Hartleys sees substantial upside in Adriatic Metals

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Adriatic Metals PLC (ASX:ADT & FSE:3FN) were up approximately 8% on Thursday morning as the market continued to absorb this week’s release of a maiden Mineral Resource Estimate for the group’s Rupice deposit, as well as an updated Mineral Resource Estimate for the Veovača deposit, both of which are located close to the mining town of Vareš in Bosnia and Herzegovina.

As a backdrop, the project comprises a historic open cut zinc-lead-barite-silver mine at Veovača and Rupice, an advanced proximal deposit which exhibits exceptionally high grades of base and precious metals.

Adriatic’s short-term aim is to expand the current JORC resource at Veovača and to complete in-fill and expansion drilling programme at the high-grade Rupice deposit.

Drilling at Veovača has added gold and silver into the entirety of the Mineral Resource Estimate and increased the Indicated Resource category to 71%.

The Veovača Mineral Resource begins at surface and currently extends to depths of 200 metres.

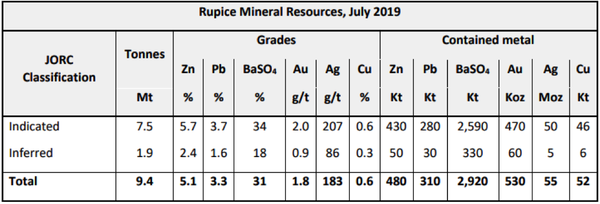

Management highlighted that the Rupice deposit is world-class and that a significant resource of precious metals exist within the confirmed base metals resource.

Consequently, further exploration will be undertaken to expand known mineralisation, and recent drilling suggests that high-grade mineralisation continues to the north.

Indeed, the numerous lead-zinc deposits that surround Rupice and Veovača suggest that there is a high probability of delineating further mineralisation.

The following map shows that the deposits are located in the prolific Balkan Metallogenic Belt, well known for hosting quality lead-zinc deposits.

Hartleys upgrades price target

Notwithstanding the upside that further drilling could offer, the company now has a substantial resource inventory thatcanbe used in initial scoping studies.

Hartleys resources analyst Paul Howard was impressed by recent developments, noting that the total combined resource for the Vareš Project is16.8 million tonnes at 3.5% zinc, 2.2% lead, 23% barite, 0.3% copper, 120g/t silver and 1.1g/t gold.

With metallurgical test work underway and results expected in September quarter, Howard’s assumptions suggests the grade equates to approximately 9.4% zinc equivalent for 1.6 million tonnes of contained zinc equivalent metal.

Howard pointed to the prospect of increasing the Rupice resource to higher confidence levels in saying, ‘’A large portion (80%) of the Rupice resource is indicated, which bodes well for future conversion to reserves.

Howard sees the prospect as having significant upside from conducting further exploration. He said, ‘’Rupice extends to 300 metres depth and remains open down plunge.

‘’Further drilling is planned to test for repetitions of the mineralisation, and will be guided by the recent IP survey, which will soon be completed across the whole project.

‘’While we have been modelling a hypothetical underground operation for Rupice, given the higher tonnage, ADT appears to be weighing up an open pit scenario as per preliminary optimisations mentioned in the resource announcement.’’

In response to these developments, Howard maintained his speculative buy recommendation - note this and any broker recommendations are speculative - and slightly increased his price target to $1.46, representing upside of more than 30% to the company’s recent trading range.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.