GTi Resource’s uranium logging results imminent

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

GTi Resources Ltd (ASX:GTR) has completed the down hole gamma logging of historical drill holes at the Jeffrey uranium/vanadium project in Utah.

A total of 26 open historical drill holes were available for logging, with data generated to calculate eU3O8 assay values.

Results from this week’s logging program are expected to be available for release within the next 14 days.

It is good timing. In the month of April, the spot uranium price rose almost 24% to mark the largest monthly increase in almost thirty years. In six weeks, the spot price has risen 41%, being the fastest rise since 2007.

Leading up to these developments, GTR confirmed the presence of high-grade uranium and vanadium potential at the Jeffrey project in Utah, and this logging program has been completed to leverage existing shallow drill holes dating from the 1970s to generate low-cost, high-value assay data.

The in-situ assay data will be utilised to refine knowledge of the local mineralisation as the trend moves away from outcrop and shallow underground exposure, as well as guide refinement of drill targets for the planned follow-up drilling campaign.

The planned drilling program due to commence in early July is expected to involve several drill holes with a depth of approximately 20 metres.

Data from Rat Nest Project imminent

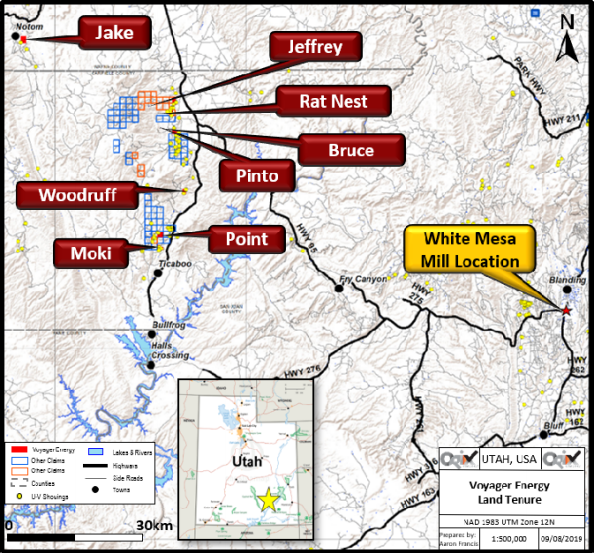

In addition to the down hole logging work and the upcoming drill campaign on the Jeffrey project, the company is currently conducting sampling and mapping work on the underground workings at the nearby prospective Rat Nest project, to the north-west of the White Mesa Mill location as indicated below.

Results from this work will be available in the coming weeks.

The Jeffrey Project is one of several projects the company holds in Utah covering approximately 1,500 hectares of the Henry Mountains region, within Garfield and Wayne Counties near Hanksville, Utah.

The region forms part of the prolific Colorado Plateau uranium province which historically provided the most important uranium resources in the US.

Sandstone hosted ores have been mined in the region since 1904 and the mining region has historically produced in excess of 17.5 million tonnes at 2,400ppm U3O8 (92 mlbs U3O8) and 12,500 ppm V2O5 (482 mlbs V2O5).

The region benefits from well-established infrastructure and a mature mining industry.

The White Mesa mill is the only conventional fully licensed and operational uranium/vanadium combination mill in the US, and as indicated above it is located within trucking distance of the properties.

The mill is owned and operated by Energy Fuels and is set up to process the sandstone hosted uranium and vanadium rich ores that have been mined in the region for many decades.

GTR is moving to rapidly advance its projects in Utah given the obvious potential to supply high-grade uranium ore to help fill existing local mill processing capacity.

Management said that it is also actively looking for value accretive opportunities to expand its US project portfolio in this space.

Ideal timing as Trump looks to boost uranium supplies

GTR is positioning itself as an emerging producer at a time when the US government is unveiling a 10-year plan which would see it invest approximately US$150 million per annum in purchasing domestically produced uranium.

The Trump administration recently unveiled its vision for reclaiming US nuclear leadership.

The 2021 budget proposes creating a US$1.5 billion U3O8 reserve through 10 years of purchasing US$150 million per annum (approximately 3.75 million pounds per annum) of domestic U3O8 production.

Further congressional approval will be sought to expand this initiative to acquire 17 to 19 million pounds of U3O8 over 10 years.

This would represent a significant uptick in demand given that 2019 US production was estimated at only 174,000 pounds

The move has seen strong industry support from US producers, who are very encouraged by a sustained improvement in the U3O8 spot price and the recently announced significant US government support.

GTR is highly supportive of the recently released US Department of Energy report and the industry support measures proposed under the Trump regime.

On this note, GTi Resources Director Bruce Lane said, “We hope the company’s high-grade potential and proximity to operating infrastructure will strengthen the possibility for an early stage production outcome under the supportive Trump regime.

‘’I look forward to providing shareholders with a consistent flow of news on the project’s development, despite the challenging COVID 19 environment, with downhole data, further assays and drill interpretation leading to a highly prospective drill campaign in early July.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.