Considering the success of first-pass drilling at the San Antonio copper mine, Valentina presents a strong opportunity to add further scale to HCH’s high grade resource inventory.

In light of its highly promising drill results and ongoing acquisition opportunities, HCH is well placed for its planned resource definition drilling in 2019.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.