GTR Resources granted five year extension at highly prospective WA gold project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

GTI Resources Ltd (ASX:GTR) has been granted a five year extension at its Kookynie exploration licence at its Niagara Gold Project in Western Australia.

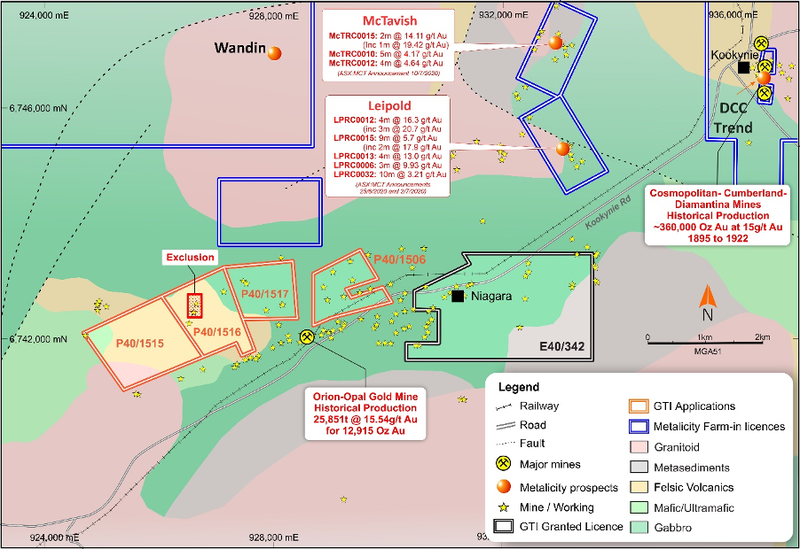

The Niagara project is located ~6km southwest of Kookynie in the central goldfields of WA and comprises one granted exploration licence, E40/342 and four prospecting licence applications, P40/1506, P40/1515, P40/1516 and P40/1517 which were recently pegged and applied for and for which further progress will be provided in due course.

Access to Niagara is provided via Goldfields Highway from the town of Menzies and the sealed Kookynie Road which bisects the northern part of exploration licence E40/342 and the southern part of P40/1506.

The project is located within the central part of the Norseman-Wiluna greenstone belt, and there have been numerous historical workings within and to the north of the project area. These include a number of major historical mines located in the immediate vicinity of Kookynie, including the Cosmopolitan Mine which produced circa 360,000 ounces of gold at average grade of 15 g/t gold from 1895 to 1922.

Also of note is the recent work done by Metalicity Ltd (ASX: MCT) and Nex Metals Exploration Ltd (ASX: NME) at the nearby Leipold and McTavish prospects as seen above, which lie just two to four kilometres to the north of the Niagara project and demonstrate the exciting potential of the region.

Metalicity Ltd recently conducted a highly successful drilling campaign that highlighted the potential of the Kookynie region. MCT, in its JV with Nex NME, hinted at the potential of GTR’s WA ground. MCT gained almost 250% after hitting “spectacular” high grade results from first assays at Kookynie.

MCT has since consolidated and is currently capped at $35M, with a 50% interest in its Kookynie project – which gives a read through value of approx. $70M for 100% of its Kookynie Gold Project.

GTR noted that the market capitalisations of Metalicity and Nex were $40 million and $95 million respectively. This suggests its $16 million market cap may undervalue the company, with its value currently being represented by its flagship uranium project in Utah, USA and not its gold project.

“Metalicity’s spectacular success, in close proximity to our Niagara (Kookynie) Project, encouraged GTI to accelerate our next phase of gold exploration and drill targeting at Niagara. Timing of the program fits perfectly from an execution planning point of view, with the exploration preparation work being undertaken at GTI’s Utah projects,” said GTR executive director Bruce Lane.

“The Company hopes to identify structures similar to those being successfully drilled immediately to the north. The Company’s uranium and vanadium projects in Utah (US) remain the Company’s key focus, however we strongly believe that there is an interim opportunity to drive shareholder value through exploring the Niagara Project at Kookynie.

“GTI has held the lease at Niagara in anticipation of the optimum conditions occurring before investing in further work on the project – we believe that the time is now right to accelerate exploration.”

Work continues at Niagara

Exploration within P40/1506, P40/1515, P40/1516 and P40/1517, during the late 1980s and 1990s, comprised trenching, sampling and shallow first pass drilling, primarily focused on the historical workings. As a result, the Niagara project remains essentially untested.

The flying of an airborne magnetic survey was completed last week at Niagara and followed up anomalous soil sampling results.

Read: GTI Resources ready to unveil another gem

The detailed aeromagnetic survey is expected to define and map potential north trending structures within the buried magnetic basement, that are associated with gold mineralisation in the Kookynie region.

Final magnetic data should be available within the next 10 days.

Interpretation of the data will also help to refine a follow up field program which is likely to include additional infill auger soil sampling and ground mapping to aid in drill targeting.

Exploration by GTI has already identified a number of significant gold in soil targets within the northern and central part s of E40/342. These are highlighted by a strong 500m long, 100m wide anomaly up to a peak of 38 ppb Au, in the north-eastern corner of the licence.

Furthermore, up to 5,000 metres of drilling has been approved, with GTI working towards an initial drilling campaign start date of September 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.