Heliborne VTEM Survey commenced at TechGen Metals' Blue Rock Valley Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

TechGen Metals Limited (ASX:TG1) couldn’t have wished for a better start when it commenced trading on the ASX on Tuesday with its shares closing at 29 cents, implying a premium of 45% to the IPO price of 20 cents per share.

As well as opening strongly, the group’s shares settled around the 28 cents mark and traded as high as 29.5 cents today.

Some of today’s momentum appeared to stem from an announcement regarding the commencement of its Heliborne Versatile Time Domain Electro Magnetic (VTEMTM Max) geophysical survey at the highly prospective 100% owned Blue Rock Valley Project in the Ashburton Basin of Western Australia.

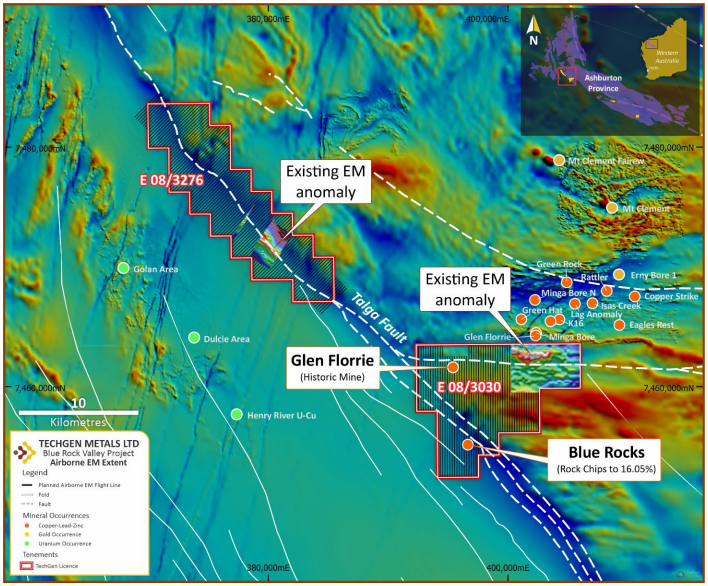

Management was attracted to the Blue Rock Valley Project by a combination of factors including the presence of major fault structures (Talga Fault and others), the existence of historic copper and base metal workings, high grade historic copper rock chip samples and an overall lack of modern exploration in the area.

It is worth noting that 85% of the Blue Rock Valley Project area has not had any previous airborne electromagnetic coverage.

The Talga Fault can be seen below, running diagonally through TG1’s tenements (E08/3030 and E08/3276), and the accompanying references to rock chips grading about 16% copper can be seen around the southern extent of E08/3030.

VTEM a step-change in surveying

The VTEMTM Max system is the most innovative and successful airborne electromagnetic system to be introduced in more than 30 years.

The proprietary receiver design, using the advantages of modern digital electronics and signal processing, delivers exceptionally low-noise levels.

Coupled with a high dipole moment transmitter, the result is unparalleled resolution and depth of investigation in precision electromagnetic measurements.

Prior to the commencement of the current survey, results from a historic but limited VTEM survey over approximately 15% of the Blue Rock Valley Project area identified two moderate to strong electromagnetic (EM) conductors.

These two historic VTEM anomalies were identified within the mid to late time channels.

The north-eastern EM anomaly is ideally located immediately south of known copper-lead-zinc workings and the anomaly lies coincidently on a prominent magnetic high and an east-west fault.

The north-western historic EM anomaly lies adjacent to the Talga Fault, a major regional structure that passes through the Blue Rock Valley Project area.

Commenting on the upcoming surveying program, managing director Ashley Hood said, “Since the company’s recent ASX listing, our technical team has hit the ground running on a number of fronts.

"At the Ashburton group of projects, the objective of the VTEM surveys is to generate quality discrete mid to late time bedrock conductors prospective for copper-gold and/or base metal style mineralisation comparable to that seen in the Cobar Basin in NSW.

"We are encouraged by the results of limited historic VTEM surveys given that areas of historic copper workings and major faults are yet to be tested”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.